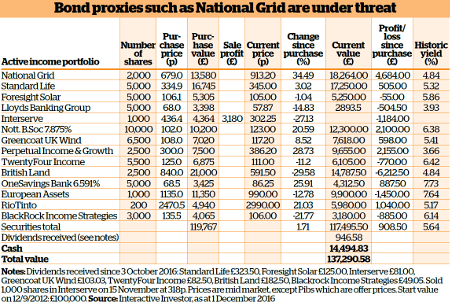

Active Income Portfolio: Opportunities after dividend sell-off

9th December 2016 09:50

by David Budworth from interactive investor

Share on

Since we last reported on the active income portfolio in October, life has got even tougher for income investors as political events on both sides of the Atlantic have continued to dictate stockmarket sentiment.

Donald Trump's election in the US has helped push the US stockmarket to a record high. Hopes have risen that the president-elect's pledges to cut taxes and boost infrastructure spending will lead to faster growth in the US and global economy.

It's good news for some, but not for investors holding so-called 'bond proxies'. Companies that possess attractive dividends and whose shares are perceived to possess bond-like characteristics have been sharply sold off since the US election, in anticipation of higher inflation and higher interest rates.

Bond proxies under pressure

The fear is that when interest rates go up investors will switch to bonds, as fixed-interest yields will rise making dividends less appealing.

One of the casualties has been , which has been such a stalwart of the portfolio. It has fallen 17% since October, not helped by half-year results unveiled last month that were broadly flat on the same period last year.

National Grid also declared an interim dividend of 15.17p per share, to be paid in January, which was slightly worse than some analysts had expected.

However, management reiterated a promise that full-year dividends will grow at least in line with retail prices index (RPI) inflation, which is on the rise due to the impact of weak sterling.

If RPI is 2%, that would result in a total dividend for 2016 of just over 44p. Even if National Grid is currently out of favour, and at risk of a rise in interest rates, the case for holding the stock remains intact.

The same cannot be said for , where unpleasant and unexpected surprises have become the order of the day. The latest shock for investors was the announcement that long-standing chief executive Adrian Ringrose is to step down from his role next year.

A trading update released at the same time showed Interserve's performance had been in line with expectations in the first 10 months of the year. However, it warned that "significant risks" still remained in the energy-from-waste business.

Last month the support services and construction company was served notice of termination on a Glasgow Recycling and Renewable Energy project after it "repeatedly failed to meet contracted delivery milestones".

After such bolts from the blue it is difficult to trust in the business. We sold out on 15 November, a day after the chief executive announcement, at a substantial loss - the shares were 27% lower than their purchase price in April.

Cash looking for a home

Rather than immediately redeploying the proceeds of the Interserve sale, we are content in these uncertain times to add it to the cash pile.

However, we will be looking to invest some of that cash, possibly in one of the out-of-favour bond proxies.

The sell-off may throw up opportunities to buy attractive companies that have the ability to grow their profits and dividends at above the rate of inflation - exactly what we want for this portfolio.

The portfolio has benefited from dividend payments worth £946.85 in the past two months, including £81 from Interserve before it was sold. Over the past 12 months nearly £7,000 in dividend payments has been collected.

On the subject of dividends, the third-quarter results from contained the encouraging news that the bank's capital reserves, or common equity tier one ratio, increased to 13.4% as at 30 September, compared to 13% at the end of last year.

This key indicator of financial strength is one of the reasons why the bank is expected to pay a higher dividend this year.

Finally, on 30 November it was revealed that is facing an investigation by the Securities and Exchange Commission in the US, a regulator that is not known for pulling its punches. An issue to keep a close eye on.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.