Uncertainty rules for UK market in 2017

6th January 2017 10:00

by David Prosser from interactive investor

Share on

A year ago, a Reuters poll of more than 20 City traders, fund managers and strategists forecast a 2016 year-end value for the FTSE 100 index of shares in leading UK companies of 6,990.

In early December, the index was trading at around 6,750, having moved within a range of around 200 points over the previous three months; for once, the polls were about right. It did, however, rally to end the year at 7,143.

Still, for less charitable observers, the words "luck rather than judgement" may come to mind - few in the City predicted the UK would vote to quit the European Union in June's referendum, and their upbeat year-end forecasts were largely predicated on a Remain vote settling Brexit uncertainties for a generation.

Instead, a Leave vote triggered a dramatic sell-off of the pound, which sent shares in internationally oriented blue-chips soaring; within four months the FTSE 100 had hit an all-time high, before easing back. Its year-end level represented an all-time high closing price.

FTSE outlook

What, then, does 2017 have in store? Well, Reuters' polling this time around puts the City consensus at 6,800 for the FTSE 100's end-of-year value in 12 months' time, which would imply a completely flat year for blue-chip UK equities.

If that sounds dull, take solace in the wide disparity of forecasts that underpin the headline average.

At one end of the scale, analysts at IG reckon the FTSE 100 could hit 7,100 by the middle of 2017 and finish the year at 7,600. At the other extreme, ETX Capital says 6,000 is a more realistic year-end prediction.

Brexit isn't the biggest geopolitical theme stalking world markets since the US election

Such broad disagreement over the outlook for UK equities next year reflects a level of uncertainty that just keeps ramping up.

In the UK, only the bravest pundits are prepared to offer any predictions about the impact of the government triggering Article 50 in March, which will start the firing gun on formal negotiations for departure from the EU; it's not even a sure thing that ministers will be able to take that initial step, given interventions from the Supreme Court and, potentially, parliament.

Moreover, Brexit isn't even the biggest geopolitical theme stalking world markets, given the shock result in the US election.

Tom Stevenson, investment director for personal investing at Fidelity International, says that against this background, the most investors can do to prepare themselves for 2017 is to focus on some key themes.

"The main takeaways will include equities rather than bonds, inflation replacing deflation, a continued rotation from defensive shares to cyclical shares, and rising interest rates as fiscal spending takes pressure off the US Federal Reserve," he predicts.

Much of that approach is related to a Donald Trump presidency, with the new administration promising economic stimulus; increasing inflation expectations have already seen equities fare strongly compared to a sharp fall in bond markets, with the Fed now expected to move towards a tightening of US monetary policy.

End to austerity

Back in the UK, inflation forecasts are rising too - albeit because of expectations that the fall in the pound's value will feed through into import prices - and while Philip Hammond, the chancellor, is no Trump, he has signalled a move away from the austerity agenda.

All things being equal, rising government spending and higher (but not runaway) inflation should provide a boost for UK equities. However, Patrick Connolly, a certified financial planner at independent financial adviser Chase de Vere, sounds a note of warning.

Blue-chips will benefit from international diversification and sterling weakness

"There isn't an immediate correlation between stockmarket performance and economic growth," he says. "At some point, corporate earnings will have to improve in order to justify stockmarket valuations; positive sentiment alone won't keep holding markets up indefinitely."

Moreover, warn strategists at Lazard Asset Management, the Brexit negotiations will act as a prism through which economic data will be examined.

"Periodic rises in volatility are likely to continue until Article 50 is exercised, after which the data will be scrutinised even more closely," says Lazard in its latest outlook paper.

"The bank says that while UK shares do not look expensive at current prices, the fundamentals may get swept away in the Brexit maelstrom.

"We expect there will continue to be good bottom-up stockpicking opportunities as macro concerns may overwhelm valuation considerations in the short term," it says.

Nevertheless, it is blue-chip stocks where the bullish case is easiest to make, with such businesses benefiting from international diversification and sterling weakness.

Macro concerns

By contrast, warns Philip Lawlor, chief investment strategist at Smith & Williamson, mid-cap stocks may find the going tougher. "A pick-up in inflation could erode real incomes in the UK," he says.

"This is significant, as real income growth has been a key driver behind the outperformance of the FTSE 250 index in recent years."

As for smaller companies, they are more exposed to the fortunes of the domestic UK economy.

And while the fallout from the Brexit vote has so far not been as punishing as most economists expected, forecasters do still expect growth to slow in 2017 - the Bank of England forecasts the UK economy to expand by 1.4% next year, compared to 2.2% in 2016.

Income seekers

Income seekers, meanwhile, should not expect the year ahead to be any easier either, even if the Fed does pave the way for a normalisation of interest rates. In the stockmarket, yields are likely to come under pressure.

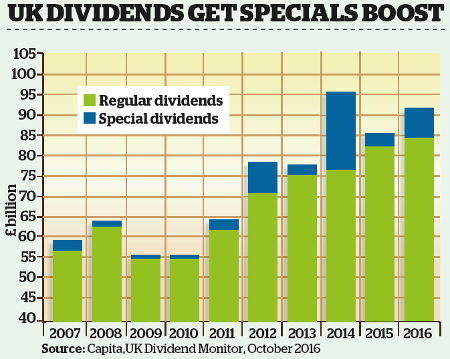

Share registrar Capita, which produces a keenly watched annual forecast for dividends, has been surprised by a small rise in payouts this year, having expected a decline (see chart, click to enlarge).

But it points out that after stripping out the effect of special dividends and the sterling increase in the value of dividends paid in dollars (not shown in chart), payouts have fallen slightly.

Tough competition in sectors such as retailing, continued weakness in commodity prices and the mounting cost of pension fund deficits have all constrained companies' ability to pay dividends, Capita warns, and there is more of this ahead.

So don't bet on total return performance in 2017 getting a valuable boost from income. And with capital gains potentially limited too, the year ahead may be rocky. Expect volatility, relative blue-chip strength and yet more uncertainty.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.