This Dogs of the Footsie portfolio will amaze you

9th December 2016 16:00

It's been almost two months since the hit a record high. A 1,300-point rally from the June low had left many seasoned investors scratching their heads, worrying about stretched valuations and upcoming political risk.

We were increasingly uncomfortable, too, so decided to test out a novel contrarian approach. The results have been dramatic.

Unlike other investment strategies based on buying unloved shares, high yield was not our priority. We were more interested in how far share prices had fallen, guessing that sentiment might improve as we head into the seasonally stronger fourth quarter.

Screening for the 10 worst-performing blue-chips so far in 2016 threw up laggards from , down over 27%, to punch-drunk outsourcer , which had managed to lose almost half its value in less than 10 months.

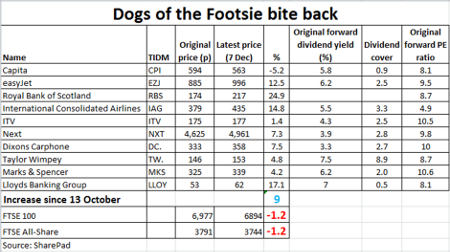

Incredibly, our Dogs of the Footsie portfolio has risen by 9% since 13 OctoberAfter diving an average of 37% in 2016, our 10 dogs traded on an average forward price/earnings (PE) ratio of less than 9 and offered a prospective dividend yield of 5%.

We asked whether investors hunting for bargains in an otherwise expensive market would spot these cheap blue chips and buy in.

Eight weeks later, the answer is an unequivocal yes!

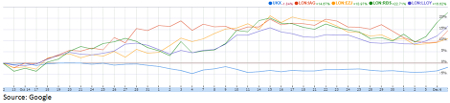

Incredibly, our Dogs of the Footsie portfolio has risen by 9% since 13 October, as our bet on a rotation into "value" stocks paid off. That compares with a 1.2% decline both for the FTSE 100 and the much broader FTSE All-Share index.

Just one of our dogs - Capita - is in negative territory. has soared by almost 25%, and that's despite a closet full of nasties, including a possible multi-billion dollar fine in the US for its part in the subprime mortgage scandal. It's just failed the Bank of England's latest stress test, too.

Clearly, investors are betting that RBS will eventually settle the American litigation issue at a lower figure, finally offload Williams & Glyn, and fix the balance sheet so the capital requirement demanded by the regulator becomes less onerous.

Lloyds is the second-best performer, up more than 17%. It stood out among the domestic lenders in the stress tests, and analysts like prospects for 2017, despite expectations of another rate cut which could further pressure margins.

Airlines have been a hard sell this year, too. A strong dollar only adds to existing headwinds such as over-capacity and falling yields.

recently lowered long-term profit forecasts, but the British Airways-owner still thinks it can grow earnings per share (EPS) by an average of 12% a year until 2020. Within three weeks the shares hit 463p for a 22% portfolio gain.

Three profits warnings from since June almost halved the company's market cap, but City number crunchers said that this already priced in "material future value destruction". Few believed would happen, and many analysts think they're worth well over a tenner.

Elsewhere, at , , and , gains were more modest, but they still easily outperformed the market.

Even attracted buying just before this update. It had looked increasingly like selling directors, boss Adam Crozier and FD Ian Griffiths, got it right.

In a weak UK ad market, net advertising revenue (NAR) is expected to fall by 7% at ITV during the fourth quarter. It may be many months before there's a significant improvement we're warned.

But what about the stubborn laggard?

A profits warning just two weeks before our portfolio began guaranteed Capita easily made the list.

IT reselling and specialist recruitment have been problem areas, while there'll be a big one-off cost linked to its Transport for London (TfL) congestion charge contract.

We'll have another look at how our 10 dogs are performing when, hopefully, markets will be swimming in Christmas cheer and continue to share the love among these blue-chip losers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks