Trump behind Dow Jones' near 1,000-point surge

11th November 2016 12:04

by Lee Wild from interactive investor

Share on

What does a Donald Trump America look like? Who knows? We can speculate, of course, but that's all it is. Indeed, there's such a level of uncertainty around the firebrand businessman's policies it's confusing the heck out of investors.

Policies we think Trump will deliver on - infrastructure spend and bank reform - have obvious winners and losers. Much beyond that and it really is guesswork. Speculation around the Fed's next move, plus the small matter of an Italian referendum on constitutional reform in three weeks' time, only fuel the volatility.

And it's why we're seeing markets move in different directions. Sterling has been one of the best-performing currencies since the election result, likely as traders bet on lucrative trade deals with Trump's administration. That soothes some concerns around Brexit.

But a strong pound also focuses the mind on expensive overseas earners, the same stocks that did so well when the currency plummeted over the summer. Down another 1.1% Friday, the has lost 250 points since yesterday morning, with gold miners and on the floor as Trump's more conciliatory tone makes safe havens unpopular.

However, cast your eye over the pond and, despite angry public protests, Wall Street has just hit a new high. The Dow Jones touched 18,873 Thursday, closing the session last night at 18,807. A week ago it was at 17,883. That's a 990-point, or 5%, gain. Include a 700-point plunge in futures prices on election night and it's a lot more!

"Markets have so far given this result the benefit of the doubt, embracing the potential boost to growth and inflation that could come from a shift in the policy mix," explain Deutsche Bank analysts.

"The extent to which this continues will depend on the policy signals from the next administration over the coming months. A Trump Presidency should be positive for the dollar and US equities and should allow for the continuation of yield curve steepening."

But who's making the running?

Until he proves himself a reliable statesman, it's impossible to call markets with convictionAs we mentioned yesterday, Trump has been no fan of banks in the past, and part of his popularity was an anti-establishment, anti-Wall Street ticket.

However, Trump wants to repeal Dodd-Frank reforms, which he claims puts too many restrictions on banks.

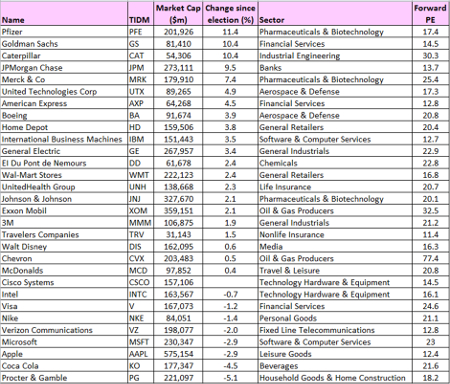

A lighter regulatory touch and appointing industry-friendly Fed officials has been great for Wall Street's finest. With an overhang caused by Hillary Clinton's threat to clampdown on drug prices removed, drug companies have rallied, too, while industrials lick their lips at the prospect of an infrastructure spending boom. (See table below for full list of Dow performers, courtesy of SharePad)

A generally pro-business administration is clearly welcomed; some of Trump's more extreme policy promises are not. Until he proves himself a reliable statesman with ideas to match, it will be impossible to call markets with any great conviction.

The sooner we get some clarity on the big issues - hopefully before he's sworn in on Friday 20 January - the better. I fear we may not.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.