Is Aberdeen Asset bid target after profit plunge?

28th November 2016 13:42

by Harriet Mann from interactive investor

Share on

Before the American presidential election, emerging markets (EM) had returned to favour following a near-fatal swing in sentiment. But protectionist policies espoused by the future leader of the free world have thrown the recovery on the rocks, and 2017 looks bad for the sector.

That's worrying for , which has just announced a slide in profits. Often rumoured to be up for sale, is the asset manager next in line for mergers and acquisitions (M&A)?

Despite the massive outflows from emerging markets, a 14% fall in net revenue to £1 billion and crash in underlying pre-tax profit of 28% to £353 million was better than feared. Earnings per share (EPS) slumped from 30p to 20.7p, with 70% generated from EM equities, a quarter from Asia-Pacific equities and around 3% from EM debt strategies.

But, with the conversion of underlying operating profit to cash climbing four percentage points to 111%, the group's maintained the full-year dividend at 19.5p.

Investors shouldn't see this as a new dawn for EM, given the impact of Donald TrumpAssets under management rose double-digits to £312 billion, underpinned by the launch of several new funds and acquisitions, which added £9.5 billion.

With the first £50 million of savings implemented, 2016 costs were reduced by £28 million, offsetting M&A costs. The full £70 million of targeted savings should be in the bag by March 2017.

Including £8 billion of lower margin insurance book outflows, net outflows were £32.8 billion last year. Equity net outflows reduced from £16.4 billion in 2015 to £13.6 billion, underpinned by the second-half improvement, with assets under management increasing from £80 billion to £89 billion.

But investors shouldn't necessarily see this as a new dawn for emerging markets given the impact of Donald Trump's election on sentiment. The MSCI Emerging Market index has slid 4% since the US vote.

Britain's EU referendum also weighed on Aberdeen's property portfolio, with £0.8 billion of negative net flows. The now-reopened was closed following the vote to try and plug the stream of withdrawals during the fall-out.

Of course, fee pressures, tech innovation and tighter industry regulation will continue to create pressure. Recurring management fee income fell 14%, while performance fees increased 17% to £15.8 million.

The blended average management fee rate slipped from 36.1 basis points to 33.6 basis points.

Further volatility

Clearly, 2017 promises further volatility as Britain negotiates its exit from the European Union and the markets react to Trump's actions as president. To navigate choppy waters, Aberdeen will sharpen its focus on diversification and costs.

"Until there is greater clarity, it is difficult to predict the impact on markets over the medium and longer term," said the company Monday.

'Short term, Aberdeen remains very much exposed to the fortunes of EM'"We will not allow any such volatility to distract us from our long term approach to investing, and we remain well positioned to identify and grasp the opportunities that may arise to deliver further profitable growth."

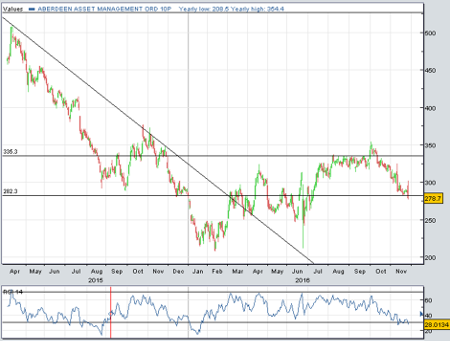

Traders had a change of heart as the morning progressed, with an initial 2% share price gain turning to a 4% deficit and a four-month low. David McCann at Numis Securities thinks the shares are "fairly valued" at around 285p.

"Short term, Aberdeen remains very much exposed to the fortunes of EM, where for choice we would prefer to wait for a more attractive entry point," he explains. "Long term, you need to believe the group can achieve growth in other areas and/or make further cost cutting motivated acquisitions and/or will be bid for, to justify purchasing today."

Consolidation fever

Consolidation fever provided a fillip in early October when Janus Capital and Henderson announced their "transformational" tie-up, to create an investment house with $320 billion (£257 billion) under management. Against so much regulatory pressure and political headwinds, there is a case for large-scale consolidation.

Michael Werner, an analyst at UBS, isn't so sure this is the way forward for large-scale asset managers. However, compressed fee margins, increasing regulatory costs and rising competition from passive funds is likely to trigger M&A among smaller players.

Taking a punt based solely on a possible takeover is rarely a profitable trade"We view large-scale asset management M&A as unlikely as the potential post-deal attrition of key personnel of the target firm is a significant challenge and can undermine any proposed value creation resulting from the combination," said Werner.

McCann is confident that after more than 30 years at the helm, chief executive and founder Martin Gilbert will want to exit on a high.

However, while one can see how the business would be attractive to potential buyers - and it could happen - taking a punt based solely on a possible takeover is rarely a profitable trade.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.