Share of the week: Seven-year rally ongoing

2nd September 2016 16:41

by Lee Wild from interactive investor

Share on

As trading draws to a close Friday, the FTSE 350 is set to end the four-day week in good form, losses in the run up to the US jobs report clawed back after non-farm payrolls came in weaker than expected. It means that apart from train company Go-Ahead, which operates the chaotic Southern rail franchise, standout performers are few and far between.

We've already covered numbers, but this gives us an opportunity to look at , up 8% this week.

Listed on the London Stock Exchange since 1960, the firm developed an acquisitive streak in the 1970s and 1980s. Another wave of acquisitions followed in the 1990s when the original businesses matured into cyclical, lower margin businesses.

The company now runs three divisions, supplying controls and wiring to hi-tech industries, medical devices to labs and operating theatres, and hydraulic seals used on heavy industrial vehicles.

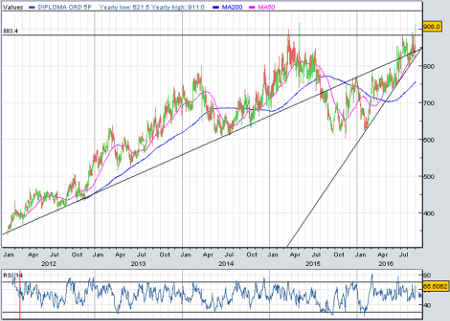

It halved in value during the financial crisis, but, after sinking to less than 100p in 2009, has risen ninefold since and currently sits within one half-decent day of an all-time high.

That's because Diploma published a bullish trading update Wednesday, reporting a "robust" second-half performance for the year ending 30 September 2016. Full-year results will meet forecasts.

We're told that revenue likely rose 14% of which 8% was from acquisitions. A slump in the pound following the Brexit vote made up 4%, as money earned overseas is changed back into sterling, which means underlying sales grew by about 2% during the period.

Reduced investment in working capital over the past six months means free cash flow will be way ahead of last year, and an anticipated "modest" net cash position will help bankroll further acquisitions.

Despite the round of buying that followed the midweek update, not everyone is convinced, among them Barclays analyst Jane Sparrow who had already downgraded Diploma last month from 'overweight' to 'equal-weight'.

Diploma has long traded on spicy multiples, but a "premium valuation" of 17.9 times earnings for 2017 is enough for Sparrow. She also has concerns about organic growth, which is tipped to remain at "subdued levels for the next few years".

That could limit "the scope for operational leverage…making growth more dependent on acquisitions (where management has an excellent track record but conversion can be lumpy)," she writes.

Over at Numis Securities, Julian Cater begrudgingly upgraded profit forecasts, but he still thinks Diploma shares are worth no more than 800p. 'Hold', he says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.