Ours Dogs portfolio outperforms FTSE 100 sevenfold

13th January 2017 17:16

by Lee Wild from interactive investor

Share on

Three months ago we had just entered what is historically the most profitable period for equity markets. Seasonal events buoy individual sectors during the fourth quarter and year-end portfolio window-dressing can tickle markets higher.

However, with many shares richly valued after a post-Brexit vote rally and sterling collapse, we bet that investors would go shopping for cheap laggards. They did.

Up 12% in the nine-and-a-bit months to mid-October, lust for the big overseas earners who'd grow rich converting expensive dollar sales back into pounds began to wane. The likes of , , , and others certainly came off the boil.

Put off by bloated valuations, we decided to simply pick the 10 worst-performing shares of the year so far, guessing that investors might "hunt for bargains in an otherwise expensive market".

All were cheap on the standard price/earnings (PE) valuation multiple and seven out of 10 offered an above-average dividend yield - that's because the shares have tanked and the market has doubts about the company's ability to maintain shareholder returns.

With the fourth quarter over, and after running the numbers one last time, our portfolio of ugly ducklings has, for the most part, at least begun to morph into swans.

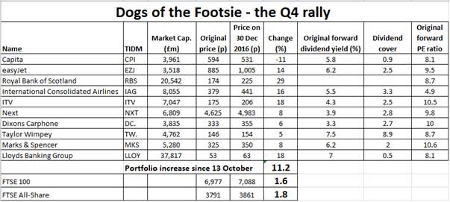

Over the period, it delivered a profit of 11.2% versus a very modest 1.6% return for the FTSE 100 and only a fraction more for the All-Share index. Five of the ten managed double-digit percentage gains, led by the banks, and only one - accident-prone Capita - registered a loss.

Source: SharePad

A business review is underway at , it's selling the shareholder registrar operation, has reassured on the dividend and directors are buying shares. Seems it'll take more to entice buyers back in.

Elsewhere, bargain hunters were out in force. was our star stock, up 29% as banks returned to favour. Resolutions to legacy issues could soon be an (expensive) thing of the past, and a first interest rate increase in almost a decade is getting closer - typically good news for lenders' margins.

Rupert Murdoch's bid for the bit of he doesn't already own reignited interest in broadcaster . As we reported last week, Peel Hunt analysts think ITV is vulnerable to a takeover "well ahead of the current valuation".

Buyers turned to again after a grim three months. Even before a team of City analysts recently said the shares were worth 75p last week, the share price had risen 18% since the beginning of our portfolio.

Taylor Wimpey is almost to pre-referendum prices recently, as Brexit fears have recededBattered airlines found clear air, too. British Airways-owner made us 16%, and budget carrier 14% over the two-and-a-half months.

Retailers and did well as investors bet that Christmas would be better than expected. Getting out on 30 December was perfect for Next as the high street bellwether shocked the market last week with another profits warning. It'll be no easy recovery either.

Again, 30 December was a good time to sell M&S. Results this week were mixed, with the clothes division returning to growth, but with little to suggest it will remain that way.

Final two in the portfolio were electricals retailer , which put in a respectable performance and turned out to be stockbroker Justin Urquhart Stewart's Interactive Investor tip of the year.

Fears around Brexit have receded recently, and high-yielding housebuilder is almost back to pre-referendum prices. This year will not be easy, but the shares are perceived as cheap, and they're Deutsche Bank's top pick in the sector. 'Buy' up to 239p, the broker says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.