The stockmarket in November: quiet month ahead?

31st October 2016 11:59

by Stephen Eckett from ii contributor

Share on

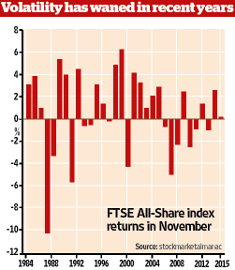

November tends to be one of the quieter months for shares. After sometimes dramatic moves in September and October, and before the traditional end-of-year rally in December, investors seem to take a break. This month currently has the lowest volatility of monthly returns in the year.

The November market was strong in many years prior to 2005 (see chart below), but since then it has been more likely to fall than rise, returning -0.6% on average.

Usually the market rises in the first four days of the month, perhaps because investors buy into the market in anticipation of the typically strong six months from November to April (the "sell in May" effect).

After that, the market gives up those gains over the following few days, rises again and falls back, until finally lifting quite strongly over the final seven trading days.

Big winners

Babcock, Compass and CRH have only had negative returns in November once since 2006.

An equally weighted portfolio of these five shares would have outperformed the FTSE 350 index by an average of 5.2 percentage points in each year since 2006.

The big event this month will be the US presidential election on 8 November.

Since 1972, on average, UK shares have traded more strongly as election day approaches and tailed off for a few days following the election.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.