Rotation from bonds to stocks is over

5th September 2016 10:55

by Lance Roberts from ii contributor

Share on

Since we are going into a long holiday weekend [US markets are closed on Monday for Labor Day], I thought it would be worth reviewing and updating a couple of my recommendations from the end of July.

Interest rates/bonds

I discussed previously that interest rates had gotten so oversold (bonds overbought) due to the "Brexit" that a reversal was very possible. As I noted previously, the rotation from bonds to stocks confirmed the push higher in the markets.

That rotation is now complete.

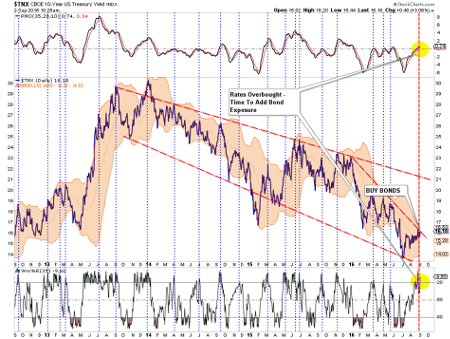

With 10-year rates now back to an overbought condition (bonds now oversold), and pushing the accelerated downtrend line that began with the conclusion of QE3 [the USA's third round of quantitative easing, launched in 2012], the most likely movement will be down, in conjunction with a "risk-off" move in the markets.

As discussed above, the suppressed levels of volatility, extremely confined trading range and the deterioration of momentum all suggest a short-term correction of the market is most likely.

I have been buying bonds fairly aggressively this past week for this reason.

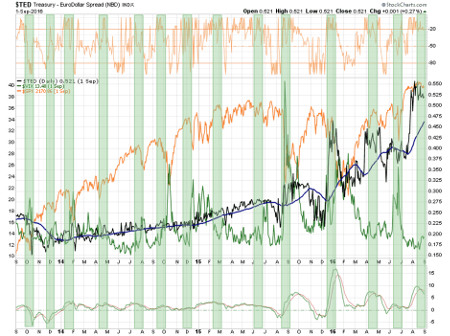

Furthermore, the Treasury to Eurodollar (TED) spread has recently peaked as well, which has historically signalled short- to intermediate-term corrective moves. By the way, notice the massive increase in volatility in the TED spread since the end of QE3.

If I am correct, and the markets do experience a short-term correction, or worse, interest rates will likely retest recent lows.

One thing is for sure - rates ain't going significantly higher anytime soon.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In