10 AIM shares with big advantage

31st August 2016 14:02

by Ben Hobson from Stockopedia

Share on

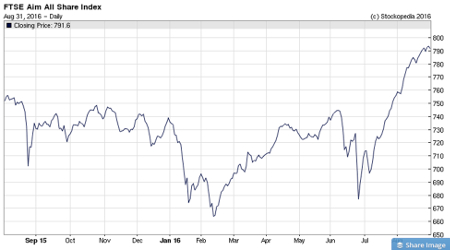

Stockmarket valuations have soared this summer and one of the strongest advances has been seen on the Alternative Investment Market (AIM) - London's exchange for growing companies. With just over 1,000 companies trading on AIM, investors face a huge task in working out which of them can deliver the best returns.

To get started, it's worth looking for stocks that are showing the signs of building wide competitive moats.

Moats have earned themselves a place in the investing lexicon that's synonymous with a robust competitive advantage and strong, resilient profitability.

It's a term that was originally employed by the highly successful American investor, Warren Buffett. He's forged an investment philosophy that looks for characteristics in a business that make it very difficult for competitors to fight against. As a result, they can generate healthy returns on capital that compound over many years.

In his book, The Little Book that Builds Wealth, Pat Dorsey, a fund manager and former Morningstar analyst, put it like this:

Durable companies - that is, companies that have strong competitive advantages - are more valuable than companies that are at risk of going from hero to zero in a matter of months because they never had much of an advantage over their competition.

Arguably, companies with the strongest competitive moats tend to be large and well established. They're the ones that have found a niche and exploited it ruthlessly to make their business models durable. Classic examples can be found among pharma groups like , tobacco firms like and consumer defensive stocks like .

But while moats are often associated with blue-chip stocks, it's still possible for smaller firms to build and protect highly profitable niches. Typically, you can find the signs in some key quality measures and metrics.

For instance, strong, stable returns from invested capital can be seen in return on capital employed (ROCE), return on equity and return on assets (ROA). These firms often have great pricing power, which often shows up in high margins and high levels of free cashflow.

To get an idea of the sorts of companies on AIM that have the hallmarks of strong economic moats, we screened the market for Interactive Investor using some of these key measures.

We sorted the list based on Stockopedia's QualityRank, which takes into account long-term quality factors, balance sheet strength and any potential accounting or insolvency risk red flags - from zero (poor) to 100 (excellent).

| Name | Market Cap £m | ROCE % | Operating Margin % | Return on Equity % | Free Cashflow/ Sales % | Quality Rank |

|---|---|---|---|---|---|---|

| dotDigital | 149.3 | 26.3 | 24.7 | 28.3 | 21.8 | 99 |

| Craneware | 278.6 | 26.7 | 28.7 | 21.4 | 30.6 | 99 |

| Ab Dynamics | 82.1 | 29.2 | 23.4 | 28.5 | 18.3 | 98 |

| GB | 411.3 | 15.2 | 13.1 | 17.8 | 15.5 | 98 |

| Zytronic | 56.3 | 20.4 | 22.1 | 19.8 | 17.5 | 98 |

| Advanced Medical Solutions | 472.2 | 16 | 24.8 | 14.4 | 27.6 | 97 |

| Somero Enterprises | 88.5 | 44.7 | 25 | 33.5 | 14.7 | 96 |

| Bioventix | 57.4 | 50.6 | 73.4 | 46.1 | 62.2 | 94 |

| James Halstead | 996.3 | 42 | 20.6 | 37.9 | 14.1 | 93 |

| Fevertree Drinks | 1,141 | 27.6 | 29.5 | 27 | 19.4 | 91 |

The sizes of companies passing these rules is considerable, with the largest stocks here being the specialist soft drinks maker, , and flooring manufacturer, .

Among the smallest are antibody supplier, , the automotive components maker, , and concrete flooring specialist, . But it's important to note that smaller companies, particularly on AIM, need detailed research.

With the value of the AIM market rising strongly in recent weeks, it's worth remembering that quality varies dramatically between the large number of stocks on the market. Those with a potentially stronger chance of outperforming over the longer term are perhaps those that can build and protect very profitable business models.

Casting an eye over some key quality measures could be a clue to finding those with the possibility of establishing strong competitive moats.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"