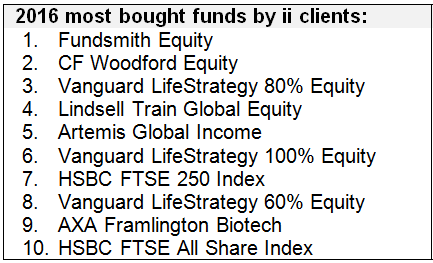

10 most-bought funds of 2016

22nd December 2016 13:02

After one of the worst starts to the year on record, and as uncertainty spread around the globe like wild fire, the polarisation between active and passive investing widened in 2016. Investors wanted active fund managers to steer them through the mire, although sometimes this trust was misplaced, the latest data from Interactive Investor shows.

We've compiled the top 10 most-bought funds by Interactive Investor clients so far in 2016. And there was a very clear winner: Terry Smith's .

Flocking to the six-year old fund, Interactive Investor traders put in more-than twice as much as the next most-popular fund, . Together, the pair had more invested in them than the following eight combined.

Well-known for his 'buy and hold' approach, Smith doubled his own stake in the Fundsmith Equity fund earlier this year, taking his overall interest to around £200 million. A champion of fund managers having 'skin in the game', nearly two-thirds of the fund's holdings are locked up in US stocks and have benefited from sterling's dramatic fall against the dollar post-Brexit and recent US post-election optimism.

The fund's recent big performers include manufacturer of vetinary products , which has rallied 38% over the last six months, and human resources management software group , which is up by a fifth since June. UK-based has also surged by 28% and US conglomerate NYSE:MMM:3M, the firm behind Post-It notes, has jumped by a fifth.

Smith's strategy is clearly working. The fund has returned 18% over the last six months and 31% over the last year.

, jointly managed by Michael Lindsell and Nick Train since its launch in March 2011, also caught the attention of investors this year. Adopting the same 'buy and hold' approach as Smith, the fund returned 26% this year and 66% over the last three.

"Markets have experienced major upheavals in 2016, driven by unexpected events such as Brexit and the election of Donald Trump," explains Rebecca O'Keeffe, head of investment at Interactive Investor. "This has offered excellent opportunities for some active managers, in particular those sterling-based funds that have an unconstrained global investment mandate."

Although Woodford's Equity Income fund was a distant second-place, his ego will remain intact, despite recent underperformance. The star manager's latest portfolio reshuffle saw his holding in business and home insurer cut in favour of bigger stakes in life insurer , drugs major , power company and infrastructure and distribution outfit .

The stockmarket's transition away from bond proxies like and stifled performance somewhat, and the fund has returned just 3.5% this year - it's the only fund to make the top 10 that has severely underperformed its benchmark (+10%).

It's unlikely investors will be put off in the New Year, however. Woodford himself has admitted the fund has had a "challenging" 12 months and is prone to underperform in "certain market conditions".

While the largest volume of cash went into active funds, passive funds were still popular among Interactive Investor's clients, with the Vanguard LifeStrategy series winning most investors over. Proof that the rotation from bonds into equities is well on its way, the , and were among the top picks - the remainder of portfolios are made up of bonds.

All beating their benchmark, the 100% equity portfolio has returned 29% this year, the fund with 80% equity exposure has grown 24%, and the 60% portfolio has returned 19%, data from Trustnet shows. Each of the funds has decent exposure to US equities, so sterling's weakness versus the dollar and the post-election rally will have been a boon.

"Faced with the higher fees levied by actively managed funds, investors have increasingly turned towards low-cost index tracker funds over the past few years, and with a broad swathe of markets moving higher in 2016, this trend has continued," explains O'Keeffe.

Another tracker fund popular with Interactive Investor users was the , which has returned 17% over the past 12 months, but underperformed the actual FTSE All-Share. The bulk of this momentum has been seen in the last six months, with the FTSE 100's surprise post-Brexit record high helping push the fund 14% higher.

With over 85% of its portfolio in UK equities, it's the blue-chip names , and that dominate the fund's top holdings. Shell kicked 2016 off with its £40 billion takeover of BG Group and now has an attractive portfolio mix of deepwater, tight oil and liquefied natural gas (LNG) assets. Its 15-year resource base represents $70 billion (£55.6 billion) of investment potential offering 20% return.

Income hungry

Income hungry investors looked to , which has returned 25% under manager Jacob de Tusch-Lec this year, but 26% over the last six months. Again, the fund has most exposure to the US, with its favourite sectors the banks and insurance. Also benefiting from the 2016 commodity rally, it's largest holding, , has surged by over two-thirds this year.

made the top 10, with its 24% return over the last six months more than double the specialist benchmark. This wasn't enough to offset the harsh sell-off at the beginning of the year, however, and the fund has returned -2.1% in 2016.

Stretched valuations and the threat of a crackdown on excessive drug pricing by Hillary Clinton made life tough for biotechs in 2016. Managed by Linden Thomson, this is yet another with chunky US exposure, with NASDAQ:GILD:Gilead Sciences, and its top holdings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks