Was FTSE 100 breakout just a fake?

18th November 2016 14:07

by Lee Wild from interactive investor

Share on

We said a couple of days ago that things were about to get exciting, and they have. A plunge in the trio of gold miners dumped the leading index a dozen points below the uptrend early this morning. It might be significant, but given its brevity and subsequent recovery, there's hope that this was just a fake.

An anticipated Trump spending spree and run of strong economic data - US weekly jobless claims at a 43-year low and consumer inflation running at a six-month high - has put a rocket under the greenback since the firebrand billionaire's election victory.

Indeed, the American currency has had its best fortnight against the yen since 1988, and it's at a near-14-year high against a basket of major currencies. Rather than economic armageddon, traders now bet that tax cuts and fiscal stimulus will drive US growth and interest rates higher, attracting money back from other assets.

That currency surge also triggered a dip in crude prices, sending oil majors lower A strong dollar is no good for gold either.

It's a safe haven asset which investors typically seek when the chips are down, but Federal Reserve chairwoman Janet Yellen admitted last night that a first US rate hike since last December will happen "relatively soon".

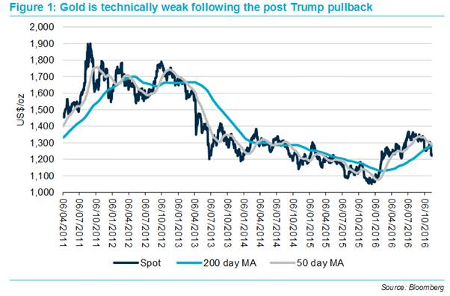

It's also quoted and traded in US dollars, making it more expensive to buyers in other currencies. After hurtling toward a 5½-month low and $1,200 an ounce, technical analyst Alistair Strang thinks it's got $1,146 written all over it.

That's bad news for both and who slumped as much as 7% early Friday, and , down over 4%.

That currency surge also triggered a dip in crude prices, sending oil majors and FTSE 100 heavyweights and lower.

Other miners like , and also struggled at the opening bell, wiping more than 50 points off the FTSE, which bottomed out at 6,740. That's below the uptrend since the EU referendum low in June, but don't panic, says Strang.

"This sort of trend break behaviour often proves fake," he tells me. "The market needs below 6,696 to justify real alarm. I suspect all we are seeing is stutters against trend on a rising cycle. Unless some politician says something stupid!"

And within an hour of Friday's low, the FTSE 100 had indeed put on over 40 points and, as I write, continues to build a lead above 6,800. It's promising, but hardly convincing.

Travel giant , Premier Inn hotels and Costa Coffee firm , and bookie are best of the bunch, up 2% or more, chased higher by , a heavy faller yesterday on results, and product tester .

But don't give up on gold just yet, urges finnCap's mining analyst Jonathan Guy, and for good reason.

"We would note that gold came under pressure ahead of the Fed taper in 2013 and the rate hike in 2015 before then going on to rally by 11% and 16% respectively," he says. Keep watching.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.