Three easy tricks to make you a better investor in 2017 and beyond

30th December 2016 11:43

by Richard Beddard from interactive investor

Share on

It's a good thing my New Year's resolution wasn't to hit every deadline, because I've missed my first one: to start the year with a fresh list of shares ranked in order of their long-term investment potential.

I'm tweaking the way the Decision Engine, my ranking system, calculates the earnings yield, the method I use to judge the value of shares. It's taking a while to implement, so, in the meantime, I'm going to hit you with a load of maths.

I'm sorry, it's not my idea of a warm and fuzzy start to the new New Year either, but it will explain why the changes should improve the Decision Engine's stock picking prowess over, I hope, many new years.

The earnings yield is usually calculated using the most recent annual earnings figure and the formula is as simple as can be. It is:

If that looks familiar it should do. It's the reciprocal (inverse) of the price earnings ratio expressed as a percentage*. A company with a price/earnings (PE) ratio of 20 (its share price is twenty times earnings per share [EPS]) has an earnings yield of 5%:

And a company with a PE ratio of 5 (its share price is five times EPS) has an earnings yield of 20%:

A company that is valued on a high multiple of its earnings (PE) has a correspondingly low earnings yield and you can convert a PE into an earnings yield by dividing the earnings yield into one (and multiplying by 100).

The PE and the earnings yields are two sides of the same coin. The PE side tells you how much you are paying, and the earnings yield tells you what you could get back**.

A share with a high PE - a high price in relation to its earnings - might be deemed expensive, and you can see that most clearly in what it might yield in terms of earnings. A share trading on a PE of 50 has an earnings yield of 2%. Either measure should put investors on high alert.

An earnings yield of 20% would be a wonderful thing. An earnings yield of only 5% may be acceptable considering you'll have to search high and low to get a yield (interest) of 1% on cash.

Making comparisons easier

I prefer the earnings yield to the PE because it makes these comparisons easier, but they're both incredibly blunt instruments because earnings are volatile.

If we pin our expectations on last year's earnings, and last year was particularly good, the high earnings yield will overstate the returns we can expect and the low PE ratio will make the shares look cheaper than they really are. If last year was particularly bad, the opposite will be true.

The easiest way around this problem is to use an average, which dampens the effect of extreme years. Some investors average earnings over a period long enough to include a full business cycle - in which the firm and its profits have experienced the effects of economic expansion and recession.

My innovation is to vary the length of the average I use depending on a company's historyA typical business cycle lasts about six years, but since some cycles last longer than others, it may be prudent to take a longer average.

But if a company has grown through the cycle, which is the kind of company I favour, earnings from a long time ago when the company was smaller, will reduce the average. This reduces earnings yields and increases PE ratios making shares look less attractive than they should.

Instead, I average return on capital to find out how profitable the company is in a typical a year and multiply the average return on capital by the amount of capital the company had invested in productive assets, buildings, equipment, stock, software and so on, in its most recent financial year. This calculation scales up average earnings so it reflects the company's current size.

My innovation is to build into the spreadsheet the ability to vary the length of the average I use depending on a company's history. Consider :

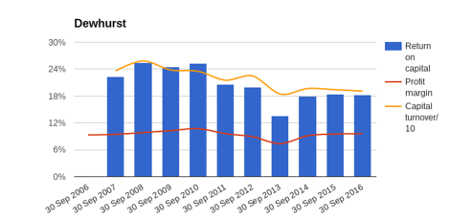

The lift component and ATM component manufacturer is something of a stalwart, but return on capital this decade has been lower than it was towards the end of the previous decade (it's still pretty impressive).

We can't completely rule out the business cycle explanation, but performance at Dewhurst was strongest during the recession that followed the financial crisis in 2008 and has been weaker ever since.

It seems more likely the business has changed. Dewhurst's speciality is pushbuttons and touchscreens are replacing them in some lifts and ATMS. Dewhurst has responded by developing control panels incorporating touchscreens, but it manufactures the pushbuttons and it buys in the touchscreens, so profit margins are lower.

The process forces me to think about profitability, what's impacting it and whether it's sustainableDewhurst has also diversified somewhat, supplying other components like hall lanterns and even bollards for roads. Perhaps these changes have had a permanent effect on profitability.

I think prudence dictates I take a six-year average (back to 2011) rather than the default ten-year average (back to 2007). In this case, it doesn't actually matter much, because profitability hasn't dropped by much. The six-year average lowers the earnings yield from 11% to 10% and increases the equivalent PE ratio from 9 to 10. Either way, the shares look like a bargain.

The procedure, though, forces me to think about profitability, what's impacting it and whether it's sustainable. Profitability is a cornerstone of good business, and its sustainability is a requirement for long-term investment.

My New Year's resolution is think this way about all the companies I follow.

Happy New Year :-)

*Actually, my earnings yield uses enterprise value instead of price and earnings before interest to calculate the earnings yield, but these are simply alternative versions of price and earnings that make it easier to compare companies with different levels of debt and other financial obligations. I've used the more familiar earnings yield and PE ratios to avoid complicating the article.

**Assuming earnings in the future are the same. I aim to invest in shares in companies I expect to increase profit over time, so the earnings yield is really a baseline, a minimum expected return.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.