10 cheap small-cap shares on the move

7th December 2016 13:58

Ben Hobson from Stockopedia

The art of value investing means different things to different investors. With so many ways of working out whether a stock is priced cheaply against what it owns or what it earns, it's no surprise that not everyone agrees. But whatever your preference, there is one aspect of value investing that has been shown to be a market beater - and that's when you combine value with momentum.

Since the early work of Benjamin Graham in the 1930s, investors have used all sorts of ratios to assess whether companies are trading at a price worth paying.

As a result, it's now common to use measures ranging from the price-to-earnings (PE) ratio, price-to-sales, price-to-book, price-to-cashflow, dividend yield and the enterprise value-to-ebitda. Depending on the market conditions, many of them tend to come and go like fashion.

Some of the most respected research into what really works in investing has been done by the US fund manager, James O'Shaughnessy.

He literally spent years studying some of the most detailed market data to find evidence of what drives outperformance, then published those findings in books, including Predicting the Markets of Tomorrow and What Works on Wall Street.

One of his early discoveries was that value and momentum in some of the market's smallest companies was very powerful. He worked it up into a strategy called "tiny titans". It uses the price-to-sales ratio as a measure of value and relative price strength over 12 months as a measure of positive momentum.

In essence, this early strategy from O'Shaughnessy was looking for cheap small-cap stocks that are beginning to re-rate. But he insisted that the volatile nature of small-caps meant it was a strategy for making individual stock picks, rather than forming an entire portfolio.

Later on, O'Shaughnessy changed his view on value because of what he was finding in his research. Rather than just price-to-sales, he found that using a composite of the main valuation metrics was a far more instructive and profitable way of finding and benefitting from value opportunities.

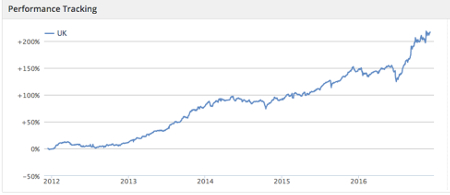

Despite this, tiny titans - a strategy tracked by Stockopedia - continues to produce some stunning results. Over the past year it has seen a 26.7% return in the UK, and 26.0% annualised since 2012.

To get an idea of some of the companies that the Tiny Titans strategy is picking up in the UK, we've taken a handful of names from the current list.

Again, these stocks are apparently cheap on a price-to-sales basis, with strong 1-year relative price strength and market caps of less than £150 million.

As a guide, we've also included the Stockopedia ValueRank, which is a rank that's calculated using a composite of valuation measures.

| Name | Mkt Cap £m | Price / Sales Ratio | Value Rank | 1 Year Relative Strength | Sector |

|---|---|---|---|---|---|

| Styles and Wood | 34.2 | 0.29 | 95 | 100.7 | Industrials |

| Randall & Quilter | 92 | 1.28 | 94 | 15.2 | Financials |

| Quarto Inc | 60.9 | 0.41 | 91 | 22.1 | Consumer Cyclicals |

| Flowtech Fluidpower | 52.9 | 1.04 | 87 | 12.5 | Industrials |

| Air Partner | 48.8 | 0.98 | 84 | 4.5 | Industrials |

| Lifeline Scientific Inc | 60 | 1.8 | 82 | 53.9 | Healthcare |

| Peel Hotels | 16.7 | 0.97 | 82 | 6 | Consumer Cyclicals |

| SciSys | 32 | 0.76 | 79 | 44.9 | Technology |

| Sopheon | 23.6 | 1.25 | 75 | 358.8 | Technology |

| Miton | 53.3 | 2.24 | 72 | 0.4 | Financials |

As O'Shaughnessy pointed out, these strategy rules target a particularly volatile and unpredictable part of the market. But it can be a useful starting point for further research.

In this list, the leading stock is , the commercial property services company, followed by insurance group , and the book publisher, .

There have been some very strong price performances in these stocks, including at software company, , healthcare group , and IT services specialist, .

Small-cap value stars

Looking for value opportunities among small-caps can be hugely profitable, but also comes with high risk. These companies can be sensitive to setbacks and need careful research.

But, as O'Shaughnessy has said: "Ultimately, the more ways a stock looks cheap, the better its chances of being a solid investment."

The success of an approach like tiny titans lies in the combination of value and momentum, which are two of the most powerful drivers of stock market returns.

As a result, it has been a consistently strong performer in one of the most exciting - and risky - areas of the market.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson of Stockopedia.com, the rules-based stockmarket investing website. You can click here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks