Fund tips for pre and post-retirement portfolios

24th October 2016 14:28

How pension investment has changed in recent years. Gone are the days when the norm was to hand your savings over to a pension company, forget about them until you stopped working, and then purchase an annuity to provide your retirement income.

Other than those employees fortunate enough still to have a final salary company pension scheme, many people are now using self-invested personal pensions (SIPPs) to build up their pension funds and particularly, around retirement, to create retirement drawdown portfolios which they can use to provide income when they stop working.

The shift towards SIPPs is not surprising. They have many advantages, allowing you to build your own investment portfolio for growth or income.

You are not locked into one investment manager or stuck with the same annuity rate for life. You can choose the best investment managers and draw down capital gains as well as income.

Right strategies

However, such is the range of investment opportunities available that narrowing your selections and constructing a well-rounded portfolio can be a challenge.

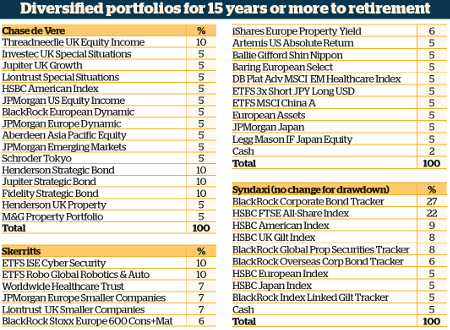

We therefore asked a number of retirement experts for their thoughts on what a well-crafted SIPP portfolio should look like.

Naturally, advisers are quick to point out that generalising about SIPP investments is difficult because much will depend on individual circumstances and attitude to risk.

When you first start building up your pension, just one good global equity or multi-asset fund may be sufficient, points out Patrick Connolly, a certified financial planner at Chase de Vere.

Spreading your pension investment around too many holdings can be counterproductiveBut, he says: "For someone with £100,000 in their pension fund, we would suggest a maximum of 15 or 16 holdings spread across different geographical areas and asset classes - UK, US, Far East equities, fixed interest and property."

Although our experts stress that diversity is important in a SIPP portfolio, they also emphasise that spreading your pension investment around too many holdings can be counterproductive.

David Thomson, chief investment officer at VWM Wealth, says: "We typically hold between 15 and 20 funds in a client portfolio, but for someone doing it themselves I think 10-15 would be a more manageable number."

The number of holdings is likely to increase with larger portfolio values, but most experts agreed that 20 holdings should be the limit.

The holdings do not necessarily have to be the same size. You may wish to combine larger "core" holdings for the long term with smaller "satellite" holdings that exploit shorter-term investment themes. However, it is important not to dilute your investments.

Robert Reid, director of Syndaxi Financial Planning, explains: "My view is that more than 20 holdings is usually too much, but a better benchmark is to have at least 5% (of your portfolio) in each fund."

He explains that this is because if you only have 2% in a fund that delivers a 20% return, it would only add 0.4% to your portfolio's overall performance.

Our Model Portfolios are relatively concentrated, with just six or seven funds or trusts in eachGavin Haynes, managing director of Whitechurch Securities, agrees, up to a point.

"You need a spread of asset classes and markets. A 5% position is a good starting point, but you might have up to 7% in a core holding, and no less than 3% in others.

"It is important to remember that if you invest in collectives (funds and investment trusts), you already have diversification. If you spread your investment too thinly, you might as well buy an index tracker."

Money Observer's 12 Model Portfolios are relatively concentrated, with just six or seven funds or trusts in each, but most of the holdings in our portfolios are well diversified and are mainly core, long-term holdings. It is also possible to combine two or more of our portfolios for a greater spread.

Growing your SIPP

If you have 15 years or more to go until retirement, advisers recommend that you can generally afford to go all-out for growth, modifying your portfolio as you approach retirement.

Connolly explains: "If you pick a wrong fund when you are investing long term, it is not a big problem, but the larger your pension pot becomes and the closer to retirement you get, the more important capital protection becomes."

Andrew Merricks, head of investments at Skerritts Wealth Management, explains his approach: "My view is that if you have 15 or more years until retirement then you need to have your foot on the pedal, which means being invested in equities.

"Other assets - bonds, gold, cash - come and go, but over the next few years it will be equities which do well."

He suggests that Skerritts's Tactical Alpha Plus portfolio is the type of long-term growth vehicle suitable for longer-term investors in the "accumulation" stage of retirement planning.

It invests in a mixture of actively managed and passive equity funds spread across world markets, with exposure to themes such as healthcare, which Merrick believes have good growth potential.

David Thomson suggests a balanced growth portfolio, but it too is invested almost exclusively in equities at present.

He says: "The current environment is unusual, in that there are a number of areas which we expect to make a loss in the foreseeable future and if we think there will be a loss we do not invest.

Connolly's suggested portfolio includes both European equity and property funds"The prime example of this is government debt, particularly gilts, and property, which we exited completely post-Brexit. We like corporate bonds and hold them in our more defensive portfolios.

"We are likely to add corporate bonds to the balanced portfolio in the near future, once we think the current equity rally has run out of steam. Our 'so-called' defensive assets currently consist of absolute return funds."

Our three remaining advisers suggest a multi-asset approach for the growth phase, including holdings in bond and property funds as well as equity funds.

Robert Reid's portfolio, which is invested in passive tracker funds, includes the largest exposure to bonds at 46%, while Patrick Connolly suggests a 30% investment in bonds and Gavin Haynes includes a 20% exposure to fixed income funds.

Connolly's suggested portfolio includes both European equity and property funds, which may surprise some investors.

Connolly explains: "It isn't currently possible to invest in some commercial property funds, although it will be again at some point.

"We continue to hold property in client portfolios and believe it has a long-term role to play. While we cannot necessarily invest in the property funds we want now, we might keep some money in cash or absolute return funds with a view to investing in property when we are able.

All advisers stress that it is important to monitor your holdings regularly"We also continue to include allocations to Europe in client portfolios. Despite its problems, Europe still has many top-quality profitable companies that often earn a large proportion of their revenue outside the eurozone."

If you are running your own SIPP portfolio, all advisers stress that it is important to monitor your holdings regularly.

As Thomson points out: "It is almost impossible to set up an all-weather SIPP portfolio that you can just forget about for 20 or 30 years. It is like setting sail across the ocean - you have to be prepared to adjust the sails as conditions change."

Thomson says he reviews clients' portfolios continually, and suggests DIY investors review theirs at least annually.

Merricks also suggests that private investors should review their portfolios a minimum of once a year, although he rebalances his clients' portfolios on a quarterly basis.

Taking an income from your SIPP

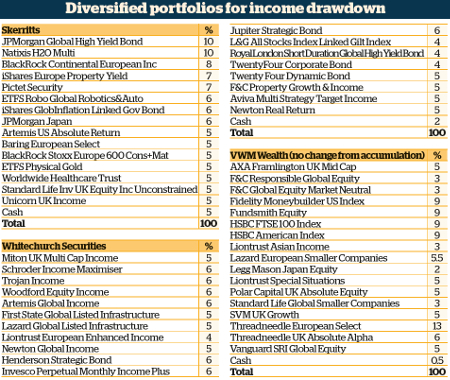

There were differing views among our experts about the degree to which you need to overhaul your portfolio when you start drawing down an income. All stressed the need to continue investing with capital growth as well as income in mind.

As Patrick Connolly explains: "If you start to draw down an income at age 65, you could be invested for another 30 years. So while it may be a good idea to reduce your risk, it doesn't make sense to take all the risk off the table."

Nevertheless Connolly suggests several changes to his recommended SIPP portfolio when it comes to drawdown. These include reducing the equity content of the portfolio from 60 to 50% and increasing the fixed income exposure from 30 to 40%.

He also suggests replacing most of the growth fund holdings with equity income funds investing in different stockmarkets worldwide.

Merricks also suggests a more balanced portfolio for drawdown. With a less full-on growth approach, his asset allocation is more diversified.

Seven of the holdings remain the same, but the post-retirement SIPP portfolio he recommends includes exposure to global bonds as well as a gold exchange traded fund and several equity income funds.

Targeted absolute return funds aim to produce positive returns in all weathers - but not incomePrior to drawdown, Gavin Haynes included a number of income-oriented funds such as and in his suggested SIPP growth portfolio.

He explains: "Even when you are looking for growth, the compounding effect of reinvested income can be powerful, and then when you reach retirement you can start drawing down the income."

At retirement, Haynes's drawdown portfolio retains 10 of its previous 19 holdings. Although the equity content remains similar, he too switches to more income-oriented funds.

The main change is an increase in the fixed income content from 20 to 35%, as a result of a reduction in targeted absolute return funds.

Targeted absolute return funds aim to produce positive returns in all market conditions, but are not designed to generate income. Haynes encourages post-retirement investors to draw down only the portfolio's natural yield - 4% in this case.

He points out: "Some people may require a greater level of income. There is no harm in them drawing on capital growth, as long as they appreciate the risk there may be in years when growth falters."

However, advisers Reid and Thomson argue that investors should focus on the total return (i.e. growth and income) from their portfolios both before and after retirement, which means there is less need for any radical alteration in their investments when it comes to taking 'income'.

It's important to budget to maintain a sustainable level of retirement capital and incomeThomson explains: "Your portfolio is likely to evolve over the years anyway - from relatively adventurous up to your 40s, to a more balanced approach after that. Thus when you move into drawdown we don't see it changing much. We would not change to 'income mode'.

"We don't look at yields, we look for funds which we believe will produce good total returns, and suggest investors take a combination of natural income and capital withdrawals to achieve their desired level of income."

Reid argues that investing for growth is always important because of the effects of inflation on your income. Nevertheless withdrawing capital can be risky when investment markets decline, and you may need to consider reducing your withdrawals.

Reid says that this is why it is important to spend time on budgeting when you first retire, in order to ensure you maintain a sustainable level of retirement capital and income.

He suggests: "By segmenting your budget into needs, wants and aspirations, basic income levels can be protected and the other segments can be reduced or increased as investment conditions alter."

Money Observer's Model Portfolios

Money Observer's own Model Portfolios could be considered by investors looking for fund ideas for their SIPPs (please remember to take professional financial advice if you are unsure which is the right choice for you).

Growing your SIPP

For investors with more than 15 years until retirement, there are two long-term growth portfolios: , designed with medium-risk investors in mind; and , for those prepared to take a higher-risk approach with greater volatility.

Bearing in mind the relatively concentrated nature of our portfolios, investors could consider combining these portfolios with the one of the four shorter or medium-term growth portfolios as they get closer to retirement, to provide more diversity and reduce risk.

Income drawdown SIPPs

When investors first reach retirement, it is important to think long-term about the need to generate a growing income. Our growing income portfolios are , designed for medium-risk investors; and , the higher-risk version.

We would envisage investors taking part of their income in the form of capital withdrawals over time. However, investors who would like to boost the natural yield on their SIPP could spread the balance of their investment across one of our other model income portfolios.

Medium-risk investors could use Golf for a high immediate income or for a balanced income, while higher-risk investors can choose between or India respectively.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks