Insider: In and out of fashion

26th August 2016 17:37

Burberry wobbles

Christopher Bailey has made a cool quarter-of-a-million pounds after dumping a stake in the high-end fashion brand.

The former Gucci designer, who will become president and chief creative officer when Marco Gobbetti takes the role of chief executive in 2017, sold 18,750 shares at 1,352p. That's about 30% more than Burberry's near-four-year low at 1,039p struck 10 days before the Brexit vote.

Bailey, who still owns shares worth over £7 million, made the sale six weeks after Burberry reported underlying retail sales were flat in the first quarter. However, like-for-like retail sales fell 3% and the firm warned that adjusted profit before tax would be more weighted toward the second-half this year than before.

UBS thinks Burberry should generate 3% like-for-like sales growth from the second quarter of 2017 and 4% the year after. The optimistic broker rates Burberry shares a 'buy' with price target set at 1,650p.

But Pascal Perrier, who runs the Asia Pacific operation, is still a seller. He's just bagged fifteen grand shy of £1 million after getting rid of 72,162 shares at 1,366p a pop.

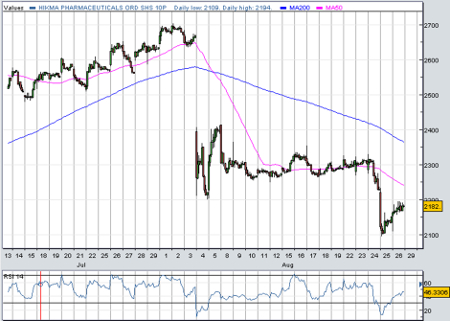

Hikma's hiccup

Blue-chip developer of generic drugs has been a spectacular performer for the past few years. Trading at not much more than a fiver in 2011, the shares topped out at 2,703p this month.

However, at the start of August and ahead of this Wednesday's half-year results, the company warned that profitability in its generics division has been hit by delayed launches from Roxane, the US generic drugs business it bought earlier this year.

That prompted earnings downgrades and wiped about 18% of the company's valuation and sentiment has worsened since. Paul Cuddon at Numis Securities was positive, however. "Should the shares over-react on the downside this morning, we see <2,400p as an attractive entry point."

Now, following the results, chairman and chief executive Said Darwazah has bought 200,000 Hikma shares at 2,160p each. That's a cost of £4.3 million and takes his stake to over 13.3 million, worth £291 million. Board member Ronald Goode also bought 2,000 shares at 2,180p.

"With much work to do in generics in second-half and into 2017 we maintain a 'hold' rating with the shares trading on 27x FY 2016 price/earnings falling to 19x in FY 2017," said Cuddon this week, repeating his price target of 2,660p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks