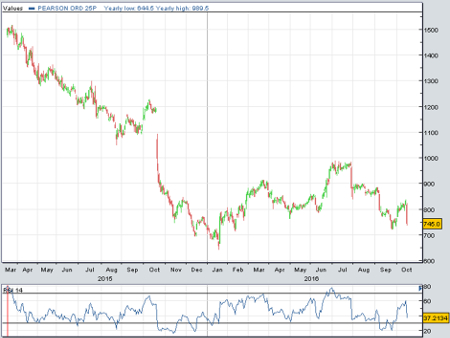

Pearson plummets again

17th October 2016 14:12

by Harriet Mann from interactive investor

Share on

Education group is learning lessons the hard way. A weaker-than-expected performance in the first nine months of the year pushed the share price down 10% Monday, unwinding most of the gains made since a recovery began three weeks ago. It's still confident of meeting full-year profit guidance, but, with sales falling fast, the market isn't so sure.

Underlying group revenue has dropped by 7% so far this year, far more than expected, with much of the damage done in North America where sales fell 9%, or 13% at constant exchange rates.

Of course, the weak pound is good for Pearson - 63% of sales are generated in the US - and revenue was down a more modest 3% when it is factored in. But it's not good enough.

Management expected challenges in North America. There were. The schools business felt the pressure of weak assessment revenues and a smaller adoption of K-12 education standards, while a further retailer destocking in the busiest months of the year hit the US colleges division. Although trends improved in September, it couldn't offset the summer damage.

If exchange rates stay at current levels until the end of 2016, EPS could jump 4.5p to 54.5-59.5pExpected declines in UK vocational course registrations and a fall in courseware revenues in smaller European and African markets left core underlying sales down 4%.

Pearson's growth business also hit a snag, with underlying sales down 3%. Pearson has withdrawn from running three Saudi Colleges of Excellence as part of its simplification plans, and further rationalised its direct deliver businesses. Excluding these exits, underlying revenue was flat on the year.

Heavy cost-cutting means the company still expects to generate operating profit of £580-620 million this year before restructuring costs, with earnings per share (EPS) of 50-55p.

If exchange rates stay at current levels until the end of 2016, EPS could jump 4.5p to 54.5-59.5p.

As part of its simplification strategy, which included the sale of the Financial Times last year, restructuring costs are expected to reach £350 million in 2016. With around 90% of its headcount reduction outlined, around £350 million of savings should be made over the next two years - £250 million in 2016 and £100 million in 2017. This could mean £800 million of operating profit by 2018.

"Our competitive performance remains strong in a tough market. We have achieved more than 90% of the growth and simplification restructuring programme we announced in January," said chief executive John Fallon.

"While market conditions continue to be challenging, particularly in higher education, thanks to tight cost management we are on track to deliver our guidance this year, and to achieve our long term growth goal."

Softer underlying growth offsets the improved currency backdrop and downbeat broker Numis keeps its 2016 EPS forecast at 57.2p. The foreign exchange benefit should feed into the bottom line during 2017, though, so analyst Gareth Davies raises estimates for next year from 67.4p to 69p.

Pearson shares have halved since peaking at £15 a share 18 months agoNet debt peaked at £1.4 billion in August due to the normal seasonal build-up of working capital in the first half - including dividend payments, restructuring charges and exchange rate movements. Net debt was £2 billion a year ago.

Share price gains made in the first half of 2016 began to unwind after Pearson's end of July interims, since when Pearson shares are now down by nearly a quarter. They've now halved since peaking at £15 a share 18 months ago.

A price/earnings (PE) multiple of 13 times for 2016 - dropping to 11 times on next year's estimates - and 6.9% prospective yield look attractive on paper, although many in the City doubt the dividend is sustainable, especially as Pearson remains vulnerable to further shocks.

Not everyone is negative on Pearson - Panmure Gordon think the dividend "looks increasingly well covered" - but even they admit "the shares may struggle to push much higher in the near term".

Davies remains wary, repeating his 'sell' rating and 710p target price.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.