Seven good long-term investments

13th January 2017 15:32

by Richard Beddard from interactive investor

Share on

Clues in and annual reports reveal why one might make a good long-term investment, and the other might not.

My new year's resolution* requires me to upgrade the Decision Engine, which means overhauling 60 spreadsheets and, sometimes, the conclusions I've reached about the companies they model.

So far I have upgraded ten sheets**. The score column next to each company name in the table is a mark out of ten, depending on how closely the shares meet my criteria. To score ten, the company has to be, in my estimation and according to the data, a good, well-managed business at an attractive valuation.

Experience tells me shares scoring seven or more are probably good long-term investments. Shares scoring five or less are questionable.

| Score | Name | Description |

|---|---|---|

| 9 | Dewhurst | Manufactures components for lifts, keypads and railway rolling-stock, particularly pushbuttons. |

| 8 | Science | Does scientific research and product development for customers in medical, industrial, consumer and energy industries. Provides strategic advice. |

| 8 | XP Power | Designs, manufactures and distributes power adapters for industrial and healthcare equipment. |

| 8 | Next | Retails clothes and homeware. |

| 8 | Solid State | Manufactures and distributes specialist electronic components and computer systems, used in harsh environments where enhanced durability is a requirement. |

| 8 | Victrex | Manufactures and develops applications for PEEK, a polymer often used in place of metal where durability and lightness are paramount. |

| 7 | Treatt | Sources and processes essential oils, which are ingredients used in flavours, fragrances and cosmetics. Develops flavours. |

| 6 | Tristel | Manufactures disinfectant systems for simple instruments and surfaces in hospitals, veterinary surgeries, and laboratories. |

| 6 | Howden Joinery | Manufactures kitchen cabinets and supplies complete kitchens to small builders. |

| 4 | ITE | Organises tradeshows, mostly in Russia, Eastern Europe and Asia |

A highly respected professor of accounting recently described the section in a company's annual report that discloses the risks it faces as a “completely useless section”, written by lawyers to protect the company from being sued***. I agree with his general point, company reports are full of useless information, but the principal risks sections is one of the first I look at.

I chuckle when I read the bit about the desperate need to retain key staff, and while the rest of the section may not be as self-serving, it is often pretty generic. But if a company deems it necessary to include an item that is not merely boilerplate, it's probably significant.

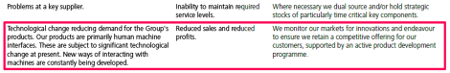

This is part of Dewhurst's disclosure from its annual report, published last month. It describes a technological threat to the business:

A large part of Dewhurst's business is manufacturing pushbuttons for lifts (and trains) and keypads for ATMs, it has many decades of expertise in the design of attractive, durable, and vandal proof pushbuttons, which is valuable because a little more spent on a pushbutton can reduce repair and maintenance bill substantially.

But the number of pushbuttons used on a typical lift control panel or ATM is falling in many instances. Destination dispatch systems send you to a lift going to the floor you have requested, they don't always need an extensive control panel in the lift car. Touchscreens are replacing keypads on some ATMs and lift control panels.

To the long-term investor, a risk of obsolescence could be the only thing that mattersThe effect of technological change on the results of a company like Dewhurst is gradual, so when it explains its performance over the year just concluded, it will focus, as Dewhurst did in 2016, on the factors that impacted revenue and profit over the short-term. Economic uncertainty had a negative impact, the cheap pound a positive one.

To the long-term investor the risk of obsolescence could be much more important, indeed, it could be the only thing that matters, but you won't read about it anywhere else in the annual report.

As I've said before, I think by broadening its product range Dewhurst is adjusting. It will probably remain highly profitable, but perhaps not as profitable as it was before. The presence of technological change in the principal risks section is a reminder to keep this decision under review.

Nagging doubts

There is something else nagging away at me about Dewhurst, and it relates to another section buried so deep it is often ignored.

Like the principal risks section, I read the segmental report before I read what the chairman, chief-executive and finance director have to say, so I know what I want them to explain to me.

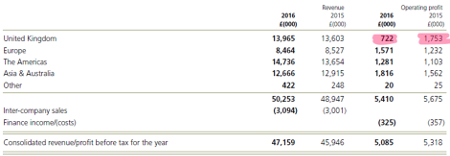

Dewhurst's segmental report shows a really dramatic reduction in profit in the UK, where in the previous year the company made the most profit.

Operating profit in the UK declined by nearly 60% although revenue increased. The result wasn't a catastrophe for Dewhurst because operating profit in Europe, the Americas and Asia and Australia all grew, but the executives provide no explanation. I don't like loose ends, and the UK performance might reveal a weakness in the business, so I've asked Dewhurst to comment.

Big changes at ITE

Right at the bottom of the companies re-ranked by Dewhurst is ITE, which published its annual report earlier this month. A score of only 4 out of 10 reflects big changes at the company in terms of where it operates, its financial strength, and its management.

ITE's Russian business, responsible for 38% of revenue in 2016, is still fantastically profitableExhibition organiser ITE's reliance on oil dependent Russia and neighbouring states has been exposed after the oil price crashed two years ago, like it was during the financial crisis of 2008.

This time around, low oil prices are more persistent and Russia's economy has also been weakened by economic sanctions, which has encouraged ITE to press ahead with a policy it was already pursuing, to mostly acquire but also develop trade shows in other emerging markets. The most promising are China and India.

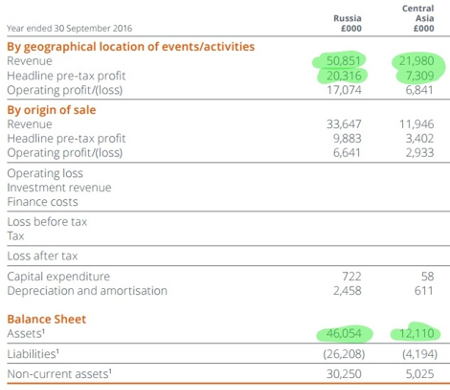

In fact, as ITE's segmental report shows, its Russian business, responsible for 38% of revenue in 2016, is still fantastically profitable, and its neighbouring Central Asian businesses (responsible for another 16%), are too.

In Russia, it earned pre-tax profit margins of 40% in the year ending in September 2016. The problem isn't so much profitability (return on assets in Russia was 44% in 2016), it's the absolute level of profit, which has fallen because ITE is contracting.

Customers pay for exhibition space in advance, which gives ITE time to reduce the space it rents, and the staff it employs, to match demand, not perfectly, but well enough to ensure it remains profitable. While the reduction in the absolute level of profit might have dismayed investors, presumably if the company had done nothing it would have stayed in business.

The company is mostly funded by debt, of one kind or anotherIt has done something though. Since the financial crisis of 2008 it's acquired dozens of rival exhibitions and companies, which has helped increase net financial obligations (borrowings and roughly capitalised lease obligations) from below zero in 2013 to over 70% of operating capital. In other words, the company is mostly funded by debt, of one kind or another.

The problem is the covenants (agreements) ITE has with its banks probably require it to maintain profit above a certain level in relation to borrowings, so its financial position could put it in jeopardy even though return on capital is still high (China, India etc. are profitable too, just not as profitable yet).

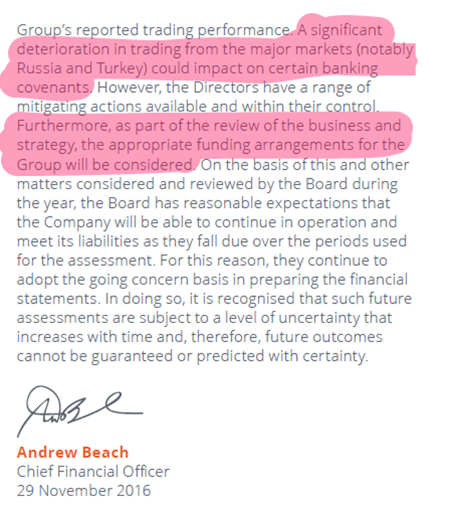

Andrew Beach, ITE's new finance director, says that should profit fall substantially the covenants could be breached:

He admits the company may have to shore up its finances. Elsewhere in the annual report ITE says its prospects in Russia are improving, but Turkey's tourism-dependent economy is troubled by political unrest internally and poor relations with its big neighbour Russia. ITE earned 14% of revenue in Turkey and Ukraine in 2016.

If business conditions improve, ITE will probably recover strongly, but the Decision Engine isn't designed to weigh up the probabilities of recovery, it's designed to discriminate between companies where things have to go right for them to succeed and companies that should be resilient come what may.

In previous evaluations of ITE I underestimated how unstable profits could be, and prior management (the chief executive is new too) has exacerbated the potential for instability by allowing debt to approach dangerous levels. The board is also an unknown quantity.

Those three factors explain ITE's lowly score.

* Three easy tricks to make you a better investor

** You might be wondering why I picked these ten. First in line are companies that have recently reported full-year results because there is new data to add anyway, followed by the highest and lowest ranked businesses because these are most likely to require decisions soon.

***In a podcast: Aswath Damodaran on the art of corporate valuation

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.