Share of the week: Best performer of 2017, so far

6th January 2017 16:58

by Harriet Mann from interactive investor

Share on

After three years of hard graft, is finally close to finishing work on its gas treatment facility in north Kazakhstan. With production and cash flow set to surge, the FTSE 250 newbie could become one of the largest independent producers in the European exploration & production (E&P) sector within just four years. And its shares have flown since a Deutsche Bank upgrade this week.

Nostrum should complete work at its Chinarevskoye gas treatment unit (GTU) in the second half of 2017, potentially doubling production capacity to 100,000 barrels of oil equivalent per day (kpoe/d). With development wells to begin drilling in the second quarter, the firm says it will meet that capacity target by 2019. Production is currently running at 48kboe/d.

With the taps turned on full blast, production should achieve 26% compound annual growth rate (CAGR) between 2016 and 2020, and 36% for cash flow. As the GTU wraps up and spending is directed to drilling, Deutsche Bank reckons capex will peak in late 2017, which will accelerate the group toward "material" free cash flow generation in 2018 - this should be a boon for investors.

A chunk of this cash will be reinvested to maintain plateau production, but the rest should be returned to shareholders. Deutsche reckons $50 million ($0.27 per share) could be returned in the second half of 2019 - 40% of net income - which will double to $100 million ($0.54 per share) in 2020.

This would mean a windfall for executive chairman Frank Monstrey. More than half of Nostrum's common shares are held by three investors: Claremont, a vehicle owned by Monstrey, Mayfair BV, owned by the exploration company building the GTU, and Dehus, an independent private equity firm. Both Claremont and Mayfair have a non-executive director on the board.

Management has a habit of protecting shareholder returns: they have stretched project phasing so work can be funded organically by hedged production.

If Brent crude trades at $65/bbl and Nostrum is firing on all cylinders, the net debt/cash profit ratio should still fall to below 1 times by 2019, even with the attractive payout.

This is why Deutsche Bank upgraded the shares this week to 'buy' from ‘hold’. With a proven resource base of around 470 million barrels of oil equivalent (Mmboe), a fully-funded pot to spend on expansion, and the ability to export via company-owned infrastructure, the broker reckons growth here is "low risk".

But, of course, there is risk. The strengthening oil industry could collapse, or Kazakhstan's economy could worsen. Recent fiscal and regulatory pressures there have been a struggle for the oil industry, but with 15 year experience, there are few better management teams than Nostrum’s able to operate in the area.

"The challenge (and opportunity) is therefore to complete its facility upgrade and accelerate the monetisation of the resource base prior to the current license expiry in 2033," explains analyst David Mirzai. "Management's commitment to return cash to shareholders is also differentiated versus the peers and increasingly attractive following a period of willful and profligate spending within the upstream sector."

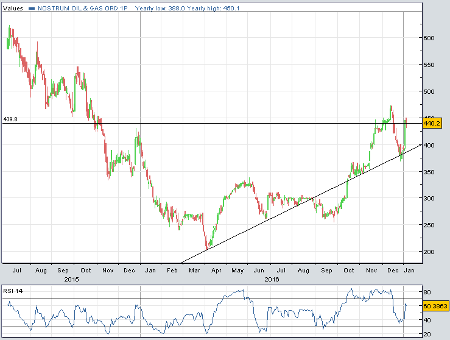

The shares had a strong second half of 2016 thanks to its FTSE 250 entry and improving sentiment over Kazakhstan, but Deutsche still reckons they’re cheap. Starting the week at 392p, Nostrum was trading on just 0.6 times its net asset value, a 20% discount to the UK exploration and production sector and a 15% discount to its three-year average.

Nostrum has since bounced 14% to 440p, a decent double-digit drive, but still a way off Deutsche Bank's target. Instead, Mirzai reckons the shares are worth 535p, which still gives them an attractive 22% of potential upside.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.