30 shares for this £1 million portfolio

16th January 2017 12:53

by Lee Wild from interactive investor

Share on

Successful stock-picking, especially in the small and mid-cap sector, is hard work. Many investors use a system to make smart investments, among them our companies analyst Richard Beddard, who invented his Decision Engine to beat the market. Now, broker finnCap has designed "The Slide Rule" to help spot the best stocks around.

"The Slide Rule has been designed to dramatically simplify the identification of the best companies in the UK small/mid-cap sector by making a quantitative assessment of the relative potential of each company," explains finnCap's head of research Raymond Greaves.

"At its core, The Slide Rule aims to identify those companies that create genuine shareholder value through strong returns on capital and solid growth, but also present a value opportunity with the potential tailwind of earnings momentum."

The Slide Rule can rank or screen almost 500 small/mid-cap companies - firms worth £50 million-£2 billion with proper revenues, profits and cashflows - on 11 key quality, value, growth or momentum (QVGM) metrics.

To measure quality, finnCap uses return on capital (ROCE basis), return on capital (free cash flow basis), and gross liabilities as a proportion of capital employed. For value, it's enterprise value/operating profit and price/earnings, for growth it's sales and operating profit, and finally there's earnings momentum.

Trialing the portfolio over fourth-quarter 2016 made 8.9% of capital gains, excluding dividends.Using a QVGM-rank for each company based on a proprietary blend of the metrics, finnCap has created a "robo portfolio" based on the Top 30 companies. The algorithm for determining the portfolio prioritises growth first, then quality, then value, then momentum.

It will be tracked over time and published every quarter alongside The Slide Rule, which will rank each small/mid-cap stock and track individual £1 million portfolios for quality, value, growth and momentum.

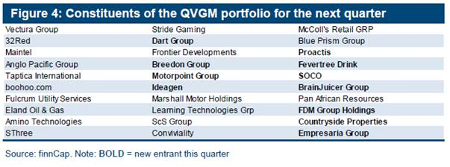

Here's the current Top 30, dominated by tech, support services, consumer, media and industrial sectors, although there are oil, mining and specialty finance firms, too.

"Our QVGM portfolio of Top 30 companies for first-quarter 2017 includes established performers such as , and but also more 'off the beaten track' names such as , and ," points out finnCap.

To test the theory, the broker has invested a notional £1 million evenly across the portfolio. Every quarter, the selection process will be re-run and the "proceeds", including dividends from the previous quarter, will be re-invested equally across the new Top 30.

Already, an initial trial for the fourth quarter of 2016 generated 8.9% of capital gains. Add in dividends and total return was 9.9%. Had it run for all of 2016, those returns would have been an incredible 31% and 35% respectively.

We'll also be watching the portfolio with interest, and later this week will look at finnCap's portfolios for quality, value, growth and momentum, and ideas generated by The Slide Rule for "undiscovered gems", "building momentum" and "debt traps".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.