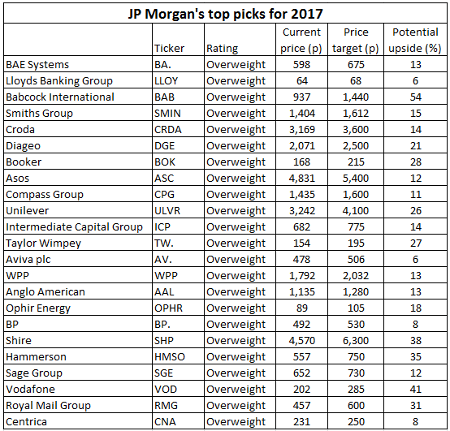

JP Morgan's 23 UK share tips for 2017

22nd December 2016 11:10

There's lots to worry about in 2017, not least new US president Donald Trump and potential problems for established politicians in elections across Europe. However, analysts at JP Morgan remain optimistic, and have named their favourite UK equities for 2017.

"We think that equities have a window of opportunity to perform over the next quarters, as the initial benefits of reflation are priced in," says JPM. "We advise a constructive stance on stocks for 2017."

Three key drivers of the business cycle are "looking better", it says. All three were bearish a year ago, but the yield curve is steepening again, credit conditions are improving and corporate tax cuts and repatriation of international cash should, at least, provide an earnings boost to US companies.

Inflows of cash could also return to equities, thinks JPM.

"Equities are a real asset class, which typically benefits from inflation picking up, given better corporate pricing power and higher revenues," the broker explains. Equities typically post their best returns in the low positive inflation backdrop.

"We see this period as having similarities to 1988, or 1999, the past episodes which followed big mid-cycle selloffs in oil price. The key risks to our constructive equity call are the prospect of more aggressive bond repricing if the Fed falls behind the curve, Euro politics, liquidity squeeze in emerging markets given stronger US dollar, and of eventual recessionary profit rollover, given that US is still in what is a late cycle."

For the UK specifically, JPM recently downgraded its view in the fourth quarter from 'overweight' to 'neutral'. It's now moved to 'underweight' as it believes benefits from the weak pound are largely priced in. Domestic activity is also expected to slow materially next year due to Brexit uncertainty.

What's more, UK shares have already seen significant earnings upgrades, and profits are now expected to grow by 19% in 2017.

"Most of this is due to commodities, but no sector, including domestic ones, is projected to have down earnings," explains JPM. "This might prove to be too optimistic if the economy weakens and the uncertainty over Brexit negotiations increases."

JPM worries about a squeeze on consumer purchasing power in 2017 and that the real fallout from Brexit is yet to come. It also points out that the UK is packed with high-yielding defensives, and it may underperform against a backdrop of rising yields.

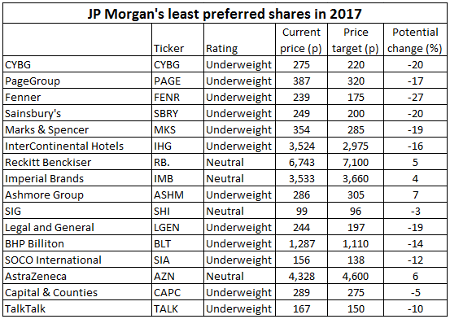

However, the broker still has 23 companies it thinks are worth buying for 2017. It's also revealed its 16 least preferred stocks.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks