Active vs passive funds: Getting the balance right

3rd November 2016 14:21

by Cherry Reynard from interactive investor

Share on

Exchange traded funds (ETFs) have their evangelists. For this group of devotees, active managers don't consistently beat markets, so the only way to invest is via cheap index funds; and there is plenty of choice, so investors never have to look elsewhere.

Others may be more circumspect, believing that there is a time and place for active funds, and a time and place for ETFs.

Certainly, that investors can now do pretty much anything they like with a passive fund is not in dispute. If, for example, an investor wants exposure to the US market, they can invest via an S&P 500 ETF for under 0.1% per year.

Are ETFs a better option than active funds?

They can also invest in a smaller companies fund such as the , for a slightly higher price (0.43% in this case).

Then they could add a technology ETF such as the iShares S&P 500 Information Technology Sector Ucits ETF (0.15%), which is exclusively invested in large US technology stocks.

The same is true for most markets and most assets, including commodities and bonds. With the exception of very illiquid markets - micro cap, bricks and mortar property, some frontier markets - investors can find an ETF to suit their every investment whimsy.

The question is more whether there are circumstances in which ETFs are generally a better option than an active fund within a portfolio. The standard answer has been that passive investments are a good solution for the most liquid and efficient markets.

This might be true of the US market, for example, where there are lots of market participants, so - the theory goes - everything that is known about an individual company is likely to be reflected in the price.

As active managers aim to exploit pricing anomalies, there isn't much for them to do in this type of market.

It might also be true for large-cap companies. In general large-cap companies, wherever they are in the world, tend to be well-researched by lots of analysts, and if there is news about a company, it is usually on the front page of the Financial Times. Again, the opportunities to exploit mispricing are limited.

Most of the assets in ETFs are held within those tracking the major large-cap indices of the , the S&P 500 or the MSCI Europe.

Nevertheless, there are some who dispute the hypothesis that the US market, for example, is efficient - active managers investing predominantly in large-cap US stocks would be an obvious example.

Equally, some dispute that indexing can't work in less efficient markets. Brian Wimmer, senior investment strategist at Vanguard, says: "While the most common approach is to use passive to access places such as large-cap US stocks, we take a different view.

"We don't find any specific markets where active or passive is necessarily better. We believe indexing can work in all markets and usually gives a smaller range of outcomes."

Predictable returns

With this in mind, ETFs can also suit those investors who don't want to take the risk of an active manager doing very much worse than the market. They are happy to sacrifice the potential to do better than the market for a more predictable return.

Moreover, there are some asset classes where the ETF is the most practical option for investment. Commodities would be a good example of this.

It is possible to find active funds that specialise in commodities, but because investors are investing in, say, gold mining companies, they do not receive pure exposure to the gold price.

There will be all sorts of other factors at work in the price of the shares - the quality of the management, the cost of extraction and so on. In general, exchange traded commodities funds are the easiest way for non-institutional investors to access a commodity directly.

ETFs are also one of the main options if investors want leveraged or short exposure to the market.

While this will inevitably remain a niche and high-risk option for most investors, some may have a strong conviction that a certain market will rise or fall, and it can be difficult for private investors to take these sorts of positions.

They can do it through specialist spread-betting or credit default swaps, but this can be time-consuming and expensive. ETFs are now available that offer short or leveraged exposure to individual markets.

To some extent, they also limit the risks of this type of investment, as investors in ETFs can only lose their initial investment, but losses on spread-betting contracts may far exceed this.

Quick exposure

For many institutional investors, if they need to take market exposure quickly, they will do it via ETFs. They may have lots of money coming into their funds.

With cash rates low, they don't want it to lie dormant and uninvested, but they may not be able to find suitable investments quickly enough. They can use ETFs as a holding position, giving themselves market exposure while they decide where to invest.

However, even though ETFs give investors the power to be more short term and tactical, this is not how most people use them. Wimmer says: "We tend to find that investors stay longer in a passive fund than they do in an active fund.

"We believe this is because they have a long-term perspective - they recognise that there are times when active managers may do better and times when they won't, and are happy for that to work out over time."

With the advent of smart beta or alternative indexation - where ETFs track benchmarks based on factors other than market capitalisation - investors can also use ETFs to gain exposure to specific factors or metrics.

These might be qualities such as momentum or value, growth in earnings, dividends or volatility. ETFs now exist from a range of providers that re-weight the market according to these qualities, rather than size.

With these ETFs, investors can reduce the volatility of their portfolios, or increase its exposure to high-dividend companies (for example, using the ).

That said, this is not without its dangers. Howie Li, executive director at ETF Securities, says: "If you know how and when to use these factors, it can be very beneficial, but that takes a certain sophistication.

"However, there might be some disappointment if the focus is on one factor which could underperform in certain environments. Multi-factor strategies have tried to address this."

Gary Potter, co-head of F&C Multi Manager Solutions, says of low-volatility strategies, which have performed very well: "We are entering a danger zone. Investors are increasingly myopic about quality growth companies and 'bond proxies'. We have seen stable businesses command increasingly high prices.

"You need to ask yourself what is driving you to reduce volatility. Is it because you are scared of risk, or of trading away from the benchmark? Volatility may just be what gives you the returns. There is a perception that avoiding risk is a good thing, but we don't agree."

Potter is in good company. Jack Bogle, founder of Vanguard, has also raised doubts about investors' ability to time certain factors. It is very difficult, he says, for the average investor to know when to invest in momentum stocks or value, or low volatility.

Chris Riley, investment research manager at RSMR, agrees: "Certainly. If factors become very popular they can get a lot of capital flows. That is not an argument against having a mix of factors, but against investing in single factors.

"In fact, this could well apply to any asset class. If you get into style and timing, and try to pick which factor will do well, you might not get diversification benefits."

Smart beta

Riley also points out another problem - these factors are becoming better known by investors.

He suggests that performance for many of the ETFs following them will look better over the very long term (50 years) than it does over the shorter term (10 years), as these factors are better understood by investors and the advantages are arbitraged away.

This, he thinks, might spell danger for the future, and is a long-term risk for smart beta.

That said, it is still better to have a cheap smart-beta option than to pay an active manager to do pretty much the same thing. Smart beta can only be applied to processes where there is plenty of available information, and therefore is a natural replacement for some types of active fund.

Riley says: "The critical element is the quality of the data set. For example, in high-yield investments there are certain criteria that can be codified into a set of values. [Fund quality] will often correlate with the availability of data.

"For a large-cap fund, data is usually quite accurate and quite plentiful. However, small-cap managers may have a more esoteric process: the quality of data isn't as good and it is difficult to codify it into a quantitative process."

All ETFs can be used to reduce the overall cost of a portfolio. Many investors will say that if they can't find an active manager that does the job, they will reduce costs by using passive.

ETFs on the main stockmarket indices are available at very low cost, less than 0.1% in most cases. Smart beta is more expensive, but is still attractive relative to active funds - a recent Morningstar report found that average fees in the European strategic beta ETF space were just 0.39%.

These lower costs mean that investors can divert their resources to singling out and paying for the best active strategies.

Wimmer says that much will come down to confidence: "Investors should think about it in terms of 'what is my confidence in selecting an active manager', and let that guide their active/passive decision, rather than trying to make forecasts about which will do better."

As such, in selecting ETFs, the decision-making process should not be significantly different from that involved in deciding on other investments.

Wimmer adds: "When we talk about funds rather than ETFs, there are more similarities than differences. It is about people's goals and their asset allocation. Whether they are going to pick an ETF or a fund is further down the list."

In a nutshell, ETFs allow investors to do what they want to do, to nuance their portfolios in a way that is appropriate for them. Their uses for investors are manifold, but as with all investments, the way they are used will depend on individual investment needs.

Active-passive strategies

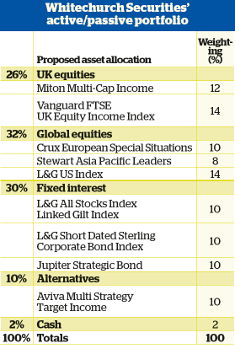

Gavin Haynes, managing director of Whitechurch Securities, outlines his guidelines for combining active and passive funds in a portfolio: "When building a portfolio, I look at both the passive and active fund options available.

"There are relatively few active fund managers who are able to outperform the market consistently.

"However, it is our job to find the ones with consistent track records for our long-term core holdings, and if we cannot then use a lower-cost passive option.

"But there are areas of investment markets, notably the US, where the probability of finding an outperforming active fund for core exposure is much more difficult.

"For government bond and core corporate bond exposure, I use a passive option. However, strategic bonds have a 'go anywhere' remit where shrewd managers can add value through investing globally across the bond spectrum.

"We will also use selected absolute return funds, the epitome of active management."

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.