A company tipped to prosper

20th January 2017 15:00

It may take nerves of high-tech composite material, but should deliver its ambitious goals.

Victrex's long-standing chief executive once told me he doesn't like to talk of commoditisation, the process by which valuable, differentiated products become indistinguishable from competitors' in the eyes of customers. Surely that's what Victrex is running from, though.

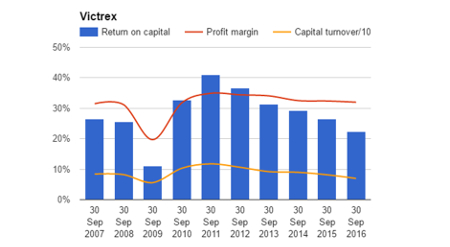

The chart below should, at the same time, be cause for celebration and concern.

It shows Victrex's profitability (blue bars) over the last decade. Not once has return on capital fallen below 10%, and, with the exception of one year of global financial crisis, the company has invariably been much more profitable than that.

But return on capital has almost halved in the last six years from 40% to 20%. That 20% is still impressive, but we need to understand the trend.

The two lines tell the story.

With the exception of 2009, the profit margin (red line), the amount of profit the company makes compared to sales, has been fairly steady. At the high watermark in 2011, Victrex turned 35% of sales into operating profit. In the year ending last September, the profit margin was 32%.

Victrex makes high-grade thermoplastics, principally PEEK, a polymer it pioneeredAlthough it doesn't look like it because I have had to fit the capital turnover line (yellow) to the same scale, the amount of sales the company earned in the year compared to the amount of capital invested in its operations declined much more, from about 120% to about 80%.

The two factors determine profitability. The higher the profit margin and the faster a company can turn over its capital, the higher the return on capital.

Victrex makes high-grade thermoplastics, principally PEEK, a polymer renowned for its strength, lightness, and durability. It's also easy to shape and relatively cheap to manufacture into products.

Pioneered by Victrex, the material has been adopted in place of other materials, metals and plastics, wherever performance is critical, like components for aeroplanes, cars, smartphones, and, in the last decade, medical implants.

Profit is up 7% since 2011; return on capital is down because capital employed has doubledAs a composite, strengthened by carbon fibre, Victrex and the manufacturers it supplies are finding more uses for PEEK and similar polymers.

While the numerator of the return on capital calculation, profit, fell a little in 2015, due to a dramatic reduction in orders from consumer electronics customers and lower demand from the recessionary oil and gas industry, it has risen 7% since the high watermark for profitability in 2011.

The main cause of the decrease in return on capital is the denominator. The company is employing a little more than twice as much capital. This is why return on capital has halved.

'Mega-programmes'

Victrex is less efficient than it was because it has added 70% to its production capacity by building a new plant. It doesn't need the capacity right now, partly because demand from the electronics and oil industries is depressed, and partly because Victrex has created capacity to meet demand from six "mega-programmes" that that have the potential to add £50 million or more to annual revenue when production peaks.

Even the most advanced of the six programmes are only bringing in a tiny fraction of that now, so the new plant has increased the capital invested in the business considerably, which explains why the capital turnover component of return on capital has deteriorated so markedly. The profit margin is slightly reduced, too, because of the higher cost of operating plant below capacity.

It's unclear how long it will take to ramp these businesses up from £1 million annual revenue to £50 million eachThe oil and gas market and electronics markets will probably pick up, but a lot rides on the new programmes and the money is a long way from being in the bank. The company says three of the six programmes are within two years of earning "meaningful" revenues of more than £1 million.

Magma, the subsea oil pipe, already earned Victrex over £1 million in 2016. Gears should by the end of the current financial year, thanks to the acquisition of a gear manufacturer last year, and 1,000 patients have already received PEEK-OPTIMA HA spinal implants.

But Victrex already has a £50 million medical business, Invibio, that earns 70% of its revenue from spinal implants, and PEEK-OPTIMA HA will, it says, cannibalise sales of its market-leading spinal implant.

Increasing uncertainties

Further out, the uncertainties increase. Adoption of Juvora, Victrex's dental brand, is slow because there are countless dental laboratories that must be persuaded of the product's superiority. Clinical trials for Victrex's knee programme start this year, but it will not be commercialised for at least five years.

Perhaps the biggest uncertainty is how long it will take Victrex to ramp these businesses up from £1 million annual revenue, which will not make a great difference to a company already earning £250 million a year, to peak revenue of £50 million or more each - and how long Victrex can sustain peak revenue before the market matures and competitors join the fray.

Innovation is expensive but in reality, all companies must innovate or eventually they will dieAlthough Victrex produces more PEEK than anyone else, and its main rivals and Evonic are not specialists, Victrex says they too are adding capacity.

Unless Victrex continues to differentiate itself by developing new grades of PEEK, and by making them into components, it will eventually fall victim to the commoditisation it doesn't speak of.

Investors don't like companies that must innovate to survive. Innovation is expensive, and sometimes it doesn't come off. In reality, though, all companies must innovate or eventually they will die.

In my view it's better to find those that are innovating, than complacently assume that those that aren't, don't need to.

A highly profitable business

I think of Victrex this way: It's a highly profitable business that, despite large competitors, has maintained high profit margins and financial strength (it had no debt at the year end and £64 million in cash) even while two of its more cyclical end markets are (probably temporarily) in decline and it's investing heavily.

Setbacks could occur, but over the long-run I expect Victrex to prosperThe chief executive David Hummel is immensely experienced, and tied to the business with a 3.5% stake*.

While competitors are commoditising the supply of the raw material, Victrex is deepening its advantage by creating new grades, and applications.

The timeline of its growth strategy is unclear, and so is the recovery in consumer electronics and oil and gas. Setbacks could occur, but over the long-run I expect Victrex to prosper.

A share price of £19.50 values the enterprise at over £1.6 billion, about 16 times profit in a typical year**, adjusted for debt and other financial obligations.

*While I don't approve of the high performance-related component of executive pay at Victrex (in common with most of its peers), it's a relief to see documented in the annual report that the company paid no bonuses to executives in 2016.

Neither did any long-term incentives vest. Victrex didn't give the executives a pay rise either. In other words, Victrex doesn't pay out unless its executives perform, which you'd have thought would be normal.

In fact, often companies pay out regardless. Lavishly rewarding performance in a single year is a sham, but it's doubly so if you pay out whether the company performs or not.

**Calculated using Victrex's average return on capital of 28%.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks