Consistency counts: 30 reliable table-topping funds

25th November 2016 16:29

by Kyle Caldwell from interactive investor

Share on

One of the biggest challenges a do-it-yourself investor faces is finding the cream of the crop among the thousands of funds all aiming to do the same thing - beat the market and their peers - as only a few will be able to consistently add significant value over long periods.

Damning studies from respected bodies, including the Pensions Institute at Cass Business School, conclude that investors are better off sticking to tracker funds, which simply aim to replicate the performance of a market index.

This, however, is not a view shared by our sister magazine Money Observer, which advocates mixing and matching between the two styles.

In defence of active management, there are fund managers out there who over various market cycles have proved their worth by consistently gaining an edge over both the index and active fund manager rivals.

Consistent performers

The trouble is that there are far more duds than gems, which makes finding a winner an uphill task. To help readers focus their sights on the superior options, Money Observer has created a shortlist of Rated Funds, which for 2016 features 194 funds.

Some readers, however, are looking as much for reliable longer-term returns as for outstanding short-term performance.

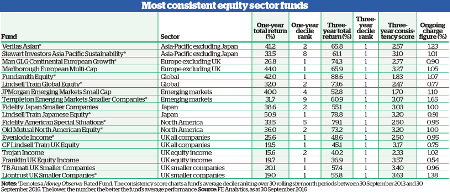

To help readers sort the wheat from the chaff, Money Observer has crunched a lot of numbers to find the 30 most consistent top-performing funds over the past three years across 15 leading Investment Association sectors

It's important to remember, of course, that the fact that a fund has been a consistent top performer over the past three years does not guarantee that its success will continue, particularly if market conditions change dramatically.

But with that caveat in mind, our Consistent 30 highlights the funds that have most reliably held their own through the uncertainties of those years.

Making the grade

To make the grade, a fund's performance needed to have been in the top 10% of the sector in question over three years.

Crucially, a fund also needed to have one of the best three-year consistency scores, as measured by the fund's average decile ranking during 30 rolling six-month periods over the same time frame.

The lower the consistency score the better. For example, a sector-leading fund with a consistency score of two may have dropped out of the top two deciles in its sector for a few of those rolling six-month periods, but it will have been in the first or second decile most of the time.

Small funds with less than £25 million in assets have been filtered out, as have funds that have not had the same fund manager at the helm throughout the three years.

We also took charges into account, occasionally penalising funds charging a premium price when it was a close call between several candidate funds.

The 15 sectors analysed included the leading equity, bond and multi-asset sectors. We excluded smaller sectors such as global equity income, and also the targeted absolute return and specialist sectors, where fund focuses and asset classes are particularly diverse.

We picked the two standout funds from each sector to end up with our Consistent 30, although, as the commentary below makes clear, in some cases the choice was less than clear-cut.

Equity fund excellence

Starting with the most popular sector - UK equity income - the two funds that topped the chart were and .

Trojan, under the management of Francis Brooke, took first prize by a notable margin for its three-year consistency score, with a ranking of 2.33. This was comfortably ahead of Franklin UK Equity Income, which scored 3.57 but produced top-decile performance strong enough to make the cut.

produced marginally better performance and the same level of consistency, but did not qualify for inclusion, because its manager Chris Metcalfe only took over in March 2014, less than three years ago.

Feted fund manager Neil Woodford's did not qualify for consideration, as the fund does not yet have a three-year track record.

But it is worth pointing out that since it launched in June 2014, its consistency score has beaten the vast majority of fund rivals, with a rating of 3.64.

To put these figures into wider context, funds that fared badly included and , have consistency ratings of 7.5 and have returned around 20% less over three years compared with Trojan Income.

In the UK all companies sector, one fund - - stood out. It is managed by Hugh Yarrow and Ben Peters.

The fund's portfolio is concentrated: it has less than 40 names and a bias towards consumer brand businesses, including , the maker of Dove soaps and PG Tips tea bags.

These so-called quality stocks have been very fashionable over the past couple of years, which has helped drive the fund's performance ahead of its rivals.

Is it time to rotate out of bond proxies?

UK fund choices

Second place was a harder call between , and .

All three funds had a similar score for consistency, ranging between 3.07 and 3.17, but the cheapest and strongest performer over three years was CF Lindsell Train UK Equity, managed by the respected investor Nick Train.

He, like Yarrow, has a portfolio full of consumer-focused businesses that typically have big brands and market-leading positions.

The small-cap space, which by definition is inherently more risky, produced two clear winners in and . The rest of the sector failed to match them for their combination of high consistency and strong returns.

Consistent strong performers were also thin on the ground in the North America and global sectors. Across the pond, and were a cut above the rest of the sector.

It is often argued that actively managed US funds struggle to gain an edge on the market because companies are so extensively researched by analysts, and this was apparently the case over the three years examined.

Only six funds of the 79-strong sector managed to beat the consistency score of Fidelity Index US, the most consistent tracker fund. In terms of total returns, it was 11% behind the top active fund, Fidelity American Special Situations.

In the global sector, active funds also struggled. Only about 10% achieved a better consistency score than the best-scoring tracker, .

But when it came to selecting the two winners, we needed to look no further than the two top performers in terms of both three-year returns and consistency: and Lindsell Train Global Equity.

Regional outlook

It was a similar story in Europe, with and the clear winners. They topped the sector consistency table, and in terms of three-year returns both were 20% ahead of the next best performer.

The Asia-Pacific excluding Japan sector also produced two clear winners in and . It is worth noting, however, that many funds in this sector that scored relatively highly on both our metrics have slipped down the performance tables over the past year.

Stewart Investors Asia Pacific Sustainability, for example, is in the bottom quartile of the sector over one year. This serves as a reminder that even consistent performance may lag the sector in the short term from time to time.

In the emerging market sector, two funds with small-cap mandates stood out in terms of performance and consistency scores: and .

The Templeton fund has a high ongoing charges figure (OCF) of 1.65%, but over three years it managed to back up that premium price with a consistently strong showing.

Moving across to the Japan sector, a handful of funds scored high marks for consistency and top-decile returns. was a performance outlier.

The fund was the strongest performer by a mile, returning a massive 102%, 23% ahead of the second-best fund, .

However, its consistency score of 4.17 was beaten by eight funds in the sector, which we deemed too many to merit its inclusion in a selection majoring on reliability.

Experts describe the fund as "not for the fainthearted", and that is evidenced by the fact that over the years it has been extremely volatile, experiencing periods of both substantial outperformance and underperformance.

Two funds that delivered a more palatable mix of strong returns and consistency were and Lindsell Train Japanese Equity. Both have consistency scores of around 3.

Bond fund winners

In our six-strong list of top bond funds, one type of strategy dominates: long duration. It has been the place to be over the past three years.

Financial planners, however, urge caution, arguing that funds that specialise in buying long-dated bonds with maturities of 10 years or more have had their day in the sun and look a risky bet from here.

They point out that bond yields, already at historic lows, cannot continue to fall forever. Moreover, if inflation makes a comeback it will negatively affect bonds with long maturities.

Nevertheless, over the past three years a number of bond funds that invest in this part of the market managed to produce strong returns, while giving investors the bonus of a smooth ride.

They include Pimco GIS Euro Ultra Long Duration, and , which all feature in our shortlist.

The other three bond funds that made the grade adopt a more strategic approach, with the fund managers investing where they see fit rather than being restricted to a particular variety of bond or those issued in a certain region.

GAM Star Credit Opportunities $ was the most consistent in the global bond sector, with a score of just 2.53. That feat was matched by another fund in GAM's stable in the sterling strategic bond sector: , with a ranking of 2.5.

The other bond fund to make our Consistent 30 was .

A bond tracker fund - - narrowly missed out in the sterling corporate bond sector. Just eight of the 66 funds in the sector had a lower consistency score.

The tracker also has an OCF of just 0.15%, compared with actively managed bond fund charges averaging 0.65%.

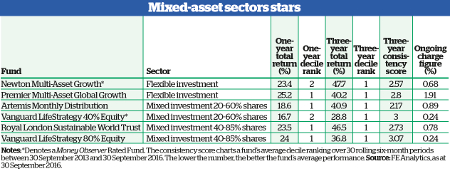

Mixed-asset fund top performers

In the mixed-asset sectors, two more Vanguard tracker funds made the grade and feature in our Consistent 30. In the mixed investment 20-60% share sector, stood out.

Its top-decile performance and return of 28.8% over three years were beaten only by three active multi-asset funds. It was, however, more consistent than two of them: and (both of which returned 33%).

It was a close call, but given that the active returns were only slightly ahead of the passive fund, we ruled in Vanguard's favour and awarded on the basis of consistency and its lower OCF. The fund that proved most consistent and produced the best returns was .

Another from the same fund range - - also appears in our Consistent 30, as one of the two funds selected from the mixed investment 40-85% share sector.

Just two funds out of 115 in the sector had a lower consistency score: and . But when it came down to performance the Vanguard tracker slightly edged out the Premier fund, returning 36.8% compared with 34.5%.

Given the small difference in the consistency ratings and the three-year performance figures, the OCF was the deciding factor: the Vanguard tracker cost only 0.24% versus a steep 1.71% for the Premier fund. Royal London Sustainable World Trust topped the table for both consistency and fund performance, returning 46.5%.

In the final sector, flexible investment, there were two clear winners in and . Both were streets ahead of rivals in terms of delivering the perfect mix of low risk and consistently strong returns over three years.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.