Is M&A about to pick up?

25th August 2016 13:23

The market is getting excited about a rebound in European Mergers and Acquisitions (M&A) activity again following a flurry of recent consolidation chatter, including technology chip maker and engineer . Yields are low and debt looks cheap, so what's holding the market back?

Conditions look perfect to support a rebound in European mergers and acquisitions, with all-time low investment-grade corporate bond yields of 1% signalling "permissive financing conditions", argues Deutsche Bank analyst Sebastian Raedler.

It also helps that the cost of equity has risen to a 20-year high of 8.4% relative to the cost of debt, which encourages companies to use debt to buy equities - through buy backs and M&A.

Indeed, we recently highlighted the four companies Barclays reckoned could unlock real earnings power through a successful consolidation strategy - they were , and .

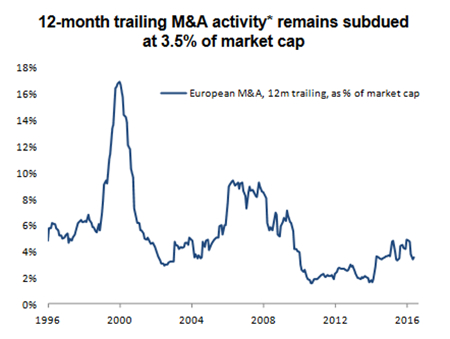

But the M&A landscape still looks quiet, with activity falling to 3.5% of European market capitalisation, which is below the 5% seen at the end of 2015 and the post-1990 5.2% average.

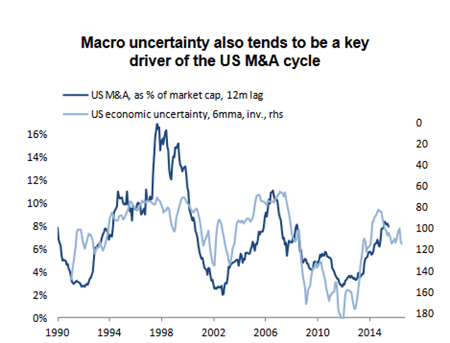

And with economic uncertainty at an all-time high after the UK referendum, it's unlikely to pick-up any time soon, claims the Deutsche Bank analyst.

"Historically, macro uncertainty has been the best predicator for European M&A activity," he explains.

"While we expect macro uncertainty to decline over the coming months, we think it will remain elevated, given the cluster of risk events in the political calendar - the Italian referendum, the Spanish government formation, the potential triggering of Article 50 by the UK, the French and German elections.

"Macro uncertainty would have to fall below its 10-year average in order for it to point to a pick-up in M&A activity, a scenario that looks unlikely."

But for those looking to capitalise on consolidation, where should investors look? Over a quarter of total recent European deals have come from the European materials sector, a switch away from last year’s active energy and consumer staples space.

Cyclical European healthcare is approaching a trough again and deals in financials and energy are falling behind. Along with materials, tech consolidation has gathered momentum over the last two years and is above average.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks