A successful income portfolio for higher risk investors

26th September 2016 11:27

by Marina Gerner from interactive investor

Share on

Each month, our sister magazine Money Observer homes in on one of its 12 Model Portfolios, assessing its aims, the type of investor it may suit and how it's performed.

This month Marina Gerner looks at Lima: growing income, higher risk.

What are the Model Portfolios?

The Money Observer Model Portfolios are a collection of 12 theoretical investment portfolios, each consisting of a selection of six or seven funds and investment trusts (predominantly Money Observer Rated Funds). They are designed to meet particular investment objectives, starting with income and growth.

The six income and six growth packages are each tailored to different time horizons and risk profiles (medium risk or higher risk) by combining funds invested in different regions, sectors and asset classes.

What are Lima's aims?

aims to provide an increasing income plus good capital growth over a period of 15 years or more through pure equity exposure, though this may involve some shorter-term volatility.

What does it hold?

Lima has seven holdings. Four funds have a UK focus. The two core holdings are , which has a solid track record, and , which focuses on capital preservation as well as growing income and capital growth.

Two further UK equity income holdings are and , which provide exposure to medium and smaller-sized companies.

The portfolio has broad exposure to international markets through and . Artemis is a classic global equity income fund.

Scottish Mortgage is more growth-oriented and can be used as a source of capital withdrawals to supplement income.

The final holding is , which provides exposure to Asia Pacific. The trust has good potential for increasing income and capital gains over the long term from this faster-growing region.

For whom is it designed?

Lima is for people looking to grow both their income and capital over the long term. However, investors must be able to afford to lose some capital in a worst-case scenario.

It could suit newly retired investors who already have a secure income and are prepared to take on additional risk to boost their income.

The portfolio may also appeal to younger investors building up a SIPP or ISA who are willing to take risks and opt to reinvest their dividends as part of a long-term growth strategy.

How has it performed?

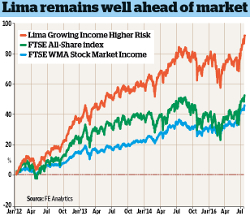

Lima returned 30.3% over the three years to 5 August.

The portfolio suffered in early 2016 when markets dipped, but it has still returned 5.8% over one year.

Over six months it returned 15.7%; the FTSE 250 returned 13.6% over the same period.

An initial £10,000 investment in Lima three years ago would be worth £13,300 today.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advise