A new top stock

26th August 2016 16:17

by Richard Beddard from interactive investor

Share on

The Decision Engine has a new algorithm and a new top stock.

Before I discuss the companies tracked by the Decision Engine that have revealed more about themselves over the last month, a brief word of warning. I'm in the process of changing the algorithm used to rank the shares. Dramatic re-rankings are unlikely, the changes are only modest, but the ranking may be more volatile than usual over the next month or two.

Since the Decision Engine identifies drivers of long-term performance, normally the rankings change very gradually. The shares in the top 20, therefore, remain investments to buy and hold, perhaps indefinitely.

I explained why I've changed the algorithm and how I've changed it earlier this month, but because I'm going to show you exactly how each company scores, here's a recap of the criteria and their definitions. Businesses should be:

1. Straightforward. It's apparent how the company makes money. The business model should be comprehensible, and the accounting should be clear.

2. Generating excess returns. Over a long period, preferably at least a decade, the business should have earned a return on capital not less than 8%, and more in most years. It should also be generating enough cash to fund present and future activities.

3. Resilient. The business should profit from activities that are likely to be relevant in future. Preferably it should do these activities in a distinctive way that is costly for others to copy, making its product or service especially valuable.

4. Managed for the long-term. Judge management by their actions and their incentives. They should invest steadily to grow and adapt the business. They should profit by making the company better, preferably through their ownership of shares.

5. Valued attractively. I use a much adjusted cousin of the price earnings ratio, an average earnings yield, to compare company valuations. An earnings yield of 10% or more scores two. Less than 4% scores zero. For earnings yields between 4% and 10%, the score rises with the yield from zero to two.

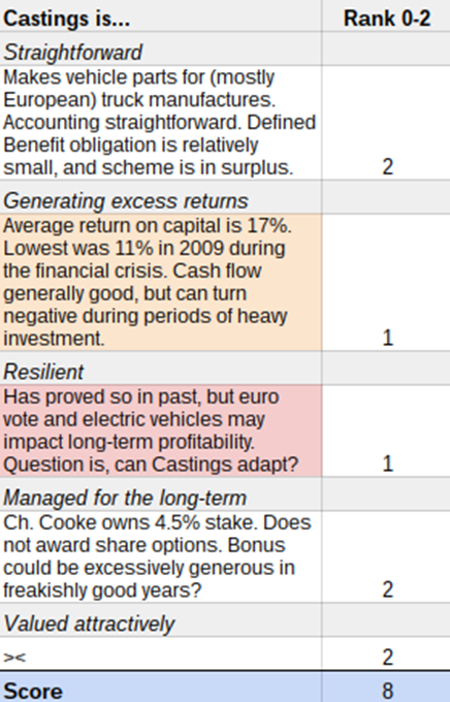

Castings

At its AGM, , which manufactures vehicle parts for European truck manufacturers, warned that demand from major customers had 'softened' since it reported full-year results in June. Then, it already expected a temporary slow-down due the end of a major contract.

The company does not say whether uncertainty due to the UK's vote to leave the European Union is causing European customers to be more cautious about ordering from their UK supplier, saying it will take time to gauge the impact of the Brexit vote.

Since it's a well-managed business, a policy of riding out past challenges, the financial crisis in 2008 for example, has proved very profitable over the long-term.

However, the vote, which may make trading with European customers more difficult, and the possibility, however distant, of a wholesale switch to electric vehicles requiring different parts made from lighter materials*, could be substantial threats.

The AGM would have been a good opportunity to discuss these threats, but I was on holiday and unable to attend (for the second year running).

Despite these reservations about Castings resilience, whether its products will be in demand in the long-term future, it scores wells on most other factors:

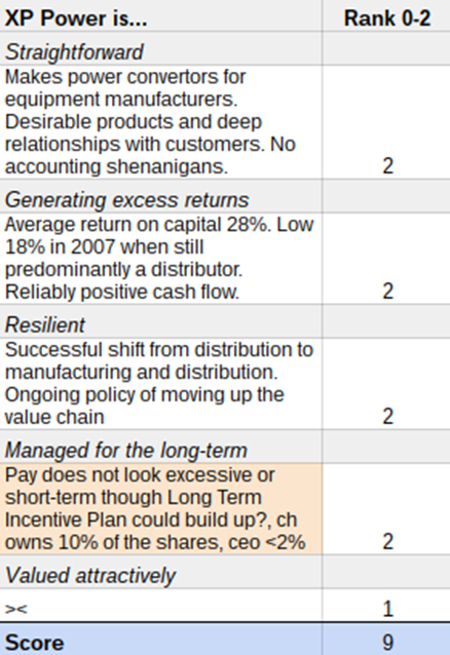

XP Power

half-year report, published at the end of July, is encouraging. The company, which manufactures power adapters for industrial, medical and electronic equipment, says its strategy is to move up the value chain. This is jargon for a process that should be as natural for businesses as it is for a plant to grow towards light.

The value chain is the activities that add value to a product or service; what the customer pays for, and what the firm profits from. Moving up the value chain simply means engaging in more valuable, profitable, activities.

When a company can articulate clearly how it's moving up the value chain, it's a good sign. XPP, which was originally a distributor, now designs and manufactures most of the adapters its sells, allowing it to develop products that are easy to design into its customers' equipment.

XPP says revenue lagged because it takes years for customers to design its products into their ownThe adapters save space, energy and installation time and are highly reliable, thereby adding value. A factory in Vietnam opened in 2014 and now producing complete adapters at lower cost than in China, improves the profit potential. Since it's more profitable as a manufacturer than it was as a distributor, the story, and the numbers match.

XPP says it has introduced a significant number of new products in the last three years, but because it takes years for customers to design them into their products, they have yet to earn much revenue. The implication is that they may do soon.

Citing record order intake, a strong backlog, and new contracts, it predicts growth.

Partly because valuation has less of an impact on the Decision Engine's rankings than it used to, and partly because the company meets all the other criteria for long-term investment, XPP has risen up the list into first place. A share price of £16.35 values the enterprise at £330 million, or about 16 times adjusted profit. The earnings yield is 6%.

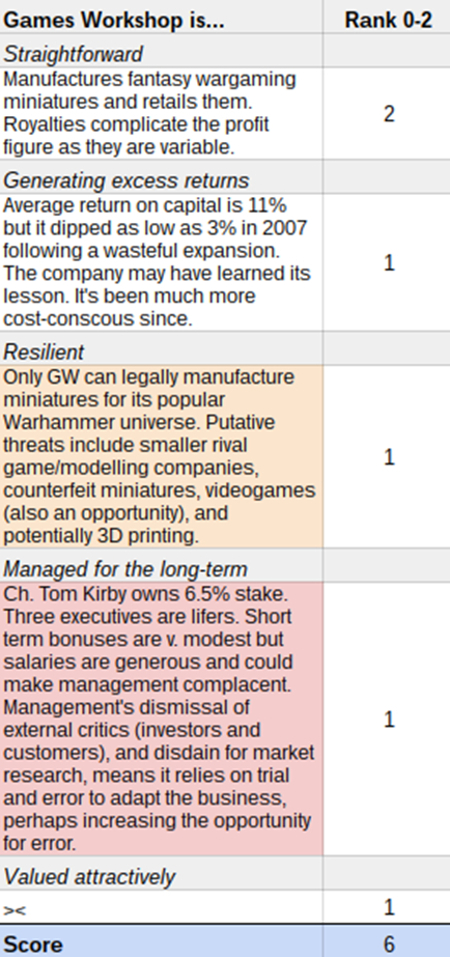

confounds me, and, therefore, the Decision Engine. If you read my review of its annual report earlier this month, you'll probably understand why it ranks just outside the top 20. Here's its updated score based on the new algorithm:

Three other companies in and around the top 20 have published annual reports recently. They are: , , and . I'm still in the process of assimilating the information into the Decision Engine and you can expect the results shortly. The scores may change again if I visit their AGMs, and of course the valuation scores shift automatically as the share prices do.

Here is the top 20 as it currently stands:

1 | XP Power | Designs, manufactures and distributes power adapters for industrial and healthcare equipment. |

2 | Castings | Manufactures cast iron parts for commercial vehicles: exhausts, transmissions and gearboxes for example. |

3 | Next | Retails clothes and homeware. |

4 | Dewhurst | Manufactures components for lifts, keypads and railway rolling-stock, particularly pushbuttons. |

5 | Science | Does scientific research and product development for customers in medical, industrial, consumer and energy industries. Provides strategic advice. |

6 | Colefax | Designs and distributes wallpaper and fabric to decorators and stores. Also decorates houses, sells antiques and manufactures furniture. |

7 | Dart | Flies holidaymakers to European destinations and provides packaged holidays. Also transports groceries in Britain. |

8 | Solid State | Manufactures and distributes specialist electronic components and computer systems, used in harsh environments where enhanced durability is a requirement. |

9 | Victrex | Manufactures and develops applications for PEEK, a polymer often used in place of metal where durability and lightness are paramount. |

10 | Portmeirion | Manufactures tableware. Owns Portmeirion, Spode and Royal Worcester brands. |

11 | BrainJuicer | Uses proprietary market research techniques to test people's emotional response to advertisements and concepts. |

12 | FW Thorpe | Manufactures Thorlux incandescent and LED lighting systems for factories, offices and shops, also signage, and road and tunnel lighting. |

13 | Cohort | Supplies technology, services and consultancy to governments and defence contractors. |

14 | James Halstead | Manufactures flooring for offices, shops, factories, hospitals, schools, sport and leisure venues. |

15 | Universe | Designs and supplies payment and loyalty systems for petrol stations and retailers. |

16 | Sprue Aegis | Designs and distributes smoke alarms and carbon monoxide detectors. |

17 | Dillistone | Develops and supplies recruitment software to recruitment companies |

18 | Treatt | Sources and processes essential oils, which are ingredients used in flavours, fragrances and cosmetics. Develops flavours. |

19 | SThree | Specialist recruiter providing skilled scientists, engineers and technicians to ICT, engineering, banking, energy sectors. |

20 | Howden Joinery | Manufactures kitchen cabinets and supplies complete kitchens to small builders. |

*For more on the potential threat of electric vehicles see this article. Since I wrote it, a correspondent has sent me a clipping about a Mercedes-Benz eTruck that can haul up to 26 tonnes for up to 200km on a single charge. The head of Daimler Trucks believes falling battery costs, and increased performance, means it will not be long before electric trucks for short-haul activities like bin lorries and grocery delivery, are economical.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.