Why this market move is not sustainable

5th December 2016 11:35

by Lance Roberts from ii contributor

Share on

Following the election, the market has surged around the theme of "trumponomics" as a "new hope" as tax cuts and infrastructure spending (read "massive deficit increase") will fuel earnings growth for companies, stronger economic growth, and higher asset prices.

It is a tall order, given the already lengthy economic recovery at hand, but, like I said, it is "hope" fuelling the markets currently.

As I discussed on Tuesday:

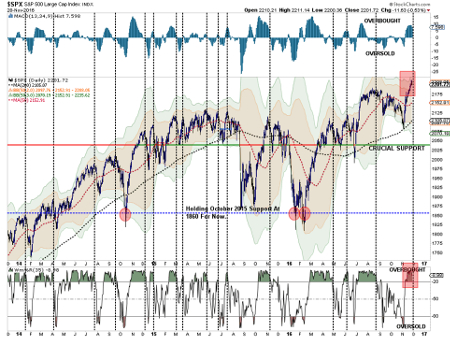

"First, the market has moved from extremely oversold conditions to extremely overbought in a very short period. This is the first time within the last three years that the markets have pushed a 3-standard deviation move from the 50-day moving average (DMA).

"Such a move is not sustainable and a correction to resolve this extreme deviation will occur before a further advance can be mounted. Currently, a pullback to the 50-DMA, if not the 200-DMA, would be most likely.

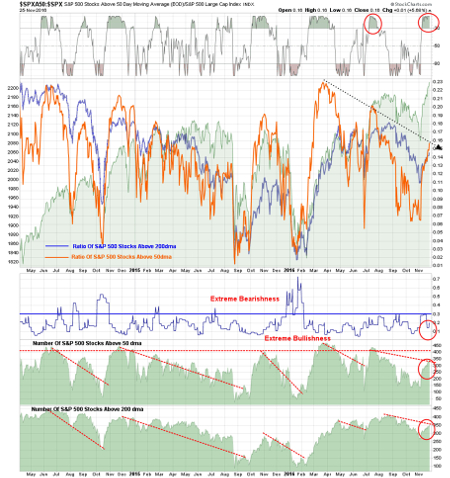

"Secondly, as discussed above, the advance to 'all-time highs' has been narrowly defined to only a few sectors. As shown the number of stocks participating, while improved from the pre-election lows, remains relatively weak and does not suggest a healthy advance."

The problem with the advance

The problem with the breadth of the advance is significant. As shown in sector rotation charts, the current rally has been extremely bifurcated. Such extreme deviations in performance tend not to last long and tend to have rather nasty reversions.

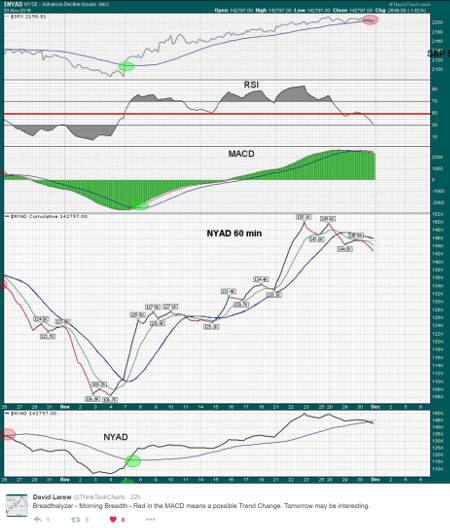

As my friend David Larew (@thinktankcharts) pointed out on Thursday, breadth has triggered a short-term 'sell' signal, suggesting a pullback to support.

Combine the current backdrop with a sharply higher dollar and interest rates and you have all the makings for a decent correction. This, of course, aligns with my prediction from two weeks ago when I stated:

"However, expect a decline during the first couple of weeks of December as mutual funds and hedge funds deal with distributions and redemptions. That draw down, as seen in early last December, ran right into the Fed rate hike that set up the sharp January decline."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.