Top share picks for December

1st December 2016 14:08

by Lee Wild from interactive investor

Share on

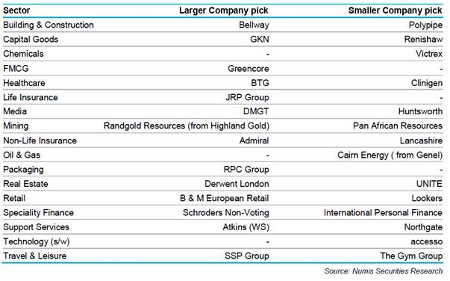

It's almost four years since the team of analysts at Numis Securities built their smaller and larger company portfolios. Both are smashing the benchmark index, up 20% and 30% respectively. But November was a mixed month, and changes have been made.

Numis's smaller company portfolio - businesses worth less than £1.3 billion - produced a total return of -2.7% last month, lagging the benchmark's 0.4% profit. Its portfolio of bigger companies fell, too - down 0.2% - although the benchmark fell 1.8%.

Neither portfolio takes a short-term trading view, preferring a 12-month horizon. However, getting the best returns requires tinkering every now and again. That means oil company replaces , a driller in the Kurdistan region of Iraq, in the small companies portfolio.

Cairn restarts appraisal drilling at the SNE discovery, offshore Senegal, in early 2017. It will drill two wells, with options for follow-on drilling. Cairn is playing down its chances, and Numis estimates are conservative.

"Incorporating a 40% chance of success for SNE Cairn trades at 0.87x our discovered resource NAV [net asset value], a premium to the sector on 0.79x, reflecting the exciting exploration/appraisal potential in Senegal and Cairn's strong balance sheet," says analyst Thomas Martin.

Up 17% in the past two sessions, Cairn has just surpassed Martin's 210p price target.

Among the heavyweights, miner kicks out . A 10-year plan should keep production at 1.35-1.55 million ounces (Moz) - developing the Massawa project in eastern Senegal and the superpit at Gounkoto in Mali, offsetting the depletion of Tongon (Côte d'lvoire) and Morila (Mali).

"Management's vision for the next decade is to maintain essentially the current level of production and quality of the asset base whilst increasing the level of distribution through higher dividends supported by solid FCF [free cash flow] generation as capital expenditure tails off," writes analyst Jonathan Guy.

"We retain a 'buy' recommendation but tweak our target price to 9,000p (from 8,500p) on unchanged multiples of 2x NAV and 15x cash flow following the inclusion of Massawa and expansion of Gounkoto."

Randgold is down 43% from its post EU-referendum peak above £98 a share. Production problems hit profits, but it's the strong dollar hurting the gold price that's the real mover here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser