Share Sleuth: How to make sense of accounting headaches

3rd October 2016 12:59

I have a confession to make. Most accounting rules are on the whole a mystery to me: defined benefit pension schemes, or derivative contracts designed to protect companies from movements in the prices of jet fuel and currencies, for example.

Accounting is the language of business, and investors should aspire to be able to read accounts like they read a book, yet pawing through notes on long-term service contracts for jet engines is like reading the foreign language footnotes in a university-level textbook from the mid-1970s.

One way around accounting ignorance is to avoid companies with complex accounts. I use various rules of thumb.

The trouble with defined benefit pension plans is that the company's obligation to present and future pensioners is dependent on variables that are constantly changing: actuaries' estimations of how long people will live and the expected returns of bonds and stocks, for example.

Toxic liability

The value of the assets that will pay the pensions depends on capricious stock and bond markets.

Because a company must ultimately plug any deficit in the pension plan, a big pension obligation can be as toxic as any other liability.

Rather than trying to figure out the risks, I tend to avoid companies that have pension obligations exceeding the value of the capital in the business itself.

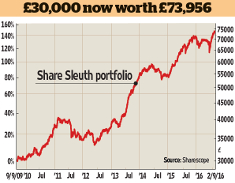

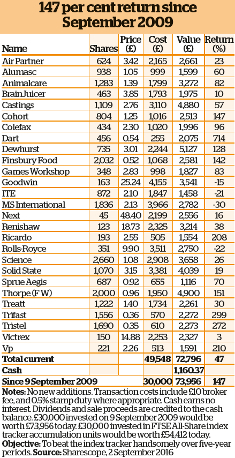

With the exception of Rolls-Royce and - the latter incidentally the portfolio's most profitable holding - the Share Sleuth portfolio generally holds companies with straightforward accounts.

When I added these two exceptions to the portfolio, I trusted management to get the accounts right, and believed other factors trumped the risk that problems might be lurking in the accounts.

Spotting the profitable

Decades of investing and reading basic textbooks have taught me enough to make sense of stable, straightforward, profitable businesses.

That is one of the reasons I favour them over more tricky situations such as , a sofa retailer that collapsed into insolvency (it has subsequently revived and is once again listed on the stockmarket).

ScS predates the Share Sleuth portfolio; it was a victim of the credit crunch in 2008. I bought the shares after they had fallen 90% on the foolish but prevalent notion that a company with no debt cannot go bust. ScS could not afford to pay the rent on its shops. It duly went bust.

Sometimes, the avoidance of complex accounting is not an option.

Many companies, including airlines, retailers, restaurants, manufacturers, distributors and hire companies, rent large amounts of equipment and property, so I decided to learn about the rental contracts known as operating leases, and how to adjust a company's financial statements to better reflect the risks.

Basic accounting textbooks for investors don't talk much about operating leases, hedge accounting, long-term service contracts or defined benefit pension schemes.

Textbooks for accountants do, but they are better at explaining how accountants should apply the rules than how investors should interpret them.

The same information is often available online from accounting firms and bodies, if you Google the particular regulation (they are referenced in the notes to a company's accounts).

Further reading

Interpretation is trickier. Sometimes bloggers and journalists write up what we have worked out or pieced together by asking other investors or analysts, but I dream of picking up a copy of Hedge Accounting Made Simple.

To get to the stage where exotic accounting bogies are bothersome, you need a basic understanding of the principles.

My favourite introductory textbooks for investors are Accounts Demystified by Anthony Rice and Why Stocks Go Up and Down by William Pike.

ShareScope, the software I use to track the Share Sleuth portfolio's performance, publishes an excellent free step-by-step guide on its website, written by analyst Phil Oakley.

He's writing a book, too. It may well be the most useful book on accounting for private investors yet.

Share Sleuth portfolio members , , Dart, and have published annual reports recently.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks