A compelling story, but is this share a buy?

16th December 2016 16:50

by Richard Beddard from interactive investor

Share on

After seven years of growth, the question that will at some point bedevil shareholders is whether the company has strengthened its business so much, it has cast off its boom and bust past.

That question is taxing me now. A share price of 186p values the enterprise at nearly £260 million, twenty times adjusted profit in the year to March 2016. The earnings yield of 5% implies growth. In fact, I'd be leery about paying any more than the current share price for a company with all-but nailed on long-term growth prospects.

In the short-term growth is expected, not least by the company itself. Half-year results, published last month, reported double-digit growth across all revenue and profit measures, adjusted and basic, although Trifast did admit to a small drop in return on capital. The firm anticipates another record-breaking year when it ends in March 2017.

But Trifast is approaching the end of an era. Jim Barker and Malcolm Diamond, both having previously served as chief executive, rejoined the firm in March 2009 to turn it around.

According to Barker and Diamond, they had to lift morale and instil a new corporate cultureBarker, chief executive once again, retired last year and now Diamond, who rejoined as non-executive chairman, is relinquishing his executive role. In April 2017 he will become non-executive chairman.

It's been an orderly transition. Mark Belton, previously chief financial officer, replaced Barker and Diamond will still be running the board.

Continuity may be significant. Although Trifast has made strategic and operational changes in the last seven years, according to Barker and Diamond, they also had to lift morale and instilled a new corporate culture when they joined.

Morale must have deteriorated rapidly if Barker left the company in good shape when he retired in 2007.

The argument for holding Trifast

Between 2009 and 2011, the company's profitability was highly questionable.

That period may have followed mismanagement, but it also coincided with recession and so the argument for continuing to hold Trifast for the long-term rests on it being a more solid performer during future recessions.

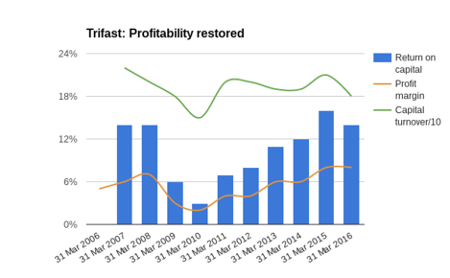

This is how it fared in the most recent cycle:

The chart may flatter reality because the return component of return on capital and profit margin excludes heavy restructuring costs, mostly goodwill write-offs, in the years before 2012.

So adjusted, the average return on capital over the last decade is 11%. A business that generates returns of 11% is viable, although the trough in 2009, 2010 and 2011 is disconcerting.

Trifast distributes and manufactures fasteners, nuts, bolts, rivets and screws, to assemblers of electronic equipment, domestic appliances and cars and motorbikes. Over decades, these sectors have been fickle.

While Trifast supplies the same sectors as before the financial crisis, the balance has shiftedThe financial crisis of 2007-2009 was at least the second crisis Trifast and its saviours had experienced. Diamond handed over to Barker in 2002 after the dot.com bust.

The company had grown rich supplying telecoms hardware manufacturers with fasteners, but demand dried up and Barker cast around for competitors supplying other markets. He settled on Serco Ryan, a supplier of industrial fasteners, which Trifast acquired in 2005.

While Trifast supplies the same sectors it did before the financial crisis, the balance has shifted since it acquired VIC, an Italian supplier to domestic appliance manufacturers like Whirlpool, Electrolux, Bosch and Siemens, as well as Kuhlmann, a German supplier of industrial fasteners, and PESP, a Malaysian fastener manufacturer supplying Asian car and motorcycle manufacturers.

More resilient

Today, even though revenue from electronics and telecoms has grown in the last seven years, at 18% of total revenue it's now third behind domestic appliances (23%, up from 8% before the acquisition of VIC in 2014) and automotive (31%, double its contribution in 2009).

Trifast says the auto sector is less 'fractious' and the company is more international and less dependent on big customers. In 2009, Trifast earned 44% of revenue abroad. In March 2016, the figure stood at 60%, with no customer responsible for more than 5% of revenue.

Barker and Diamond introduced initiatives to up productivity and efficiencyI believe that Trifast is more resilient. Acquisitions in Malaysia and Europe have improved its ability to supply global manufacturers across Europe and Asia at low cost, which is increasingly important as they rationalise suppliers.

The development of fasteners made of fewer and lighter materials and a zero defect capability increases the attractiveness of the product to manufacturers with large production lines that work around the clock.

Providing fastener engineers to work on those lines deepens Trifast's relationship with its biggest customers, which it serves through 26 distribution and manufacturing subsidiaries, eight in the UK, eight in Europe, six in Asia, and one in the USA.

Barker and Diamond introduced a hailstorm of initiatives aimed at increasing productivity and efficiency not just in manufacturing but distribution and sales, during the company's recovery phase.

The trouble with companies with cyclical pasts

For now it's in the ascendent, acquisitive and investing in factories and warehouses. The decline in return on capital in 2016 is due to a sharp increase in operating capital, as it's acquired new companies and re-equipped new and old.

Perhaps Management should be alert to the dangers of over expansion in good times, and the write-offs that follow. Diamond may be taking a step back from operating the business but Belton has seen it all too. He joined in 1999.

Despite the compelling story, I'd bet against the leopard completely changing its spotsCollectively an international manufacturing and distribution network, a culture that fosters discipline, innovation and collaboration, and decades of expertise may well add up to a strong business.

With only a 1% share of the market, and only a 25% share of the business of its biggest customers, Trifast thinks it can grow by increasing market share, even in a falling market.

Despite the compelling story, if I were a betting man, I'd bet against the leopard completely changing its spots. Trifast will continue to suffer when its cyclical customers do, although maybe not as much as it has done in the past.

The trouble with companies with cyclical pasts is the best time to sell them is usually when everything is going well and has been for a while, but it's so damned hard to do, precisely because everything is going well and it could continue to, at least for a while.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.