The stockmarket in October: a volatile month?

30th September 2016 09:00

by Stephen Eckett from ii contributor

Share on

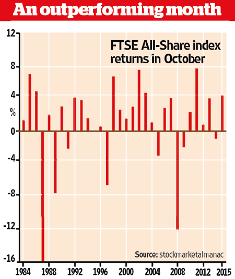

October can be a volatile month for equities. Since 1984, seven of the 10 largest one-day falls in the market have occurred in October, the largest happening on 20 October 1987 when the FTSE 100 index fell 12.2%.

Moreover, since 1970 the average monthly return for the stockmarket has been 0.4%, ranking October a lowly ninth of the 12 months.

However, the chart shows why averages don't tell the whole story, and highlights how things have changed in recent years.

For example, since 1992 the market has fallen in only five years. Since 2000 the average stockmarket return for the month has been 1.7%, making it the second best month for equities after April.

'Sell in May' effect

The strength of equities in October may not be unconnected with the fact that the strong six-month period of the year starts at the end of October (part of the 'sell in May' effect); investors may be anticipating this by increasing their weighting in equities during October.

But, while October should therefore be regarded as a generally good month for shares, any occasional weakness in the month can be severe.

The month is one of only two months (the other is September) when FTSE 100 stocks tend to outperform the mid-cap FTSE 250 stocks - since 1986 the FTSE 100 index has on average outperformed the FTSE 250 by 0.7 percentage points in October.

And, finally, for connoisseurs of market anomalies, here's a good one: "Sell before Rosh Hashanah, buy before Yom Kippur" is an old Wall Street adage.

Rosh Hashanah falls on 2 October and Yom Kippur on 11 October.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advise