How to find companies that pay dividends no matter what

29th November 2016 11:59

by Jeff Salway from interactive investor

Share on

There are several broad ways in which investors can negotiate turbulent markets. One is to go with the ups and downs and hope to emerge in one piece. Another is to be in a position of confidence that their fortunes aren't dictated by events out of their control.

The same applies to investment managers, particularly those exposed to sectoral, national, regional and global macroeconomic forces.

Recent months have featured fluctuating commodity prices, political unrest, sovereign debt sell-offs, the UK vote to leave the European Union, debate over central bank policies and the ongoing implications of low interest rates, among other factors that can have a significant impact on investment portfolios.

The International Monetary Fund warned in October of growing medium-term risks as the global economy enters a new era "characterised by chronic weak growth, prolonged low interest rates, and growing political and policy uncertainty".

Dividend dependability

It is against this backdrop that managers must deliver the growth and income that investors require, with demand for income particularly strong.

Managed by Baillie Gifford, The (Saints) is, despite its name, a global income vehicle investing in companies that can grow dividends in real terms and can be relied upon to continue doing so in times of stress.

That's why the emphasis, according to manager Dominic Neary, is on identifying companies with both the ability and the will to pay dividends whatever the macro climate.

"Active management focuses on understanding not only a company's ability to pay dividends but also its belief in - and commitment to - dividends," says Neary, who runs the trust alongside deputies James Dow and Toby Ross.

"[Most of] the companies we hold have always been committed to it, such as ; and there are also those that now get the idea and truly believe in dividends."

When the outlook is as uncertain as it is currently, the attitude of company boards towards dividends is of paramount importance both to managers and to investors wanting a dependable and sustainable income.

"You can get an indication from the chief executive or the chief financial officer, but it's also about talking to the chair and other members of the board," observes Neary.

There may also be a strategic element in the commitment to dividends. "Company boards realise that if they have been paying dividends in tough times, they are more likely to get support when they recapitalise."

The Saints managers use various predictors of dividend dependability, including the proportion of earnings and cash flow the company pays out on its dividends; the profitability of the business; and whether it's structurally shrinking or growing.

Companies that score highly across those different factors are viewed as being reliable sources of sustainable dividends.

"There's also cash-flow generation. Long-term sustainable dividends have to be supported by cash flow generated by the business and available for dividends," explains Neary. "The emphasis is on cash-flow resilience as well as dividend growth."

Macro factors come into play when testing what could hurt the growth case in a company or sectorNeary points out that market noise can be disruptive, with potentially too big an influence on major decisions, when in reality there will always be stocks with characteristics that allow them to thrive regardless of macroeconomic headwinds.

There's an obvious risk in allowing investments to be shaped by the unknown outcome of events such as referenda or central bank monetary policy decisions.

External and macroeconomic factors tend to come into play, however, when testing what could potentially undermine the growth case in a company or a sector, and identifying what can't be controlled in the context of the business and its dividend dependability.

But, he adds, "we try to invest on a secular growth argument - so even if it's a bumpy trajectory, the dominant factor is the company".

Brexit forced our hand on some investments

While investment decisions are almost always stock-specific, there are occasionally exceptions where events can force the manager's hand.

Changes were made to the portfolio in the wake of the UK's referendum on EU membership, for example. "Post-Brexit we think there's lots of uncertainty about the outlook for the economy," says Neary.

"We did a full review and we sold after doing incredibly well from it.

"It's an untested model in challenging times, and its target demographic could suffer in the post-Brexit climate. But it was one of very few macro calls, and there was a valuation element to it as well."

The trust also reduced its exposure to resources, ahead of the fall in crude oil prices. "While balance sheets were decent we could see compromises to the dividend potential. We've been quite timely with our reductions in the energy sector," he adds.

Regulatory decisions and attitudes can have an influence too. Neary cites the example of the changes afoot in the Australian retirement environment, which helped inform the trust's recent investment in Challenger Financial, the Australian annuity provider.

"The superannuation system in Australia and the ageing demographic there mean there's a wall of money going into investment solutions. Australia is looking at creating recommended portfolios, and it's likely there will be at least a small component of annuitisation within that.

The US has a relatively undeveloped dividend culture, with exceptions such as Coca-Cola"Challenger has seen steady and consistent growth on the back of growing retirement savings, and we've done a lot of work talking to its customers, who all speak highly of the company."

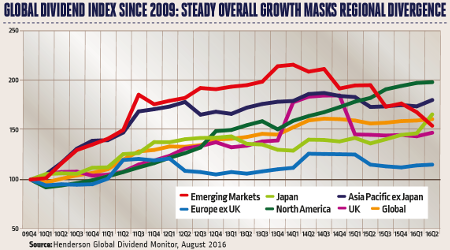

The search for global income has become more fruitful (as well as more necessary) in recent years, as the dividend culture so embedded in the UK has become more evident in other regions.

The US has a relatively undeveloped dividend culture, with exceptions such as Coca-Cola that have long track records of growing dividends through good times and bad. There are signs of change, however.

Rich pickings among US 'dividend aristocrats'

"The US is an example of a place where there's a sense of more interest in paying dividends to shareholders, but is it just a way of getting the stock multiple up? Will it go away when rates normalise [and investors start to favour deposit accounts again]?", says Neary.

"There's a good solid core of dividend aristocrats in the US, and there are companies there that are really committed to dividends. Others are on what one hopes is a secular trend.

Dividend culture is becoming more prevalent in Asia too"That's why we speak as much as we can to the boards of companies to find out how willing they are to grow dividends. We can quickly work out if it's a passing fad or something more substantial."

Dividends are becoming prominent in the tech sector, where stocks such as and are making payouts, having avoided doing so during the boom years of the late 1990s and early 2000s.

Back then it was seen as an indication of limited growth potential, but that's no longer the case, says Neary.

"In the US tech sector there are capital-light companies, like , that can grow nicely and also pay a dividend. It's not the admission of ex-growth that it used to be."

Dividend culture is becoming more prevalent in Asia too, with Taiwan Semiconductor Manufacturing Company a longstanding Saints holding that embodies the dividend dependability the trust looks for in companies.

Every country or region has a different perspective on dividends, according to Neary.

"Japan is one area where cash returns are attracting more attention. It's not that the starting yields are especially high, but attitudes are changing and it's part of improving governance."

Undulating valuations show the importance of patience and conviction in taking positionsDemand for income has had an effect on company valuations, however, stiffening the challenge faced by investors. Neary notes that the team talks about valuations more than they used to.

"A number of pretty high-yield sectors without high-growth prospects have been bid up quite significantly, such as US utilities. Dependable but low-growth, high-yield stocks have benefited greatly in share price terms.

"We are aware of areas being bid up, but the strength of balance sheets gives us confidence."

Ultimately, the undulating nature of valuations underlines the importance of patience and conviction when taking positions.

"We spend a lot of time studying businesses we own, but we're very careful in terms of when we invest. Patience has become more important, because everyone is out there for income generation."

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. Some of the views expressed are not necessarily those of Baillie Gifford.

This article contains information on investments which does not constitute independent investment research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned.

Investment markets and conditions can change rapidly and as such the views expressed should not be taken as statements of fact nor should reliance be placed on these views when making investment decisions.

Please remember that the value of a stock market investment and any income from it can fall as well as rise and investors may not get back the amount invested. Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates. The level of income is not guaranteed.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.