How dollar rally could crush profits

17th October 2016 13:08

Back in July of this year, I began writing about how the dollar will likely continue to strengthen in the months ahead. To wit:

"While Central Banks have gone all in, including the Bank of Japan with additional quantitative easing measures of $100 billion (£82.3 billion), to bail out financial markets and banks following the 'Brexit' referendum, it could backfire badly if the US dollar rises from foreign inflows.

"As shown below, a stronger dollar will provide another headwind to already weak earnings and oil prices in the months ahead which could put a damper on the expected year-end 'hockey stick' recovery currently expected."

Here is an updated version of that chart.

As mentioned, the earnings outlook could be in jeopardy. The chart below compares recent months to where estimates stood in January of this year.

As of 1 October, forward estimates are at their lowest levels yet (let the "beat the earnings" game begin).

If we assume those estimates are correct, now the forward price/earnings (PE) multiple rises to 19.64x earnings. Certainly not cheap.

But even those estimates are a likely a fantasy. Throughout history, earnings are consistently overstated by roughly 33%. This overstatement of estimates can be clearly seen in the chart below.

If we held Wall Street analysts to their estimates at the beginning of this year, much less the beginning of the previous quarter, 100% of companies would have missed earnings during the second quarter of this year.

In fact, in just the past three months, analysts have now ratcheted down their estimates for the third quarter to their lowest levels yet.

A real problem

The dollar rally could be a real problem with respect to the earnings recovery story going into the end of the year. With an already weak economy, a stronger dollar means weaker exports for companies and a drag on corporate profitability.

Michael Pento noted this problem in his article this past week:

The free pass on over-hyped stock valuations is now over. And with the S&P 500 trading at 25x reported earnings, this market needs a huge revenue and earnings rebound in the third quarter or the gravitational forces of rising interest rates will send stock prices significantly lower.

The low on Treasury yields is most likely behind us. In fact, the 10-year note yield has risen from 1.36% in July to 1.8% recently.

And the Fed has similarly duped itself into believing asset prices are not in a bubble and that borrowing costs can normalize without hurting equity prices and economic growth.

However, both assumptions are extremely far removed from reality.

The truth is that this protracted economic and earnings malaise - that shows no sign of turning around - coupled with record high stock prices and the reversal of a nearly decade-long zero interest policy on the part of the Fed, points to a collapse in equity, bond and commodity prices concurrently.

The reversal of the central bank's trickle-down wealth effect could very easily cause a recession to hit the economy hard by the middle of 2017.

Let's take Michael at his word about historically high valuations. Heading into the turn of the century, valuations spiked to an astronomically high level driven at first by irrational exuberance and then collapsing earnings.

However, prior to that period, every bull market in history ended when valuations approached 23-25x earnings.

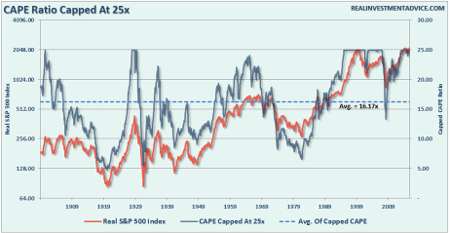

The chart below is a thought experiment which compares the inflation adjusted S&P 500 index with Robert Shiller's CAPE which has been capped at 25x trailing earnings. By stripping out the one anomaly, we can find a potentially more realistic view about current valuations and as it relates to expected forward returns.

Given the current level of valuations, if there is a failure of earnings to rebound going into the fourth quarter, the justification of higher valuations is going to become much more difficult to support.

This is particularly the case if interest rates rise further, which will become to crimp further demand for credit, along with a stronger dollar impacting exports.

By the way, don't expect for a moment the Fed will actually hike rates in December. That particular window has been closed, boarded up and cemented over.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.

Editor's Picks

.png)

.png%20%09)