Our reliable winter portfolio takes turn to smash the market

6th January 2017 16:40

by Lee Wild from interactive investor

Share on

Interactive Investor has had great success running a pair of portfolios based on an historically lucrative seasonal investing strategy. With the US presidential election, Brexit and elections across Europe in 2017, we had reason to be nervous this year. We needn't have been, and both our consistent and higher-risk basket of shares are doing well.

Trump's win, which many not only thought impossible but also predicted would cause chaos, has done quite the opposite. Since election night, almost $2 trillion (£1.6 trillion) has been added to the value of US quoted companies, and indices there remain near record highs.

In the UK, the Trump effect continued to rub off on equity markets and the weak pound raises the prospect of heightened takeover activity. British firms now look cheap and foreign companies are already shopping here.

The FTSE 350 benchmark index soared 4.9% in December, hitting a record high during a shortened final trading session of the year. Drax rose by a third after receiving European Commission approval for state-aid to convert one unit of its power station from coal to biomass.

Bids for and takeover speculation around triggered gains of 27% and 23% respectively, and both oils and financials proved popular.

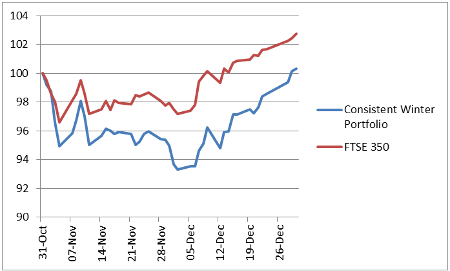

It would be tough to beat an index performance like that, but the Interactive Investor Consistent Winter Portfolio did, bouncing back from a terrible November to rally 5.6% in December and back into the black. Our so-called Interactive Investor Aggressive Winter Portfolio also continued its winning start to the strategy, keeping its nose well ahead of the wider market.

Consistent Winter Portfolio

Our consistent portfolio is made up of the most reliable performers in the FTSE 350 over the past ten winters. Stats confirm these five stocks really do consistently perform better than others in the cold winter months.

Things started badly, however, with the basket of usually dependable shares down 5% in November, worse than the 350's 2.1% decline. Despite limitations on our involvement in the picking process, we were nervous about this year's portfolios in October when we announced the constituents.

Big overseas earners like and (JMAT) were especially popular given the weak pound, and their share prices had already risen to either record levels or multi-year highs, making valuations less attractive.

Speciality chemicals leader Croda fell another 2% during December, although catalytic convertor giant JMAT clawed back almost 2%. Good job then that the other three constituents were on fire.

Irish building materials firm ended the month with a 6.4% gain, leaving it up 7% for the strategy so far. Catering colossus jumped over 9%. Its shares look expensive, and chief executive Richard Cousins sold 200,000 shares at 1,371p mid-month. But that sale was premature as the price went on to top out at over 1,500p.

Best of the bunch was perhaps the least well-known. , a £1.2 billion supplier of heat treatment services to carmakers and plane manufacturers, rallied more than 12% last month.

As we reported four weeks ago, Alexandra Laforie, a "person closely associated" with new finance director Dominique Yates, bought 100,000 Bodycote shares at just over 591p. The pair clearly anticipate big gains. And why not? Bodycote shares have risen between 1 November and 31 March in nine of the past 10 years, and by an average of 22%.

Aggressive Winter Portfolio

I think it's called taking a breather. After making 4.5% in its first four weeks, the Aggressive Winter Portfolio had added a further 1.5% by mid-month before losing puff to end December up just 0.3%.

It was great to see workspace provider plc, formerly Regus, do well. It's had a rough year, but seems to have rediscovered its mojo, adding 5.6% in December to move within a whisker of positive territory for the two months.

Happily, a resumption of downbeat housebuilder recovery from Brexit blues coincided with the start of our portfolio. It rose 3.5% last month, and is up 8% since the end of October. Interest has picked up in the past few days, which should guarantee a bonanza in January.

was last year's star stock, and it started the 2016/17 portfolio with big gains, too. But it's gone and "done a ", accused by the media of mistreating staff at its Kingsway distribution centre.

It's putting things right, and City analysts still think the earnings upgrade cycle is intact. JD shares are contributing well to the portfolio, too, although a trading update due this month, possibly next week, will be significant.

Gambling software firm kept going the wrong way last month, still clouded by sterling weakness and recent director stake selling. And infrastructure company slowed down, finally, adding just 0.8% last month. However, we can't be too disappointed with a Trump-inspired 24% profit since November 1st!

Please be aware of the risks involved. Past performance of the underlying constituents is not a guarantee of future performance. The value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. These portfolios are designed for a short trading period so market fluctuations may be more pronounced. If in any doubt, please seek advice. If you buy the portfolio the holdings will not be automatically sold on 29 April.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.