Risks remain for rest of the year

24th October 2016 12:39

by Lance Roberts from ii contributor

Share on

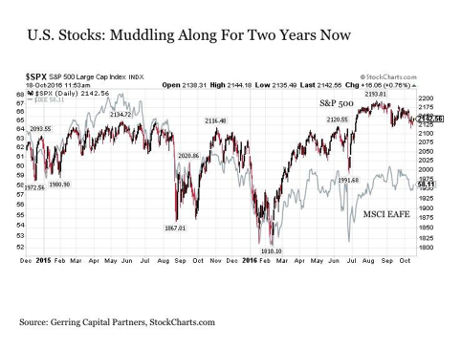

It is interesting that many people believe the stockmarket has actually been doing well. However, the reality is that for the past two years the market has actually not gone anywhere. This was a point noted by Eric Parnell via Seeking Alpha just recently:

"Although the US stockmarket is barely higher than it was nearly two years ago when the Fed's QE3 mega stimulus program came to an end, it did recently touch new all-time highs as recently as August.

"It did also bounce back impressively from its tough start to the year and has shown much more verve than its developed market counterparts across the rest of the globe in regaining its footing.

"Moreover, it appears to be increasingly setting up for a solid year-end rally post-election during the historically supportive months of November and December."

He is correct. On a short-term trading basis, as opposed to the longer-term outlook…we are moving into the "seasonally strong" period of the year for stocks. However, there are many risks, even in the short-term, to consider, as Eric notes:

• Other notable risks include the ongoing depreciation of the Chinese yuan currency, the ongoing instability in the European banking system, and the increasing realization that risks associated with 'Brexit' did not end but only just started with the conclusion of the vote back in late June.

• The S&P 500 Index is now trading at more than 26.2 times trailing as reporting earnings. This is a valuation that is venturing well into tech bubble territory at this point and comes at a time when corporate profit margins are in decline.

And, while extreme valuations during the tech bubble were heavy concentrated in selected sectors such as technology, media and telecom, today's frothy valuations are more evenly spread across the entire sector spectrum.

Put more simply, unlike the tech bubble, no stock investors should consider themselves safe from the effects of the next bear market once it finally arrives.

• One other persistent risk is the ever-present potential policy mistake or unexpected shift. This would include most notably a major global central bank suddenly shifting toward a more tightening policy stance. This risk is most pronounced out of China, which has recently been draining liquidity out of its financial system.

While everyone refers to the so-called "taper tantrum" of May-June 2013 as being the reason for the sudden and sharp stock and bond market sell-off at the time, the far greater reason was the fact that the Chinese interbank lending market had effectively seized up at the exact same time.

• Lastly, the constitutional referendum vote in Italy is set for Sunday, 4 December. Why exactly would global investors care about the outcome of a constitutional referendum in Italy in the coming weeks?

Because the outcome has the very real potential to turn what was an isolated incident in the United Kingdom leaving the European Union suddenly into a trend.

So, while there is a potential the market could hold onto support long enough to muster up a rally into the year end, there are mounting risks that something could indeed go horribly wrong.

As an investor, you will be well served to monitor events closely and adjust portfolio risk accordingly depending on how events begin to play out.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.