This trader's strategy picks 10 hot stocks

18th January 2017 14:03

by Ben Hobson from Stockopedia

Share on

Growth stocks can fly in bullish market conditions, and that's exactly what we've seen over the past year. In that time there's been a rapid re-rating in some of London's small-cap indices. It has been driven in part by spectacular price gains in fast-growing companies. But anyone looking for opportunities now faces a dilemma - growth shares are looking pricey.

Part of the challenge is down to how some growth investing strategies work. It's true that models used by the likes of Peter Lynch, James O'Shaughnessy and the late Jim Slater all favour earnings expansion and price strength. But to varying degrees they also care about valuation.

This kind of approach is commonly known as "growth at a reasonable price", or GARP. Buying growth at a modest price ideally means catching stocks before they've raced ahead. This hunt for hidden gems is the cornerstone of what makes growth investing so appealing to so many.

But while GARP strategies are struggling to turn up meaningful numbers of buying opportunities, that doesn't mean that other growth approaches won't work well.

Mixing 'financials' and 'technicals'

In the United States, Charles Kirkpatrick is seen as a legend among growth investors. Back in the 1960s he was involved in research using relative price strength to pick stocks. It wasn't taken seriously at the time. But he later wrote an award-winning paper called Stock Selection - A Test of Relative Stock Values Reported Over 17-1/2 Years.

To cut a long story short, Kirkpatrick had quietly been earning guru status for performing incredibly well against the market using a strategy that relied heavily on relative strength. And he still does it today.

Among his strategies is a growth checklist that combines two factors. First is a focus on stocks in the top 10% of the market for relative price strength over the past 130 days. Second is a focus on stocks in the top 10% of the market for relative reported earnings growth (operating profit) over the past four quarters.

In simple terms, it's a strategy that looks for explosive profit potential in stocks that may have already caught the imagination of investors. They've also got to be valued at more than £200 million.

Kirkpatrick ignores valuation in his main growth strategy, but he does have strict 'sell' rules. They include:

1. When the relative price strength rank falls to below 30% in the market

2. When the relative reported earnings growth rank falls below 70%

3. When the stock price falls below two previous notable lows

Screening using Kirkpatrick's growth strategy

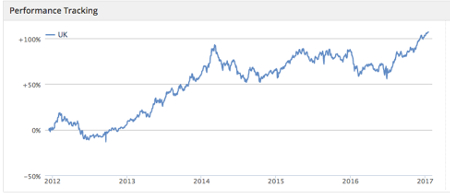

At Stockopedia, we track the performance of a strategy based on Kirkpatrick's rules. What we've found is that it does well at picking up the fastest-moving stocks in bullish markets.

Unlike other growth models, it actually finds more stocks during these strong periods. It's generated a 26.6% return over the past six months.

Leading the list of those passing the rules right now is the online fashion retailer , which was one of the best-performing small-caps last year.

But the rules draw companies from a range of sectors. As expected, the names are not what you'd normally see on GARP investing screens.

They range from the likes of the pub group to the high street chocolate retailer , logistics group and energy generator, .

| Name | Mkt Cap £m | Operating Profit Growth % | % 130d Moving Average | Sector |

|---|---|---|---|---|

| Boohoo.Com | 1,626 | 89.1 | 38.3 | Consumer Cyclicals |

| Enterprise Inns | 638.7 | 158.9 | 34.9 | Consumer Cyclicals |

| Severfield | 230.1 | 815.6 | 26.9 | Industrials |

| Highland Gold Mining | 565.9 | 141.2 | 26.4 | Basic Materials |

| Hotel Chocolat | 329.5 | 83.8 | 25 | Consumer Defensives |

| Sanne | 858.2 | 337.4 | 24.9 | Financials |

| Wincanton | 310.9 | 99.5 | 23.7 | Industrials |

| Victoria | 341.1 | 82.7 | 22 | Consumer Cyclicals |

| On The Beach | 352.2 | 141.1 | 19.5 | Consumer Cyclicals |

| Drax | 1,535 | 150.8 | 18.7 | Utilities |

Kirkpatrick's use of relative price strength and profits growth are both familiar features of growth investing strategies.

But it's the absence of any valuation measures that sets it apart. This has the feel of a real trader's strategy, so it needs careful use. A critical element is that Kirkpatrick has strict 'sell' rules. If any of his stocks suffer a notable breakdown in the 'pass' rules, they're sold.

For investors looking for potential growth opportunities, a pure focus on the biggest movers in bullish conditions could offer some ideas.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.