Is oil price heading back below $50?

11th January 2017 09:50

by Alistair Strang from Trends and Targets

Share on

Written: 10 January 2017 - 10:55pm

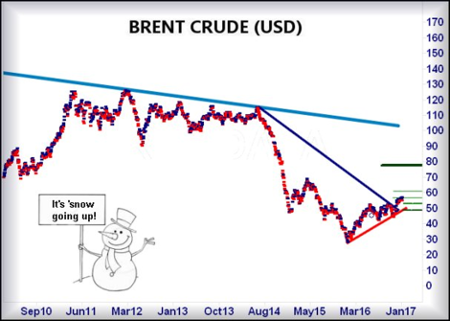

This is causing a degree of puzzle, due to the price hitting the $50s and essentially stopping. Our in-house rule of thumb when this sort of thing happens is to look for reasons it will instead go down, despite the presence of pretty lines on charts.

We've no doubt the downtrend from 2014 was valid but, unfortunately, when the price of Brent bettered this trend, it achieved our initial halfway target then seemed to lose interest. The price was supposed to achieve our secondary above $55 at $60.5, but has failed to show any real strength.

Therefore, the situation now is a bit interesting as, should the price of the product close a session below $53.37, we're looking at coming reversal toward $52.88 initially with secondary, if broken, around $49.15. This would represent a bonk against the red line on the chart below, the immediate uptrend.

At time of writing, Brent is trading at $53.9 and is coming close to triggering a reversal cycle. Of course, the big question is whether $49.15 (or so) would provoke a bounce, or is there a risk of the product dripping below such a point?

Currently, there is ample reason to believe that below $49.15 will indeed provide a bounce, as movement below would signal the immediate uptrend has failed, propelling the product into a region where $47.4 becomes viable and, frankly, below risks a sharp dip into the 30s.

For now though, our suspicion is the price is trapped, essentially oscillating between the $53.3 and $58.5 level for a while, doubtless waiting an excuse to either weaken or strengthen.

Immediate calculations warn us not to take any rise seriously unless the price betters $56.4, as this should provoke growth to $57.5, a fairly important number 'cos if $57.5 is bettered we shall start talking about $60.5 thereafter.

For now, it's not messy, just pretty boring. Perhaps a visit to the $60.5 level will serve to break the oilers index above the blue line.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.