Why you must start paying attention to your investments

24th October 2016 12:21

by Lance Roberts from ii contributor

Share on

It's not just the US election that is weighing on me, but the indecision of the markets as well.

As I noted last week:

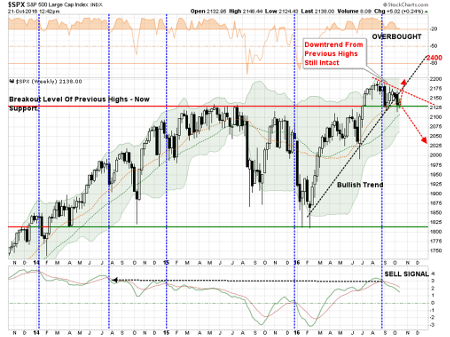

"Importantly, the market broke that bullish trend line this past week with the market remaining overbought and on a 'sell signal'.

"These combined events put further downside pressure on the markets into next week."

"If we zoom in we can get a little clearer picture about the breakdown."

The two 'dashed red' lines show the tightening consolidation pattern more clearly.

Currently, the market has been able to defend crucial support at the level where the markets broke out to new highs earlier this year. However, the market now finds itself "trapped" between that very crucial support and a now-declining 50-day moving average (DMA) along with the previous bull trend support line.

Importantly, the "sell signal", which is shown in the lower part of the first chart above, suggests that pressure remains to the downside currently.

However, there is a concerted effort to keep prices elevated over the last week. Following the bounce off of the critical 2,125 level this past week, the market has consistently fought off weak openings and has rallied back into the close. This is shown in the chart below.

The red circles denote when the market had reached extreme overbought levels during the trading day, which typically denoted the limit of the upside advance for the day.

The broader point to be made here is that, while the market is defending its current support level at 2,125, the question is whether the market can muster the momentum to reconstitute the bullish trend into the end of the year.

As shown, the longer the market languishes below the downtrend line, and the previous bullish trend line from the February lows, the sharper the rise needs to be to re-establish the bullish trend. It would currently require a move to 2,200 to accomplish that feat next week.

While such a move is certainly quite feasible, there is a substantial level of resistance currently weighing on the markets. The 50-DMA has begun to trend lower, the downtrend resistance from the previous market highs remains present and the "sell signal" occurring at high levels suggests the risk of a further correction has not currently been eliminated.

The election is easy to point to, but the strong dollar and weaker economy are what's weighing on earnings It is important, as an investor, not to "panic" and make emotionally driven decisions in the short term. All that has happened currently is a "warning" you should start paying attention to your investments.

With earnings season now in full swing, a pickup in volatility is certainly expected. However, so far, the earnings have been a mixed bag, with several companies pointing to the election as a reason for missing earnings.

While the election is certainly an easy culprit to point to, the reality is much more likely a strong dollar/weaker economy and consumer story that is actually weighing on their earnings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.