FTSE 100 a whisker from record high

4th October 2016 12:51

by Lee Wild from interactive investor

Share on

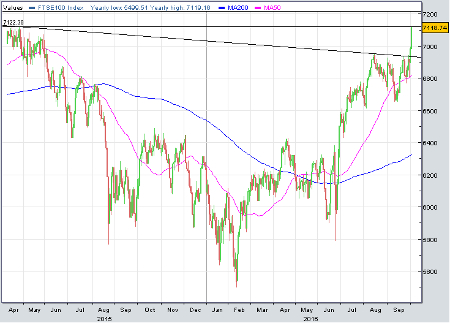

What a start to the fourth quarter! Momentum had been building since mid-September, but we spotted a chart pattern last week that "could mean fireworks". Well, the breakout we predicted happened, and the is up 300 points in quick time.

At lunchtime Tuesday, the FTSE 100 had soared as much as 135 points to 7,118. It hasn't been that high since 27 April 2015, the day the index hit a record 7,122 and made a best-ever closing price of 7,103.

Hats off to Alistair Strang. Not for the first time, the technical analyst and Interactive Investor contributor wrote yesterday about a move to 7,102. Implication here is that a new record high, only a handful of points away, is very possible.

In fact, Alistair has just confirmed to us that his software pinpoints 7,350 as the "top attraction on a big picture cycle".

continues its post-Brexit recovery with a stunning 8% rally. Profit forecasts were upgraded following half-year results in July, and specialist lenders and challenger banks remain popular.

Analysts at Barclays think challengers remain geared plays on the UK macro situation, but also believe that "high profitability, comfortable capital ratios and low valuation multiples should provide a great deal of insulation".

It's why the broker upgrades earnings per share estimates and its rating for both and to 'overweight'. Price targets for the pair rise from 235p to 340p and from 150p to 200p, respectively.

Housebuilders continue to benefit from news out of the Tory party conference that £3 billion is available to help build 25,000 new homes during this Parliament.

According to chancellor Philip Hammond and communities secretary Sajid Javid, the money will also bankroll 200,000 more in the years after, with a further £2 billion earmarked for infrastructure.

Predictably, investors are stakebuilding at , and .

A surprise return to growth for the UK construction industry has also boosted sentiment. An increase in the Markit/CIPS UK Construction Purchasing Managers' Index (PMI) from 49.2 to 52.3 foxed economists who'd pencilled in a fall to 49. A figure above 50 implies growth.

The numbers come hot on the heels of yesterday's stunning manufacturing PMI. An increase to 55.4 in September from 53.4 the month was the sector's fastest rate of growth in over two years.

"The weak sterling exchange rate remained the prime growth engine, driving higher new orders from Asia, Europe, the USA and a number of emerging markets," said Rob Dobson, senior economist at IHS Markit. "The domestic market is also still supportive of growth, especially for consumer goods."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.