A share about to break 'glass ceiling'

19th October 2016 10:34

by Alistair Strang from Trends and Targets

Share on

Our last glance at had postulated 6.75p initially with secondary 7.25p. Anyone who's been reading our occasional reports against this absurdly "popular" share will be aware we've some reservations just above the 6.75p level.

The situation now is quite interesting. In the last few sessions, the share price has repeatedly tickled and bettered the 6.75p level, but 17 October was the first time it closed bang on target.

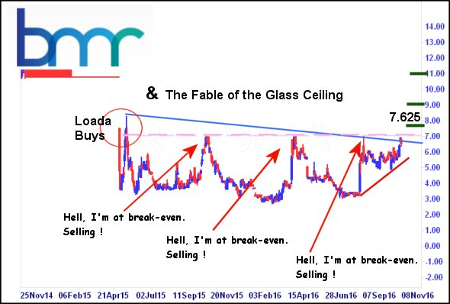

The colourful chart below has quite a tale to tell, one which dates back to the share suspension being lifted at the start of 2015. It appears there was massive interest in shares when it started trading again and, every time the price hit the retrade levels, a bunch of folk turned into BABEs (bail at break even).

Visually, this has happened three times - so we hope the wimps have all left the building, as the price is once again challenging the 7p level.

Further down the road, we'd a "big picture" argument favouring 11pCertainly, there have now been three sessions with little sign of panic selling, so the situation remains of closure above 6.9p suggesting a new phase of price recovery has commenced.

Backing this up, the share price closed 17 October above the 'blue' downtrend since relisting, so it's officially "fingers crossed" time.

We'd be wasting everyone's time suggesting closure above 6.9p leads to 7.25p next. It's becoming pretty obvious, so if we step back and take a "big picture" viewpoint, we can expand this toward closure above 6.9p pointing at 7.625p as a major point of interest. If bettered, the share will find 9.125p hard to avoid.

Further down the road, we'd a "big picture" argument favouring 11p with this resulting in a curious logic where this share need only trade above 11p to suggest some proper recovery has become inevitable.

But for now, the share would need to slither below 5.5p ('red') to suggest recent movements have all been a dreadful mistake.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.