15 stocks with substantial upside

6th October 2016 15:16

by Lee Wild from interactive investor

Share on

With the near an all-time high and economic data strong, the UK's reaction to Brexit has shocked many City pundits. But, as we edge closer to "B-day" - or at least when Article 50 is triggered next year - and continue to negotiate the terms of how we leave the union, uncertainties persist. In response, broker Barclays has tweaked its Top Pick portfolio, which it reckons can deliver 23% upside.

"The subsequent unprecedented monetary reaction from the Bank of England, the benign and ongoing positive data surprises, and the corporate world's rapid move to head off panic and promote the benefits of weaker sterling have subdued volatility and restored the uneasy equilibrium between uninspiring earnings growth, late-cycle dynamics and a lack of investable alternatives which seem to continuously loop back to equities as the 'last man standing'," says the Barclays team in a meaty 50-page note.

Underpinned by cheap valuations, Barclays is "cautiously" confident equities will continue to "grind higher" in the fourth quarter, preferring the cyclical sectors consumer discretionary, financials and industrials.

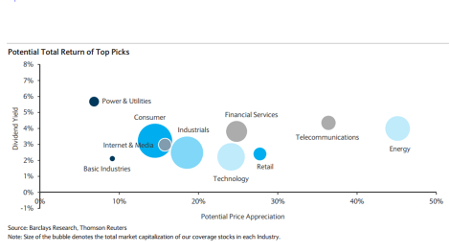

Their portfolio of 28 European top picks has 23% potential upside, according to Barclays, and offers a secure 3.2% yield. The energy sector has the most profit potential, while power & utilities have the least upside.

Boasting of average earnings per share growth of 17.5% and trading on a price/earnings (PE) multiple of 13.2 times, the portfolio is cheaper than the European index, which trades on a multiple of 14.4. The portfolio has an average return on equity of 22%.

Below, we detail the investment case for the 15 London-listed members of the portfolio, which also includes the European quote for consumer groups and , and industrials , , Vastas Wind Systems, and .

Retailer , tech groups , and and Swedish miner also made the list.

Making way for the new additions Vinci, , Société Générale and Unilever, Barclays kicked out , Grifols, , and .

Imperial Brands (3,927p)

Target price (TP): 4,400p - Upside: 12%

improving organic sales momentum, profitability and cash generation should underpin double-digit dividend growth over the medium-term. As a sub-sector, tobacco's high barriers to entry and protected profit pool positions it well against risks seen elsewhere in Staples, and Barclays reckons Imperial's margins will continue to outperform, especially in the US.

There are some short-term pressures: UK competition, losing a PMI distribution contract and EU regulatory costs. But with its brand migration strategy ahead of target, cost efficiencies on track and currency headwinds set to turn into a benefit, things should get better. Its share of the attractive US market has also stabilised over the last year, with investment to step up a gear.

"IMB is trading on a CY 2017E PE of 14.2x, but we believe the c.25% PE discount of Tobacco to Staples in Europe is overdone," say the analysts.

BP (473p)

TP: 600p - Upside: 27%

Barclays has tipped BP shares up to £6 for over three months now, although a lot has happened to confuse the investment case. Restating its bullish view for the oil giant, trades on 10.8x Barclays' 2017 earnings per share (EPS) guidance, a discount to 12x.

BP has protected its dividend throughout the collapse in oil prices, and the shares now trade with a 6.5% yield, compared to Shell's 6.8%.

Repeating its 'overweight' rating, Barclays reckons BP's investment story lies with its imminent production growth, better margins, better efficiency and an ability to grow the portfolio without an acquisition.

With oil prices now expected to trade above $50 a barrel in 2017, cash flow should increase by $4.5-5 billion. We covered the story yesterday, read it here.

Ophir Energy (79.17p)

TP: 125p - Upside: 58%

Concerns over the quality of Fortuna Floating Liquefied Natural Gas project has caused the group to significantly lag its European peers in the valuation tables, trading at a 45% discount to its tangible net asset value (NAV) compared to the sector's 20% average discount.

With a project PV10 breakeven of under $4/million cubic feet (mcf), the project's strong economics position it well to join forces with upstream partners without reducing its 80% stake and keep on track for first gas in 2020.

The priority is to ensure midstream partner Golar can deliver the converted vessel and finalise gas sale agreements. Finding an upstream partner to free up capital for other exploration can be put off until after the Final Investment Decision. Taking advantage of low drilling costs, a two-three well campaign could start in early 2017 in Myanmar and Cote d'Ivoire.

Petrofac (906p)

TP: 1,250p - Upside: 32%

With its valuation at multi-year lows, it's not been easy for . Disappointing execution of the Laggan-Tormore project, controversial decision-making, slow order intake, higher working capital and the recent departure of its CFO has weighed on sentiment.

But with underlying profitability, a solid order backlog and management's determination to improve cash flow generation, Barclays reckons the fundamental investment case is "intact".

3i (675p)

TP: 700p - Upside: 3.7%

While the UK economy has surprised most in its strong reaction to the decision to leave the EU, there is no doubt that global macro uncertainties are only going to increase into next year.

With the upcoming US elections and invoking Article 50, investors will want an investment sanctuary. Private equity giant is one such safety net, reckons Barclays, boasting of defensive characteristics and strong net asset value growth potential.

With strong weighted earnings growth behind its private equity portfolio, the group has promised a 16p base dividend and a proportion of net realisations for 2017. Last year a dividend of 22p was the equivalent of a 3% yield.

Prudential (1,441p)

TP: 1,648p - Upside: 14%

A true bull on the pensions group, is the one true large-cap growth stock in the European insurance sector, reckons Barclays. Of course, it is exposed to industry risks and no investment is truly "safe", but the analyst reckons there is enough underlying growth momentum.

With market-leading businesses in Asia, the US and UK, its record of growing earnings by 17% (compound annual growth rate) since 2004 is likely to ease back to 9% over the next five years, but this doesn't cloud Barclays' sentiment.

Barclays says: "We believe Prudential is the only large-cap company in the sector with sustainable compound growth over a prolonged period, and that the multiple of 10x FY 2017E earnings does not reflect any premium for this growth."

Derwent London (2,486p)

TP: 3,500p - Upside: 41%

A repeat outperformer of the UK Real Estate Investment Trusts, delivers returns over that of the London office market. Even though post-Brexit concerns have weighed on sentiment, Barclays reckons the experienced management team can succeed with its £800 per square foot portfolio trading at a 25% discount to sport net asset value.

While the analysts don't rubbish concerns over macro uncertainty, they reckons low vacancy rates and limited supply should stop rents falling as low as the share price suggests.

Wolseley (4,492p)

TP: 5,000p - Upside: 11%

US business is on the cusp of a multi-year opportunity to expand in its fragmented core and adjacent markets. While a fifth of its sales come from online - and this is growing - 95% of its competitors have no internet offering at all. Delivering 4% US sales growth last year despite headwinds, Barclays is confident in its outlook for 2017.

The UK business has so far held the group back, but a new strategy should be able to turn this around. Investors will hope the Nordics division can share the same fate. Even against European uncertainty, earnings should still grow at high-single-digit percentages (on a compound annual growth rate (CAGR) basis).

Oxford Instruments (657p)

TP: 970p - Upside: 48%

While industrial and scientific tool maker remains high risk, there is the potential for high reward here, reckons Barclays.

2016 earnings were in line with guidance, but the better-than-expected debt level is likely to have grown again due to its earnout payments and dollar-denominated debt. Still, Barclays reckons the majority of this risk is discounted into the current price.

On a positive note, the US research budget outlook looks good and Oxford should benefit from sterling's devaluation.

Redrow (405p)

TP: 432p - Upside: 7%

Unlike some of its peers, housebuilder continues to invest in its own future growth, which should underpin performance further out as the current housing cycle shows no signs of slowing down.

Its re-entry into the London housing market includes the recent Colindale scheme that has gross development value of over £1 billion, but the majority of its units will be priced at less than £600,000 - the upper limit of the help to buy scheme.

Yes, investors will have to sacrifice near-term dividends, but they will get exposure to a longer-term growth story, says Barclays.

Ashtead (1,310p)

TP: 1,279p - Upside: 2.4%

A key driver of sentiment over equipment rental company share price is the health of the American economy, so Barclays' belief that the US is just slowing and not entering a recession should be taken well.

With market conditions supportive of the rental industry, the non-residential property market should continue to climb higher, allowing Ashtead to outperform - given its track record.

Investors should expect some margin outperformance as its rental stores mature, which is expected to be the share price catalyst.

WPP (1,808p)

TP: 2,100p - Upside: 16%

Over the last ten years, which includes a recession, marketing group WPP has grown organic revenue by 2.8% and EPS by 10% (on a CAGR basis). With recent results ahead of expectations, Barclays reckons management will continue to deliver double-digit EPS growth during times of growth, recession and recovery.

The largest listed advertising group, management reckon it will achieve full-year organic growth of over 3% and a 30 basis point jump in margins. While the group trades at a premium, it's deserved reckons Barclays.

SSE (1,542p)

TP: 1,675p - Upside: 8.6%

Kitted out with a sustainable 6% forward dividend yield, diversified business mix and exposure to structural growth in renewable and regulated networks, is Barclays' top European Utilities pick. Although there is concern UK supply regulation may become tighter than recent recommendations, the utility group has limited exposure.

Even a cancellation of Carbon Price Support will reduce cash profit by just 2%.

Paddy Power Betfair (8,820p)

TP: 11,500p - Upside: 30%

Barclays' favourite in European leisure, the analysts see the brand as the recent merger of the two best quality names in the sector. Its multi-year growth story includes the potential for strong free cash flow growth and subsequent capital returns.

Strong EPS growth will be underpinned by high operational gearing and no balance sheet constraints.

"Scale is key and the business operates in structurally growing markets, with a strong management team and leading technology platform that can benefit from centralised technology and resources to develop new products to segment and target consumers in order to take market share," says Barclays.

Cineworld (572p)

TP: 665p - Upside: 16%

With consumers still going to the cinema, even during periods of economic weakness, defensive nature looks attractive. With limited supply growth in the industry, minimal exposure to the National Living Wage and attractive cash flow, Barclays is bullish on the group.

Its cash flow allows it to finance its rollout, refurbishments and 55% payout ratio, while still paying down debt. EPS is expected to increase 10% over from 2015-2018, and its 2017 dividend currently yields 3.6%.

"This offers investors double-digit total shareholder returns assuming no change in the PE multiple," they add.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.