A 'very good' company to buy and hold

11th November 2016 15:22

by Richard Beddard from interactive investor

Share on

is a very good company that should be a good "buy and hold" investment.

You won't find XP's power convertors in your computer, or other consumer electronic. They do the same job, converting high-voltage electricity from the mains into stable, low-voltage electricity used by machinery, but XP designs, manufactures and distributes power convertors embedded in industrial and medical equipment, often equipment in operating theatres or manufacturing facilities that must not fail.

The company claims to supply the widest range of power convertors, hundreds of product families that can be incorporated directly into customers' equipment or easily customised. Once designed-in, and taken to market, XPP can expect revenue to build up for years depending on the life-cycle of the customer's' product.

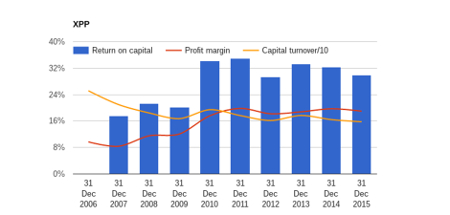

To nick a phrase from a fellow contributor, this chart tells the story. It decomposes profitability into its two components, profit margin and capital turnover according to the DuPont formula, named after the company that first used it in the 1920s.

Return is synonymous with profit, and turnover is synonymous with sales. The DuPont formula says that return on capital is the profit margin multiplied by capital turnover, profit margin being profit divided by sales and capital turnover being sales divided by capital (the investment in factories, warehouses and equipment required to produce the goods).

Here's the formula:

A company can increase profitability by increasing profit margins, for example by charging more for products and reducing the cost of producing them, labour for example. It can increase capital turnover by being more efficient, spending less on equipment and machinery or holding less stock.

Positive transition

XP went through a transition towards the end of the last decade. It increased profit margins (the red line in the table above) from about 8% to about 30%, but capital turnover (yellow line) also fell from over 200% to 160% (I have divided capital turnover by 10 to fit it on the same scale).

Overall, though, the effect was positive. Return on capital (blue bars) has risen from the high teens to 30%, typically.

For the time-being at least, the company is much more profitable than it was.

Over the past decade, XP's cash flow has averaged 80% of its profit, which is respectableProfit, though, depends on how the firm's accountants apply accounting conventions, so we need to check how closely it is mirrored by the cash that entered the firm's bank account each year.

It's unlikely to equal it. XPP has been investing in factories and developing new products, which is a bigger immediate drain on cash than profit. That's because in determining the profit figure accountants are permitted to defer some of the expense, matching costs to revenue by depreciating them gradually over time.

Over the past decade, XP's cash flow has averaged 80% of its profit, which is respectable for a company that has nearly tripled profit over the same period.

If XP is earning a 30% return on capital, and receiving 80% of that return in cash every year, it should easily be capable of funding future investment and dividends.

What makes a business special

Judging what makes a business special is always tricky, but XP makes the job easier by itemising its advantages in its annual report. This can be a sign of strength. A company unafraid to show competitors how it succeeds is probably confident they are more likely to be deterred by the difficulty of aping it, than encouraged to compete in the same way.

Although XP is mooting more customisation, its success is built on a huge range of standardised product families. A power convertor is often considered late in the design of a machine, requiring it to be developed quickly. Adopting, or slightly modifying, an existing design is cheaper and quicker than producing a custom convertor from scratch.

Although it's a market leader, XP only started manufacturing in earnest a decade or so agoIn healthcare and high-end industrial applications where failure and downtime are unacceptable, and customers increasingly demand environmentally friendly products, XP has found a synergy: High efficiency products do not require mechanical cooling. The fan is the most unreliable part of the converter so removing it improves reliability and allows the convertor to be sealed, which prevents contaminants from damaging it.

XP manufactures the convertors in two facilities, one in China and a brand new one in Vietnam, where it makes components and assembles converters. Vertical integration, the company says, gives it lower costs and faster turnaround.

Although it's a market leader, XP only started manufacturing in earnest a decade or so ago. Originally a distributor of power convertors, it now earns 68% of its revenue from convertors it designed and manufactures itself, a proportion it expects to increase to 75%.

Today, XP sells directly to large global manufacturers, but its origins as a distributor may have given it several advantages; good relationships with customers, insight into their requirements, and a network of offices spanning North America, Europe and Asia.

Targeting a bigger share

Now it's targeting a bigger share of their business by developing and acquiring new products, which it's uniquely capable of supplying because, XP claims, it has the largest and most technical sales force. Its customers are receptive because global multinationals are seeking to reduce costs by dealing with smaller numbers of suppliers.

The acquisition of EMCO a specialist in DC to DC convertors, as opposed to the AC to DC converters XP has hitherto specialised in, gives it a new product to sell throughout its global network. EMC's sales were previously confined to the US.

Going back to my chart, by building factories, XP has increased the capital it needs, and capital turnover has decreased, which, other things being equal, is bad for profitability.

Historically, healthcare has been XP's most reliable sector, increasing sales year-on-yearBut by taking control of manufacturing and design, it is better able to serve customers it already had good relationships with, creating more valuable products, perhaps more cheaply than its erstwhile suppliers. This has enabled it to improve profit margins.

Historically, healthcare has been XP's most reliable sector, increasing sales year-on-year, but demand from industrial and technological customers like semiconductor equipment manufacturers is more variable. The healthcare segment brought in less than a third of revenue in 2015, suggesting revenue and profit may not grow every year.

The company should remain profitable enough through thick and thin to retain the confidence of long-term shareholders though, partly because of the wide range of industrial sectors it serves, and partly because revenue is almost equally distributed between North America and Europe (8% comes from Asia).

Establishing continuity

Even trickier than determining what makes a company special, is establishing that the culture which enabled it will continue to ensure its competitiveness. XP Power says it has about 6% of a market in which it competes against other global suppliers like Artesyn, Cosel, Power-One, SL Industries and TDK-Lambda as well as smaller regional firms.

I value continuity: That the executives who built the company are still building it.

A share price of £17 values the enterprise at £350 million, about 17 times adjusted profitChairman James Peters founded XP in 1988, and chief executive Duncan Penny joined in 2000 as finance director. He was promoted in 2003. In its last annual report the company reported the 11-person executive management team had an average age of less than 45 and an average length of service of over 15 years.

Since Peters owns 10% of the shares, Penny has a holding approaching 2%, and the board's remuneration, while adorned with annual bonuses and share options, does not appear excessive, at least in comparison with similar companies.

It looks to me like management are still more interested in growing a business, that provides careers for staff and serves customers and shareholders well, than they are in milking it for short-term gain.

A share price of £17 values the enterprise at just under £350 million, or about 17 times adjusted profit. The earnings yield is 6%. That's not obviously cheap, but I think XP is a very good business at a reasonable price.

Yesterday, I "bought" XP for the Share Sleuth portfolio, a model portfolio I run, and "sold" shares in . More on the transactions next week...

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.