10 fastest-growing dividend stocks

12th October 2016 13:36

by Ben Hobson from Stockopedia

Share on

In early September, the value of dividends paid by UK-listed companies since 2000 topped £1 trillion. The second trillion is expected to be paid out much faster, with estimates putting the date within the next 10 years.

This acceleration in payouts is a reminder of just how important dividends are when it comes to squeezing returns from the stockmarket.

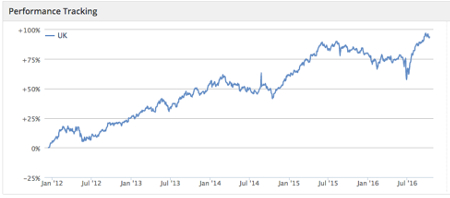

In fact, analysis by , which tracks UK dividends, points out that at the end of this summer, the FTSE All-Share index was only 14% higher than it was at the beginning of the century.

But reinvesting all those dividends would have boosted an investor's returns to well over 90%. With interest rates and bond yields at low levels, the supercharging effect of dividends can't be ignored.

Hunting for dividend growth

One of the biggest challenges faced by income investors is balancing the risk and reward of high yield stocks. High yield is obviously attractive, but toppy yields can actually be a warning sign.

They can point to companies that have lost the faith of the market. If their earnings are under pressure and their dividends are at risk of being cut, then their share prices will likely fall. As a result, the yields on those shares rise - and may present a trap to unwitting investors.

Dividend growth is often considered vital by growth company investorsThis is why many investors are much happier to focus on a track record of consistent dividend growth, rather than just high yield. Dividend growth can be seen as a hallmark of well-managed firms with growing earnings and progressive dividend policies.

For these reasons, dividend growth is often considered vital by growth company investors. Legends of finance like the late US investor Philip Fisher, put a premium on companies where the dividend is only raised with the greatest caution and only when there is a high probability that it can be maintained.

In the modern day, you see similar importance attached to dividend growth by popular growth company investors like Robbie Burns, the Naked Trader.

Screening for dividend growth stocks

At Stockopedia, we track a strategy that adopts this dividend growth approach. It looks for companies with dividends that have been increased for at least five years. They also need to have grown their earnings per share (EPS) by at least 10% compounded over the previous five years.

Debt levels have to be below average and, as a measure of liquidity, each company needs to show that it's more than able to cover its short term liabilities with its current assets.

These rules combined have resulted in a portfolio return of 14.7% annualised over nearly five years (pre-costs and pre-dividends).

Name | Mkt Cap £m | Dividend growth streak | Forecast yield % | 5-Year average yield % | Year-on-year dividend growth |

Walker Greenbank | 122.5 | 6 | 1.5 | 1.6 | 25.1 |

Galliford Try | 1,099 | 7 | 6.5 | 4.9 | 20.6 |

Photo-Me International | 544.8 | 6 | 4.4 | 4.1 | 20.1 |

ECO Animal Health | 318.7 | 6 | 1.2 | 2.0 | 20.0 |

Advanced Medical Solutions | 490 | 5 | 0.4 | 0.6 | 16.4 |

Brooks Macdonald | 235.1 | 9 | 2.1 | 1.7 | 14.8 |

James Latham | 128.6 | 7 | 2.3 | 3.0 | 14.4 |

Nichols | 514.5 | 9 | 2.0 | 2.3 | 14.2 |

Bovis Homes | 1,082 | 5 | 5.5 | 2.2 | 12.5 |

Jupiter Fund Management | 2,066 | 5 | 5.0 | 3.4 | 11.9 |

The current list of companies passing these rules includes small-cap stocks like the interior furnishings company , timber products distributor and animal pharma company .

But a focus on both dividend and earnings growth also captures larger companies, such as the housebuilders and , and the asset manager .

Taking comfort from consistency

A consistent dividend growth record can be an important reference for income investors. It can offer an indication of how sustainable a dividend is and whether the payout might be at risk.

It can also give growth company investors an insight into the confidence of a management team and whether they expect earnings to grow in the future.

Dividends, of course, can be cut at very short notice when things go wrong with a company, so careful research is needed. But in the search for dividend safety and earnings growth, a strong track record could be a useful place to start.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.