Blue Prism volatile after maiden finals

24th January 2017 14:06

by Harriet Mann from interactive investor

Share on

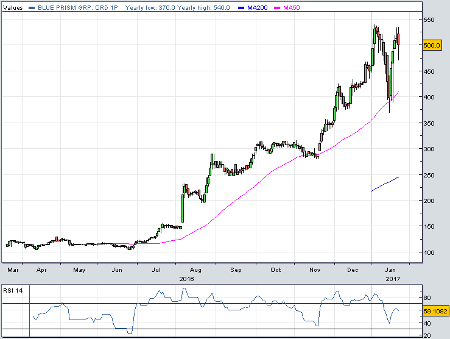

A lot can happen in a year. hasn't even celebrated 12 months on the stockmarket, yet shares in the AIM-listed robotic software company are already up almost seven-fold to a high of 540p. They've wobbled on Tuesday's maiden full-year results, but patience may be rewarded.

The shares, which came to market at 78p last March and raised £8.8 million of net cash for the firm, rallied 592% over the next 10 months, overcoming a major wobble earlier this month that saw the shares slump by over 30%.

House broker Investec Securities is convinced there are enough catalysts to trigger another rerating, upgrading financial forecasts and its 320p price target to 580p. That implies 16% potential upside.

Blue Prism gives blue-chip companies technology to create a digital software robotic workforce that performs routine back-office clerical tasks. On the brink of the Third Industrial Revolution, according to some, the robotic process automation (RPA) market has certainly evolved quickly over the last year. It's why Blue Prism has stepped up its growth strategy in the US and is beefing up sales and marketing teams. These remain priorities in 2017.

Recognised revenue jumped nearly 59% to £9.6 million in the year ended 31 October, with 85% of it recurring business. Just 40 licence deals were signed in 2015, but this surged to 189 last year as Blue Prism signed up 96 new customers. Upsells accounted for 81 of 2016 contracts and 12 customers renewed deals. US deals exploded in the fourth quarter.

Most of Blue's new customers came through its partner channel, but a £0.8 million one-off licence in 2015 skews the comparison somewhat. Perhaps the 143% monthly recurring licence increase to £946,000 is a better display of momentum. Winning more work in the US as the pound plunged added £322,000 to numbers.

Add the IPO money to the £2.2 million management received in advance customer payments, and cash rocketed from £2.4 million to £11.8 million over the year - well ahead of IPO guidance. The company now has four consecutive years of positive cash generation behind it, although an ambitious expansion strategy will mean losses widen temporarily.

Of course, it costs to float on the stock exchange. Factor in its £502,000 of IPO costs and £362,000 of share-based payments and Blue Prism made an operating loss of £5.3 million in 2016 versus £0.8 million the year before.

"Taking into consideration the FY16 exit monthly run rate and assuming the ongoing momentum in new customer wins and upsells continues, we expect revenue for the current financial year to be comfortably ahead of existing market expectations," chief executive Alastair Bathgate says.

Investec has increased revenue forecasts by 8% to £14.1 million in 2017, but still reckons the group will make a pre-tax loss of £8.1 million this year and £5.7 million in 2018.

This is a great story, but Blue Prism won't make a profit until at least 2020. That does makes its share price vulnerable – as we saw earlier this month - if the company fails to justify market optimism.

Investec admits that the share price outperformance since IPO means they trade on an EV/sales multiple "considerably above the sector average, or indeed any stock of materiality in the sector".

"As a result, we employ a probability-weighted scenario analysis to value the stock, based on a range of FY19E outcomes. We use EV/sales as the group is still forecast to be lossmaking in FY19E, albeit we note management is committed to returning to EBITDA breakeven in due course."

However, it also believes there is "significant possible upgrade momentum from here".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.