Lloyds to rally after huge upgrade

6th January 2017 11:16

by Lee Wild from interactive investor

Share on

Banks have become popular all of a sudden. After years of struggle following the financial crisis, lenders have repaired their balance sheets, are over the hump in terms of PPI claims and other fines, and most are paying dividends again. Bank shares have already rocketed over the past six months, but there's still reason to buy, argues one heavyweight analyst.

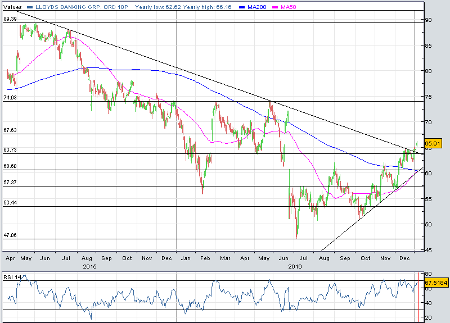

Every domestic bank has wiped the floor with the FTSE All-Share index, outperforming by at least threefold since the sector bottomed out in early July.

And, despite an uncertain UK economic outlook, Barclays analysts Rohith Chandra-Rajan and Aman Rakkar see "clarity emerging to support the earnings and capital return outlook for Lloyds".

"We now expect positive net interest margin [NIM], supported by the planned MBNA credit card acquisition, and cost of risk to peak at 35 basis points [from] 47bp previously, reflecting a weak but still growing economy and a relatively modest deterioration in unemployment."

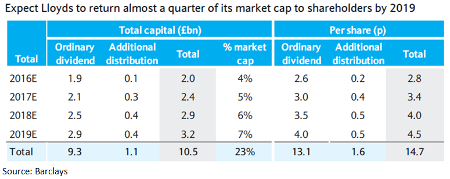

This implies that can generate a 13% return on tangible equity (ROTE) over the next three years and hand back almost a quarter of its £47 billion market capitalisation to shareholders.

Given Barclays reckons this should drive further outperformance for Lloyds shares, the broker upgrades its rating from 'equal-weight' to 'overweight' and hikes the price target by 36% from 55p to 75p.

With the likelihood of further rate cuts in the UK, margin is now tipped to peak at 2.78% in 2018, better than previously expected. So is that 35 basis points of assumed provisions against further fines and misdemeanours, down from 47 basis points before, and despite the £1.9 billion MBNA buy.

Selling the government's stake down from over 9% to below 7% over the past few months has clearly done the shares no harm, and Barclays believes the spectre of further disposals will no longer be a drag on near-term performance.

However, Barclays does trim dividend estimates for the past year, predicting a total payout flat at 2.8p a share. Returns are tipped to pick up, though, and over £10 billion of capital, or nearly 15p a share, should be returned through to 2019.

Barclays nudges up forecasts for 2016 to reflect a lower provision charge, but upgrades pick up significantly for this year and next. Expect 7.1p in 2017, up 14% on previous estimates, and 7.2p the year after, 17% better.

It says the revised numbers reflect both better credit quality and a more robust margin outlook, plus MBNA which should complete in the first half of this year.

This means Lloyds trades on just nine times forward earnings, among the lowest price/earnings (PE) ratios of the European banks and a 30% discount to the sector. At the same time, the 5.3% prospective dividend yield looks attractive relative to the 4.4% sector average.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.