Don't shy away from foreign stocks

13th September 2016 13:21

by Ken Fisher from ii contributor

Share on

Does even the phrase "foreign investing" give you shivers? Do foreign stocks just seem so... foreign? You're not alone.

Far too many investors wholly ignore the outside world. Or they may consider foreign investments an inherently "riskier" asset class, holding just 10 or 20%. Too little!

I've heard even established professionals claim foreign is "riskier". Riskier than what, they don't say. This is easily disproved with free public data and a bit of history.

The truth is that foreign equity and bond investing shouldn't be any more or less risky than domestic investing. A good, well-diversified equity portfolio will benefit from being mostly in non-UK stocks.

Missing a world of opportunity

Seem outrageous? It's not. The UK is the world's oldest stockmarket, but it's only about 7% of the developed world equity markets*.

Considering the whole world - undeveloped markets too - it's about 6%*. If you're UK-only, you miss a world of opportunity, plus extra diversification benefits.

Once upon a time, maybe it made some sense for UK individual investors to ignore the non-UK world.

Trading globally has become quick and easy - you can buy Chilean stocks as easily as BritishTransaction costs for foreign stocks on foreign exchanges could be excessive, eating into potential benefit. And we couldn't always count on complete transparency from non-UK firms.

But in recent decades, as exchanges have gone electronic, trading globally has become quick and easy - you can buy lots of Chilean stocks as easily as any British stocks.

And in developed nations and even in many (if not most) emerging markets, accounting standards are normalised for publicly traded firms.

Whether buying a French, Brazilian or US stock, accounting and reporting obligations are largely the same. Sure, there are currency fluctuations, too - but they also iron themselves out over time.

More correlated than you think

If non-UK stocks were materially riskier, returns would be wildly variable. But they're not!

UK and non-UK stocks are more correlated than people think, and it's been that way for a long time (in my 1987 book The Wall Street Waltz, I have scads of charts showing strong correlations between markets going back centuries).

UK might be up or down more than foreign, or vice versa, but they tend not to go in opposite directionsWe live in a global economy and always have (at least much more so than people have commonly appreciated, as documented in that book) - and many of the same macro-economic forces acting on UK stocks at any one time also impact non-UK stocks.

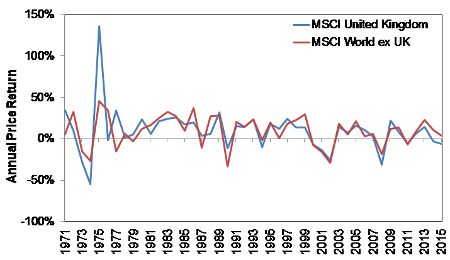

Figure 1*** (below) shows UK and non-UK annual stock performance as measured by the MSCI UK and MSCI World ex-UK indices.

Generally, when one is up, the other is too; UK might be up or down more than foreign, or vice versa, but they tend not to go in opposite directions. If UK stocks are down a lot, foreign stocks are down too.

It's a question of degree. There can be big divergences, but they're shortlived. Since 1970 (as far back as we currently have exceptionally good data), UK stocks have annualised 10.2% and world stocks 9.7% (measured in pounds)**.

Reducing risk through diversification

There's just no reason to believe, going forward, that one or the other will be inherently better or inherently riskier over long periods. But the two together are overall more stable with less volatility than either by itself. Hence the diversification is worthwhile.

With this great diversification you are fundamentally reducing risk by fully investing globally.

Think this through another way.

Many complain endlessly that the UK is doing wrong things socially and politically, and that will cause Britain to no longer have the global leadership position it held for so long. Well, maybe that's true; maybe it isn't. But if you have those fears, that is even more reason to globally diversify.

In fact, by not investing as broadly as you can, you could be missing opportunities to manage risk! But thinking you can't benefit from foreign stocks is bunk.

There's enough difference year-to-year between UK and non-UK stocks to reap benefits from diversification. So stop being a stranger to foreign and go fully global.

*FactSet, as of 30/6/2016.

**FactSet, as of 26/8/2016; MSCI UK total return with net dividends annualised, MSCI World ex UK total return with net dividends annualised from 31/12/1970 to 31/12/2015, in GBP.

***Figure 1 source: FactSet, as of 26/8/2016; MSCI UK annual price return, MSCI World ex UK annual price return from 31/12/1970 to 31/12/2015, in GBP.

Ken Fisher is founder and chairman of Fisher Investments.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.