Why purely income-based portfolios are a bad idea

28th November 2016 12:01

by Rebecca Taylor from ii contributor

Share on

In 1952, Harry Markovitz introduced the concept of modern portfolio theory, for which he was awarded a Nobel prize in economics.

Further notable works from Eugene Fama and Kenneth French have developed these principles further and, whilst some aspects of modern portfolio theory are outdated or criticised, there are many principles that hold true today and are the basis of construction for many investment portfolios.

Portfolio return is the weighted return of the asset returns. Therefore, the effect on a portfolio return from an asset class is more important than the performance of the asset class itself.

- Volatility is derived or controlled through the correlations of the assets.

- Negative correlation is where two assets move in opposite directions in an economic cycle.

- Diversification: a diversified portfolio can achieve an equivalent return for a lower risk premium than an undiversified portfolio.

- Efficient Frontier, the ultimate risk-optimised portfolio, is where the maximum return is given for the minimum risk.

You are most probably aware of the above principles and strive to create your own portfolio to optimise the return available for the risk parameters that you are comfortable with.

Fundamentally, most people are risk averse and want to achieve the best possible return for minimum risk.

Only when we have the luxury of having "enough" money do we then move on to investing for the thrill and taking risk where there is no need - similar, I guess, in the way that some will gamble, knowing the odds are against them but enjoying the experience nonetheless.

Pension portfolios, pre- and post-retirement

So why is it that well-laid principles, that have been widely understood and agreed with for many decades, go out of the window when an investor moves from the accumulation phase of their life to the decumulation phase?

This is as important, if not more important, than growing a portfolio, as getting this wrong can impact on an investor's whole way of life. This is because they are now in a position where they are no longer earning and in control of bringing in an income.

By its nature, concentrating on yield distorts a portfolio considerablyI see portfolios, time and again, where a whole portfolio is moved across to yield-producing assets.

This has what some might call a "logical concept" where the yield is sufficient to cover the income required. Logical, unfortunately, is far from what this is in reality.

By its nature, concentrating on yield distorts a portfolio considerably, concentrating investment across those tried and tested stocks paying high dividends, with some bonds and property thrown in in varying proportions.

This creates a portfolio that is highly vulnerable to economic conditions and inflation.

Preserving capital is a common desire, but generally based on no real logic, other than an instinct that it has been hard earned over many years, so should not be frittered away.

Retirees should be investing for the next 30 years

Fundamentally, retirement portfolios are there for the long haul. Many retirees expect to live in retirement for 30 years plus and so the investments need to be planned to provide for this.

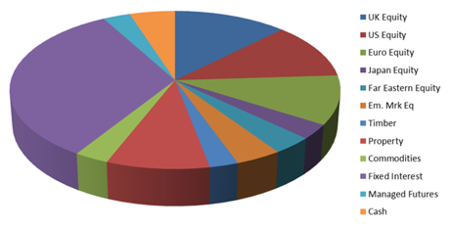

The pie chart below shows a well-diversified "medium-risk" portfolio. This would have a fairly even split between "growth" and "defensive" assets and would be considered a fairly well-optimised portfolio when looking at an efficient frontier.

When we look underneath the asset classes in a well-diversified portfolio, there are further methods of diversification looking to add further value.

An example of this would be the UK equity sector, where this is further divided into subcategories of large-cap, mid-cap, small-cap and value stocks.

This holds true across all of the asset classes shown below where there are many sub-categories to help diversify and increase the premium return on a portfolio.

Now, imagine a pie chart that throws all of the underlying principles above away, and invests solely in investments designed for yield. We can remove some of the global equity sectors as not all have high-yielding stocks, or where they are they are limited considerably in availability.

Managed futures and any other type of alternative such as timber can also be removed, along with commodities. Taking the earlier example of UK equity, diversification is further lost by the need to remove everything except the large-cap stocks, as this is where the yield comes from.

Concentrating portfolios on yielding assets naturally curbs the growth potentialThis eventually results in a highly concentrated portfolio, naturally moving it up the risk scale, even though the split between growth and defensive assets may be identical to that above.

Lastly, I alluded earlier to the effect inflation has on retirement income. Concentrating portfolios on yielding assets naturally curbs the growth potential and as such most of the income is static.

Whilst this may help to prevent income fluctuations that are unwanted, it certainly limits inflation proofing.

Rebecca Taylor is a certified financial planner and managing director at Aurea Financial Planning.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.