8 high quality dividend payers

3rd October 2016 14:50

by Harriet Mann from interactive investor

Share on

Markets refuse to buckle despite increasingly uncertain times, and dividends are tipped to grow by 0.7% globally over the next 12 months. Admittedly, much of that is being driven by the US and there are areas of concern elsewhere. However, UBS has identified its eight favourite quality dividend stocks in the UK, and they don’t necessarily come with a hefty price tag.

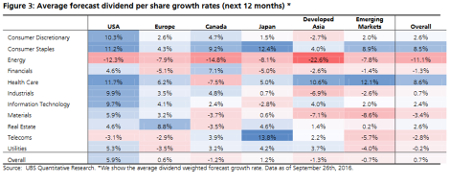

Underpinned by robust consumer staples and healthcare sectors, UBS thinks American dividend payments will surge by 5.9% over the next year. There are big differences in dividend safety across regions, however, with payouts from emerging markets, developed Asia and Canada set to fall 0.7%, 1.3% and 1.2% respectively.

Including London-listed stocks, European payouts should inch 0.6% higher as growth from the high-yielding real estate and healthcare sectors is offset by energy plays and financials.

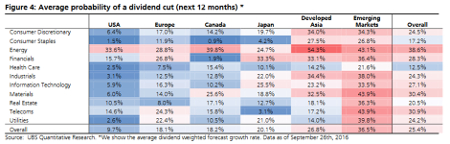

Despite promising momentum recently, oil and other commodity prices are still low, which is hurting corporate cash flow. Energy issues will weigh on dividend growth in Canada, says UBS, and the probability of a dividend cut among US energy stocks is put at over 33%.

Regionally, the likelihood of a cut in payouts in the US is put at less than 10%. In Europe it's nearly double that. However, in emerging markets it's over 36% and in developed Asia almost 27%.

Still, the big dividend names look quite cheap when looking at their book to price ratio, despite the hunt for income in a "lower for longer" rate environment. Developed Asia and Canada look the most expensive, with the average book to price only slightly higher than their benchmark, according to UBS.

"For most regions, the valuation is not very unusual compared to recent history. Despite the recent outperformance of yield in Japan, high yield stocks still appear to be slightly cheap there compared to the Japanese market as a whole," says the broker.

London quality

While there are pockets of concern, there is also optimism and UBS has compiled a 45-strong list of high quality dividend stocks.

UBS screened for stocks with both a high quality dividend stream and the earnings power and balance sheet to support it. The broker quantitatively assessed the potential for the name to outperform its sector, and its analysts scrutinised the fundamentals for a forward-looking perspective.

Eight of these top-notch income generators are listed on the London market and all yield between 2-6%.

From the UK, and , formerly Reed Elsevier, feature, yielding 3% and 2% respectively, joined by drinks colossus , drugs giant and insurers and , yielding 3%, 4%, 6% and 3%, respectively.

Although Admiral's market value has slipped back 8% from August's all-time high, the shares have still climbed by over a quarter this year.

Another company that has a robust yield despite impressive share price growth this year is . Surging 40% in the year-to-date, the Newbury-based software group recently agreed to buy assets from Hewlett Packard worth $8.8 billion, but still yields 3%.

Utilities are often added to portfolios for their defensive qualities, with reliable cash flows leading to stable dividend payments. , offering a 4% yield, gets the nod from UBS.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.