Seven 'magnificent' stocks for your portfolio

5th January 2017 12:08

by Lee Wild from interactive investor

Share on

Forget Donald Trump, forget Brexit, forget French elections, at least for the first six months of 2017. Now is the time to own equities, argues one team of analysts, and, judging by past performance, they're worth listening to.

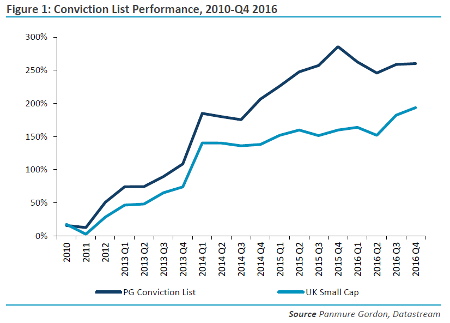

Panmure Gordon's Conviction List has outperformed the market in 11 of 19 periods since it was set up in 2010. Reinvested, it would have returned 260% against 194% for the Small Companies index, despite lagging the benchmark over the past two years - up 17.5% versus 12.3% for the index.

Following a review of the portfolio of UK shares, Panmure's head of research Barrie Cornes has made some big changes to reflect the broker's non-consensus outlook for an ongoing sweet spot for UK growth during the first half of 2017.

"The downside risk from the uncertainty of the EU referendum result has been countered by stimulus from the Bank of England, looser fiscal stance from the Treasury and a 15% year-on-year reduction in the sterling exchange rate," he says.

"Despite recent moves higher, low nominal fixed income spreads continue to provide a valuation underpin for global equities."

Given a broad-based recovery in global corporate earnings, Cornes is confident UK equities can maintain current valuations, while support from accommodative central banks means debt will remain cheap everywhere.

Reviewed each quarter to make sure each stock can justify its place in the portfolio, four constituents are dumped this time, replaced by seven with serious upside potential.

Both pub company and Alton Towers and Legoland owner are removed as Panmure changes its analysts. Long-term savings provider faces tougher sales comparatives, so loses its place, and Panmure has lost patience with , although the story still looks intact.

First to replace them is . The oil major had a stunning 2016 as oil prices recovered from multi-year lows and as a well-timed acquisition of BG Group was priced in. But analyst Colin Smith believes there's "still time to act", valuing the shares at 2,500p.

"Although Shell still looks expensive on a PE basis, that and other multiple ratings should improve sharply from this year with the debt adjusted cash flow multiple down to 6.1x from 2018, in line with the historical average," writes Smith. "Then there is the dividend and a rising cash yield from 2018 as the scrip is turned off and share buy-backs resume."

Resurgent flares and countermeasures supplier gets the nod as its balance sheet continues to improve.

With a new finance director arriving in days, Panmure analyst Sanjay Jha is optimistic: "With a strong order book and an improving balance sheet, the company now has strategic options."

"We expect the stock to be re-rated to 10x EBITDA like the rest of the UK Aerospace & Defence sector, and we raise our target price to 190p."

If Panmure's Adrian Kearsey is right, low maintenance building products manufacturer could be worth 185p, an 81% improvement on current prices.

AIM-listed Epwin is an "undiscovered gem", according to Kearsey and colleague Michael Donnelly. "Despite the attractive position and solid financial metrics, the forward PE is a mere 7x (circa 30% lower than a year ago). We believe the market has overlooked this value story and the earning multiple is simply wrong."

Significant rerating opportunity

There's a significant rerating opportunity at , too, making an interesting contrarian trade, says Panmure's Kieron Hodgson.

A trading update toward the end of January should confirm Gem hit full-year production targets, and that it offers the potential to deliver a positive surprise in average values from its Letšeng diamond mine in Lesotho during 2017. The shares could be worth 162p, nearly 50% more than today's prices.

A far-reaching transformation plan launched in autumn 2015 - Repair, Prepare, Grow - could drive significant margin expansion at , thinks analyst Peter Smedley.

The company, which makes private label household and personal care products for supermarket own-brands - still offers an attractive valuation, with further upside as it delivers on its recovery potential and scope for growth. Buy up to 210p, says Smedley.

Recovering equity markets and rising interest rates are great news for wealth manager . Cornes, who covers the shares himself, argues that the share price is just too low.

"A realistic valuation would place the shares at 1,274p, driven by the better than anticipated [European embedded value net asset value] at 30 September at 838p/share," he says. "The dividend has increased strongly over the last few years and now delivers a good dividend yield based on our 2017 forecast of 36.96p/share."

There's space in the portfolio for budget airline . Momentum in its core central & eastern European markets means it's enjoying a purple patch, according to analyst Mark Irvine-Fortescue.

"Low cost DNA enables Wizz to charge low fares profitably, taking advantage of positive structural trends," he says. "Fleet upgrades, ancillary revenues and maturing route profiles could see upside to our 13% revenue [compound annual growth rate] FY16-19e."

The price target of 2,300p implies 28% potential upside.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.